Call for action on housing 'crisis'

- Published

- comments

Ruth Patrick lives with her partner and says she is struggling to get onto the property ladder

The housing market will be plunged into "crisis"' without government action to address the "chronic under-supply of homes", a body representing housing associations in England has warned.

The National Housing Federation (NHF) said it risked locking an entire generation out of the housing market.

It predicted further falls in home ownership rates and even higher rents.

The government says it has made more land available for building and is investing £4.5bn in lower-cost homes.

Housing Minister Grant Shapps said his plans would "get Britain building again".

"That's why I've announced plans to release thousands of acres of public land for housebuilding.

"And despite the need to tackle the deficit we inherited, this government is putting £4.5bn towards an affordable homes programme which is set to exceed our original expectations and deliver up to 170,000 new homes over the next four years."

But the NHF said this represented a cut of 63% on the previous programme of government spending on homes to rent or buy.

"What we need to do is to build new homes," NHF campaigns director Ruth Davison told BBC Radio 4's Today Programme.

"Governments of all colour have not properly understood that we in the grip of a housing crisis, and unless they do something about it an entire generation will be locked out of decent housing."

'Expensive and unregulated'

The level of house prices, the need for larger deposits and stricter lending criteria set by banks, had combined to cut first-time buyers out of the market, the National Housing Federation said.

"People need much bigger deposits now, and typically people can only get mortgages of about 75% of the price of the home," she told the BBC.

Research it commissioned from Oxford Economics suggests that the proportion of home ownership in England, which has been falling steadily for the last 10 years, could decline further from its current rate of 67% to 63.8% over the next decade.

The forecasts are based on assumptions that affordability will worsen, as employment prospects and wages fail to keep up with a predicted 21% rise in house prices over the next five years.

But with rents forecast to keep rising, and more than 1.5 million people on waiting lists for social housing in England, it is also the lack of affordable alternatives to home ownership that is worrying to the NHF and others.

"Millions of people across the country remain desperate for an affordable place to live, with more and more forced into expensive and unregulated private rented accommodation," said Campbell Robb, chief executive of housing charity Shelter.

'Through the roof'

The number of new homes built last year was the lowest in peace time since 1923, recent figures suggest.

"With major developers holding planning permission for at least 188,000 new homes, the government must urgently look at ways to get construction going. This will not only create jobs and drive growth but will deliver the homes people desperately need," said Shelter's Mr Robb said.

David Ritchie, chief executive of homebuilder Bovis, told the BBC that he was "frustrated by the lack of support for first-time buyers", saying the firm had itself lent the cost of deposits to help the buyers of its homes.

The NHF said the problem of unsold new homes was particularly acute among smaller one- and two-bedroom homes in city centres built in recent years.

Bovis, which has just revealed a doubling of first half profits, confirmed that it had shifted the mix of new homes it was building to larger, more expensive properties.

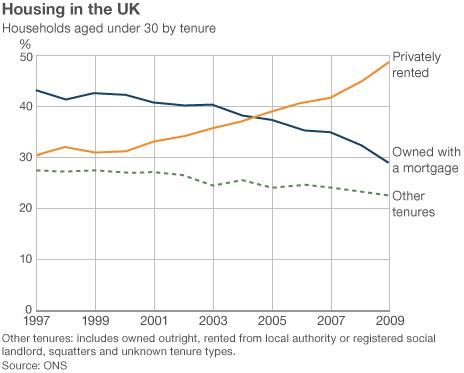

'Generation rent'

Oxford Economics predicts that average rents will jump by almost 20% over the next five years.

Matt Griffith of campaign group priceout.org said young people in particular now faced the "toughest housing environment in decades".

"This is producing a lose-lose for 'generation rent'," he told the BBC News website.

"Squeezed incomes from rent rises, inflation and stagnant wages are making saving for a deposit difficult.

"We have a slump in house building levels whilst government efforts to stop declines in the wider housing market benefits existing owners over those priced out of the market," he said.

Mr Shapps said that he was determined to "pull out all the stops" to help first-time buyers.

Housing Minister Grant Shapps says the coalition government's planning reforms will help the situation

"That's why I've held summits with lenders to encourage them to do more to help people take their first step onto the housing ladder, and I've launched the FirstBuy scheme as a valuable alternative to the 'Bank of Mum and Dad' for those struggling to get together that much-needed deposit."

Announced in the Budget, the £250m scheme aims to help up to 10,000 people buy their first home by helping them out with a deposit.

Those buying properties from some developers could receive a loan worth up to 20% of the value of the home from the government and the housebuilder.

Pricedout.org said only a small number of those wanting to buy would be helped.

But it praised government proposals to change the planning system to try to encourage more commercial residential housing.

The National Housing Federation also said last month's draft National Planning Policy Framework, which aims to simplify the planning system, was "a step forward".