Could the US economy go the way of Japan?

- Published

- comments

Is the US economy on the right track to recovery?

There have been times, in the past few years, when US policy makers weren't sure how the financial crisis was going to play out.

But on one point they were absolutely certain: the US would not - could not - go the way of Japan.

The economy was too flexible, the policy response to the crisis too dramatic, and the electorate too downright demanding for Japan-style stagnation to happen in the US.

Ask Treasury Secretary Tim Geithner today, he would tell you the same thing. So, for that matter, would Ben Bernanke.

At the recent conference of central bank governors and economists in Jackson Hole, the Federal Reserve Chairman said he did "not expect the long-term growth potential of the US economy to be materially affected by the crisis".

But Chairman Bernanke also said that avoiding that kind of damage would require policy makers to take a number of difficult steps. It is doubt about the political capacity to confront those challenges which leads many people - inside and outside of the US - to wonder whether it might be "going Japanese" after all.

Even six months ago, such pessimism would have sounded overdone. Though it was problems in the US financial system that had helped trigger the global recession of 2008/9, the loss in US national output had actually been smaller than in many other advanced economies, and the US recovery somewhat faster than in most of Europe and Japan.

True, this recovery had been much slower than past US upturns, but this was felt to be the inevitable price of the financial crisis. Policy makers still felt that they had applied the lessons of the Japan experience - and avoided the same fate.

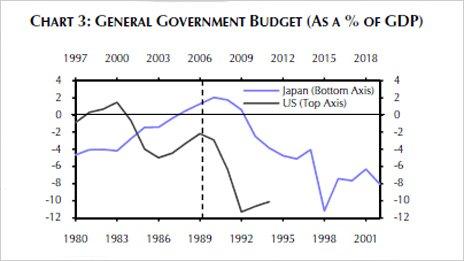

For example, the Fed had cut interest rates to near zero in less than two years - something it had taken the Bank of Japan six years to do in the 1990s. The fiscal response to the crisis in the US had also been much more dramatic (see Capital Economics chart 3), albeit at the cost of souring relations between the two major US political parties for years to come.

But recent revisions to the official GDP numbers now make the downturn look rather deeper, involving a 5.1% fall in national output from peak to trough, not 4.1%, as previously thought. They have also made the recovery look somewhat weaker.

The upshot is that national income is not yet back to where it was before crisis, as it is, for example, in Germany, which actually had a deeper recession.

Unemployment woes

In terms of economic growth, the US's performance over the last five years now looks no better than Japan's in the five years after its asset bubbles burst in the late 1980s. Indeed, in employment terms it has been considerably worse.

The jobs picture was already bleak at the start of the year - but, if anything it now looks even worse, with unemployment still hovering around the 9% mark, and a record 40% of the jobless now unemployed for more than six months.

In the past, economists have tended to laud the flexibility of the US labour market: unemployment might rise more quickly in a recession, but it would then fall more quickly as the economy recovered, and long-term unemployment was always much lower. Now US labour flexibility seems only to be operating in one direction, while the "over-regulated" German labour market has performed surprisingly well.

A few startling statistics highlight the failure of the US economy to deliver jobs for its rising population: in 1958, 85% of working age American men were in work. Today, less than 64% have jobs, and - in case you think that is simply due to women entering the workforce - the share of all Americans, men and women, in work is now lower than it has been since the early 1980s.

It's not only jobs. In its latest assessment of the US economy, the IMF looked in detail at the past ten US recessions. On nearly all the key measures - loss of output, employment, investment or growth in personal disposable income, the two downturns of the 21st century (2000-1 and 2008-9) have been the worst.

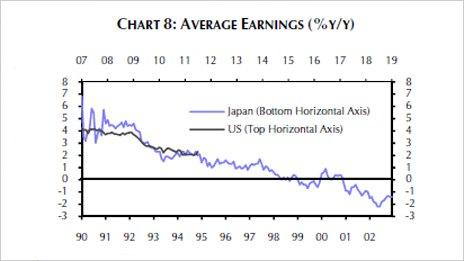

That is what gives rise to the suggestion that the US has already suffered a "lost decade" - at least on Main Street. Real average household income fell by 3.6% between 2001 and 2009, and real incomes have fallen again in 2011, as inflation has picked up but wages have remained flat. The weakness in earnings is also uncannily similar to Japan (see Capital Economics chart 8).

As the chart also shows, the US is not Japan yet. It would need another five years of this to really follow the path of Japan.

The problem is that commentators are starting to see another feature which the US in 2011 shares with Japan in the 1990s: political paralysis. This, more than weak growth or the current level of public debt, is what has given the major ratings agencies cause for concern.

Moderate recovery?

Many economists think that the US could see a moderate, but steady recovery over the next few years. But, as Chairman Bernanke emphasised, that will require some difficult decisions by politicians, including a credible plan to low federal borrowing long-term, without hobbling the recovery next year by withdrawing the stimulus too quickly.

Even with the recent debt ceiling agreement, there is a good chance that disagreements between Democrats and Republicans will result in the opposite: excessive tightening in the short term, on the order of 2% of GDP in 2012, without a credible path to set public debt on a declining path within 5 years.

For all of these reasons, it is easy to get depressed about the US's future. And also easy now to understand why Standard & Poor's concluded that US government debt was no longer triple-A. But you could also still find a host of reasons for saying that S&P - and all the other pessimists - are selling the US short.

Why? Because - politics aside - a lot of the adjustments that the US economy needed to make to stop running up debts with the rest of the world and to compete in global markets are already well under way.

Household and corporate savings have risen sharply, while the flip-side of the poor employment outlook is that US productivity has taken off. The current account deficit has likewise fallen, meaning now that almost all of the country's massive budget deficit is being financed by its own citizens (though of course a significant chunk of the accumulated debt stock is foreign held - notably by Asian central banks).

According to Diana Choyleva, of Lombard Street Research, unit labour costs in US industry fell by 2% in 2009 and another 2.8% in 2010. The figures for China are harder to come by, but rising prices and wages mean that unit labour costs for Chinese firms have probably been rising by between 2.5% to 4.3% a year.

That means that, even with China allowing only a modest nominal appreciation of the yuan against the dollar, American firms are looking a lot more competitive than they were a few years ago.

Asian future?

Perhaps the 21st century will "belong to China and India", as many suggest. But the US has been written off many times before. The global industries that have done well in the past decade - particularly those in the digital economy - seem to reward risk-takers, iconoclasts and creative thinkers.

For better or worse, the US is better known for those qualities than the likes of China or Germany.

Whether or not it's another Japan, the US economy looks to be heading through a difficult period. But looking across the Atlantic, it's difficult to argue that the major European countries are handling their problems a lot more decisively.

And, unlike the US, the eurozone economies do not have demography on their side: in most European countries the labour force is now shrinking, and so, probably, is the long term potential growth rate.

This, perhaps, is the true lesson of the downgrade of America's credit rating, and the market reaction to that event. Investors may have good reason to worry about America's future, but for now, at least, the world stilll revolves around America.

If events are conspiring to put the US economy on a permanently lower path, that could be even worse news for the rest of the world than it is for America.