Bank lending 'should be controlled'

- Published

- comments

The Bank is concerned UK banks might suffer if eurozone governments default on their debts

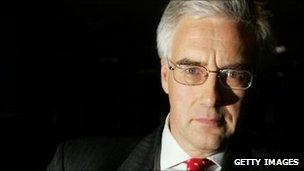

Lord Turner has once again tried to put a sizeable bomb under the economic orthodoxy that has determined government and regulatory policies towards banks (as I noted in my post this morning, a couple of years ago he suggested that a financial transaction tax might be a decent idea, and argued that some financial innovation and trading might well be "socially useless").

In a speech delivered this afternoon at Southampton University, the chairman of the Financial Services Authority argues that the free market cannot be trusted to deliver either the socially optimal aggregate amount of credit creation by banks, in boom times and bust times, or that bank credit will go to the right parts of the economy

Lord Turner says that the conventional institutions that we look to provide stability for the financial system and the economy - micro-prudential regulators such as the FSA or central banks like the Bank of England - don't have adequate tools for the task.

It's in effect a demand for the new macro-prudential regulator being created by the Treasury which will sit within the Bank of England - the Financial Policy Committee, of which Lord Turner is a member - to have important and unprecedented new powers to determine credit creation by banks and to determine the distribution of credit.

So, for example, he says that if - as now - there is evidence that banks are creating too little credit for the health of the economy, the Financial Policy Committee should perhaps have an explicit power to limit dividend payments by banks, so that the banks retain more capital to underpin lending.

Yesterday the FPC asked banks to limit dividend and bonus payments. But the FPC was asking, not ordering.

Lord Turner also believes that if retail banks are ring-fenced within universal banks, as recommended by the Vickers commission, then the FPC should have the power to make sure that the capital retained through dividend reductions should sit within the retail side of banks - so that credit creation would be concentrated on what he would see as socially useful lending to businesses and households, rather than underpinning trading by investment banks.

Perhaps even more controversial is his idea that the FPC should possibly be able to adjust the risk weightings attached to different categories of loan, so that banks would no longer find it cheaper to provide mortgages and property-backed loans rather than economically vital loans to small and medium size enterprises.

His argument is that by coercing all banks to lend to small businesses, the FPC would be able to stimulate sustainable economic growth - which would have the effect of reducing the risks of lending to small businesses.

Or to put it another way, the regulator would be able to bring about an outcome that was both socially useful and rational for banks.

In contrast, he fears that if left to the free market, any individual bank would refrain from lending to small businesses, because of its fear that other banks weren't lending to small businesses - which would undermine economic growth, increase the incidence of bankruptcy and make it quite rational for any bank to refuse credit to small businesses.

The corollary of course is that in a property boom, where credit creation explodes as rising asset prices provide spurious increases in the security that back property loans, the FPC should have the power to significantly increase the risk-weightings of property loans, to make it more expensive for banks to provide such loans.

Some in the City may well see his views as only a short step away from a Soviet-style command economy.

So it may be worth pointing out that the Treasury's Merlin targets for small-business lending by the banks can only be seen as a manifestation of the view that the free market isn't delivering the credit that the UK needs.