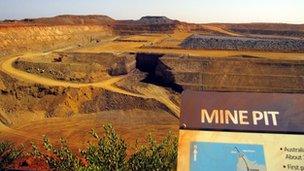

Australia mining tax clears hurdle, after much debate

- Published

The Australian government's plan to impose a 30% tax on big mining companies has cleared a major hurdle, passing through parliament's lower house.

It will go to the upper senate early next year, but is expected to pass.

The government said the tax was a way to distribute wealth more evenly from Australia's resources boom.

It will go into effect in July 2012, and will apply to mining giants such as Rio Tinto and BHP Billiton.

Spreading wealth

The Minerals Resource Rent Tax Bill will tax coal and iron profits.

When the tax becomes law, mining companies will have to pay about $11bn Australian dollars ($10.8bn; £6.9bn) in charges in the first three years of the tax.

The government says that the money raised will go towards reducing taxes on other companies, and helping the government bring the budget to surplus next financial year.

"This is a way in which all Australians share in the bounty of the mining boom," said Treasurer Wayne Swan to Parliament.

Australia's iron ore exports rose to a record high in September of $6.3bn Australian dollars, with the biggest demand coming from China and India.

Intense debate

The tax has sparked intense debate in Australian society, one that has been raging for 18 months.

Chinese demand has driven up the price of Australia's iron ore and coal

The conservative opposition is against the tax, arguing that it would deter foreign investment in the mining sector driving it overseas and resulting in job losses for Australians.

The bill passed narrowly with 73 votes to 71 with support from the Greens, a leftist liberal party.

Analysts say, this clears the way for it to pass when it goes to the upper senate in early 2012, where the government and the Greens hold the balance of power.

- Published8 November 2011

- Published19 September 2011