Chinese luxury labels to challenge Western counterparts

- Published

Western luxury brands target Chinese consumers

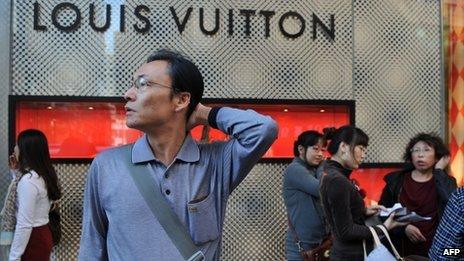

Outside the Louis Vuitton store on Hong Kong's Canton Road, there is a queue forming as security guards limit the number of shoppers, largely from China, entering the packed store.

A similar scene is played out at Chanel further down the road. There's no line outside a nearby Prada but a group of Chinese tourists take their picture outside the shop.

Chinese consumers' love of Western luxury brands is well-documented and shows no sign of flagging.

But there is a small but growing stable of companies who are betting that Chinese luxury goods buyers will begin to seek out items that reflect their own culture, rather than just the European heritage and exclusivity that have been so popular to date.

While industry experts say it will be an uphill struggle for such brands to take on the prestige and marketing power of well-established luxury goods and fashion houses, some big-name companies are gearing up to meet the challenge of changing appetites.

One example is Shang Xia (pronounced Shang Shia), a Chinese luxury label backed by French leather goods-maker Hermes.

Other brands include jewellers Qeelin and Chow Tai Fook, Taiwan fashion designer Shiatzy Chen, who has stores in Paris and China, and Shanghai Tang, founded by Hong Kong entrepreneur David Tang and now owned by Swiss luxury goods group Richemont, which also owns Cartier and Chloe.

And Louis Vuitton owner LVMH owns a Chinese distiller called Wenjun that has launched a high-end line of the Chinese white spirit or baijiu that costs between $100 (£65) to $200 a bottle.

Up and down

Shang Xia, which means up and down in Chinese, opened its first store in Shanghai in September 2010 and Jiang Qiong Er, chief executive and creative director, says feedback is has been positive so far, particularly from Chinese customers.

Shang Xia is betting that Chinese will want to rediscover luxury inspired by their own heritage

"The most touching thing is when Chinese people, after seeing the collection, say 'Wow we are feeling proud again to be Chinese'," she says while visiting Hong Kong to speak at a Business of Design Week forum.

Ms Jiang says she is planning to open new stores in Beijing and Paris soon, but is coy about revealing how the brand is performing financially and appears to be under little pressure from Hermes to turn a profit.

"The purpose of Shang Xia is not when it will make money, but it is how we can build a healthy Shang Xia brand so it can live for a 100 or 200 years," she says.

Shang Xia's products range from jewellery to furniture, cashmere and felt clothing to ceramics. Its best-selling line is a porcelain tea set with 0.2mm thick strips of bamboo woven by hand around the outside that act as a chic tea cosy.

It costs 25,000 yuan ($3,123; £2,055) and has a three-month waiting list.

Brands

Henry Steiner, who runs Hong Kong-based Steiner & Co that advises companies about brand creation and strategy, is sceptical about the chances of a high-end, Chinese brand emerging any time soon.

"They have to go through this very difficult process of not just coming up with a cute idea, but really building a company, working on it strategically and logistically and sticking their neck out when it comes to marketing," he says.

"Western brands come with a certain personality that's been built up over the years, with recognition and consistency and dependability - all the things that Chinese brands don't have."

Few Chinese brands have recognition in the West - luxury or otherwise.

According to a survey of 1,476 people by Calling Brands consultancy released in November and conducted in France, Germany and the UK, only a few could spontaneously recall any Chinese brands.

Some 7% named PC maker Lenovo, while 2% named mobile phone handset maker Huawei and appliance maker Haier.

"One key challenge for ambitious Chinese brands looking to grow in Europe is the idea that brands from China still conjure up a one-dimensional image: low price," the survey said.

Different tack

Saurabh Sharma, a planning partner at advertising agency Ogilvy & Mather in Beijing, says that Chinese companies do have a genuine opportunity to thrive in the luxury sector, but to succeed they will have to take a different approach to their Western forerunners.

"They need to look at things differently, like tailor-made luxury," he says, citing the example of a chain of boutique hotels being set up in China that will offer "imperial hospitality" by treating guests like emperors.

"If you can do things in a more personal way instead of a packaged and merchandised format, you will get more margin out of it.

"The challenge for Chinese brands is to leverage the 'made in China' tag more creatively. They need to tap into the rich spirit of Chinese history and heritage."

Ms Jiang at Shang Xia is keen to point out that China's appreciation of luxury items dates back centuries before Louis Vuitton and Thierry Hermes crafted their first monogrammed trunks and leather saddlery.

"It's not just about showing off and bling," she says.

"If you look at our cultural roots, Chinese people have always looked for excellence and quality.

"We are looking to revive the timeless aesthetic that China had before in Ming furniture, Song porcelain and Han-dynasty dress."

But she admits that Chinese people are unlikely to abandon their love of Western brands quite yet.

"In the last three to five years, little by little, there is a small group of Chinese people starting to go back to their roots.

"It doesn't mean they will quit buying Western luxury brands but... you do need a balance."