Greece 'integral' to the eurozone, say European leaders

- Published

- comments

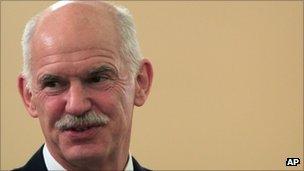

George Papandreou spoke with Nicolas Sarkozy and Angela Merkel by telephone

The leaders of Greece, France and Germany have said that Greece is an "integral" part of the eurozone.

It follows a telephone call between Greek Prime Minister George Papandreou, French President Nicolas Sarkozy and German Chancellor Angela Merkel.

Greece also reiterated that it was determined to meet all the deficit reductions plans it agreed to in exchange for its two bailouts.

Concerns continue that Greece will default on its debt.

The comments are aimed at calming markets that have seen turbulent trading in recent weeks over fears surrounding Greece's finances.

This has also increased speculation that Greece may have to leave the 17-nation single currency zone.

Greek government spokesman Elias Mossialos said: "In the face of the extensive rumours of the last few days, it was stressed by all that Greece is an integral part of the eurozone."

Mrs Merkel and Mr Sarkozy said in a joint statement: "Putting into place commitments of the (bailout) programme is essential for the Greek economy to return to a path of lasting and balanced growth."

The European Union and the International Monetary Fund agreed in May of last year to give Greece 110bn euros ($151bn; £96bn) in emergency loans, which it is still receiving in tranches.

It was then agreed in July of this year that Greece would gain a second bailout fund of 109bn euros, but this still has to be ratified by the parliaments of a number of eurozone member states.

Greece is set to receive the next loan from its initial bailout later this month, but it will get this only if inspectors from the European Union, European Central Bank and International Monetary Fund agree that it is keeping up with its spending cut targets.

There are some fears that they may rule that Greece has fallen behind. Without this month's loan, Greece will not be able to meet its debt payments by the middle of next month.

A spokesman for Mrs Merkel said: "[Greece sticking to its targets] is the precondition for the payment of future tranches of the programme."

Eurobond proposal

The talks between Mrs Merkel, Mr Papandreou and Mr Sarkozy came after EU president Jose Manuel Barroso said he would urge the eurozone nations to issue joint bonds as a means to tackle the debt crisis.

Under so-called eurobonds, member states would be able to borrow money collectively.

The idea is that this would strengthen the positions of the more indebted nations such as Greece and Portugal as it would allow them to borrow more cheaply.

However, Germany has repeatedly expressed its opposition to the idea.

Because Germany is the strongest economy in the eurozone, it can attract buyers to its existing government bonds with much lower interest rates, so it has much to lose from eurobonds being introduced.

Also on Wednesday, credit rating agency Moody's downgraded two French banks after reviewing their exposure to Greek debt.

Credit Agricole was cut from Aa1 to Aa2 and Societe Generale from Aa2 to Aa3.

A third bank, BNP Paribas, was kept on review for a possible downgrade.