University lecturers resume dispute on pensions

- Published

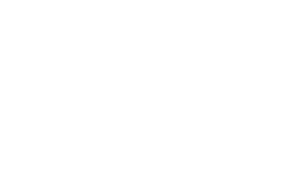

The dispute could escalate to new strikes, the UCU said

Lecturers at 67 UK universities are going to re-start a programme of industrial action from 10 October over changes to their pension scheme.

They will start a "work to contract" if the universities do not resume negotiations over the pension changes.

Substantial cuts to the benefits of the Universities Superannuation Scheme (USS) were introduced on 1 October.

The University and College Union (UCU) said 40,000 members at the affected universities might eventually strike.

The union's general secretary, Sally Hunt, said the aim was to force the university employers to renegotiate some of the changes they have just brought in.

"There are key areas that we believe need to be looked at again," she said.

"Examples being accrual rates and another example being redundancy payments for those who are 50 and 55."

The dispute affects staff at the 67 traditional universities which were in existence before 1992, when the former polytechnics and higher education institutions were upgraded to university status.

'Sustained campaign'

The industrial action may be a precursor to more widespread action which has been threatened by unions with members in other parts of the public sector, such as local government, the civil service, NHS, schools, police and the fire service.

The government is trying to press ahead with substantial increases in staff pension contributions, to be followed by full-scale conversion of most of the schemes from their current final-salary basis to become less generous career average schemes.

The lecturers' industrial action will start with a "work to contract" which the UCU said would be the start of a "sustained campaign of industrial action".

Depending on local employment conditions, this might include union members working no more than their contracted hours, not covering other lecturers' classes, and refusing to carry out any additional duties or attend voluntary staff meetings.

"This will affect the universities in very different ways," said a spokesman for the employers body the UCEA (Universities and Colleges Employers Association).

"The changes would be considered moderate by many as they include the retention of a final salary pension for all existing USS members."

The UCU said if the employers refused to start negotiating again at a scheduled meeting later this month, the action might be escalated to a boycott of internal administration, student assessments and even rolling strikes.

Second campaign

The USS pension scheme has 137,000 contributing members at nearly 300 education institutions.

One-day strikes in March, at universities around the country, failed to deter the employers from pressing ahead with the bulk of their pension changes, which have been in train for three years.

So the UCU held a second industrial action ballot last month, which produced a 77% vote in favour on a 42% turnout - even higher than in the union's first ballot earlier this year.

The union said the some of its members would lose £100,000 of their pension income over their prospective retirement as a result of the changes.

It said the employers' private aim was to make huge savings by cutting their contribution rate from about 16% of staff salaries to just 10%.

This might be achieved, the UCU said, if the university employers were able, in a few years' time, to impose the career average scheme for new recruits on existing staff as well.

Big changes

The USS changes were brought in from 1 October in a separate process to the one the government has initiated for the other big public sector pension schemes.

The university pension changes were changes were:

A normal pension age of 65 came in for new entrants and for the future service of many existing members. The exceptions to this are those members who were in the scheme before 1 October - and who were also aged 55 or over at that date. They will be exempt from the normal reductions in their accrued pensions that will be imposed if they take their pensions before the age of 65.

The normal USS pension age will rise in line with any increases in the state pension age, which is scheduled to rise to 66 by 2020. It is important to note that this will only affect pension built up after April 2020.

The employee contribution rate for members of the final-salary section has gone up from 6.35% to 7.5%.

Pension increases (for pensions in payment and deferred pensions) will now be inflation-proofed in line with increases in the consumer prices index (CPI) up to 5% a year. But for pensions earned after 1 October 2011, if inflation is more than 5% but less than 15%, the increase in pension will be 5% plus half of the increase above that level. And if inflation is more than 15%, there will be no extra pension increases - they will be capped at 10% a year.

A career-average revalued earnings (CARE) benefits structure has been introduced for new entrants. The benefits are still be based upon a 1/80th accrual rate and cash lump sum of three times the pension.

The contribution rate for members of the new CARE section is 6.5%.

If the overall cost of the scheme rises above 23.5% of salaries, then "cost sharing" will be introduced. This means any further increases in contributions will be shared in the ratio 65:35 between employers and employees respectively.