MPs attack HMRC's 'cosy' deals with big business

- Published

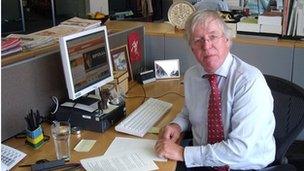

Chief tax collector Dave Hartnett announced earlier this month that he would retire next summer

A committee of MPs has criticised "cosy" deals between HM Revenue & Customs (HMRC) and big businesses.

The MPs singled out Dave Hartnett, permanent secretary for tax, for failing to handle tax negotiations with some big companies properly.

The Public Accounts Committee said large firms got favourable treatment and there was a lack of public accountability over how deals are done.

HMRC rejected the findings and said the MPs had misunderstood the facts.

The Prime Minister's official spokesman also rejected claims of "unduly cosy" relationships.

"They don't get preferential treatment. HMRC support all taxpayers even-handedly," he said.

"Poor judgement"

The committee of MPs said they believed there was £25bn of outstanding tax potentially owed by big companies and wanted the Revenue to be more open about its dealing with large firms.

It was especially critical of Dave Hartnett's role as HMRC's chief tax collector.

"The absence of full transparency about his relations with companies risks the perception that he acted improperly or exercised poor judgement," the MPs said.

A spokesman for HMRC hit back, saying the MPs were simply wrong to call Mr Hartnett's honesty into question.

"The report is based on partial information, inaccurate opinion and some misunderstanding of facts," the spokesman said.

"The idea Dave Hartnett cuts a large tax bill in return for a glass of wine and a cheese sandwich is just plain nonsense.

"If he was interested in feathering his nest he would have accepted one of the many highly lucrative offers of work he regularly receives from the private sector," the spokesman added.

Stonewalling

The report by the committee contains some of the most severe criticism of a civil servant yet published.

Margaret Hodge MP says HMRC has a "David and Goliath" relationship with big business

The MPs accuse Dave Hartnett of mishandling tax negotiations with some big companies such as Goldman Sachs, letting it off millions of pounds in interest on its tax bill.

He had also, the MPs said, tried to stonewall their questions when they quizzed him at committee hearings during October and November this year.

The MPs say he:

authorised a large tax settlement whose negotiation he had been involved in, breaching HMRC's internal rules

had given "imprecise, inconsistent and potentially misleading answers" to MPs

had relationships with big companies that were "too cosy", resulting in the appearance they received "preferential treatment"

had used a bogus excuse of observing taxpayer confidentiality to avoid explaining the tax deals he had been involved in.

The MPs said the scale of potential tax losses due to apparently cosy deals with Goldman Sachs and Vodafone had only been brought to their attention by an HMRC "whistle-blower" and the publication Private Eye.

But HMRC said many of the specific criticisms by the MPs were wrong.

It admitted making a mistake in the Goldman Sachs but said there was no "systemic failure" at HMRC.

It said the figure of £25bn tax outstanding had been an initial estimate before investigation, as of March 2011, but in fact in many cases it turned out that no more tax was owed at all.

It rejected completely the whistle-blower's suggestion that in fact £20m of interest had been foregone in the Goldman Sachs case.

Veil of secrecy

Margaret Hodge MP, chair of the Public Accounts Committee, told the BBC that she thought the relationship between big corporations and HMRC was like "David and Goliath".

"Big companies have very expensive advisers, consultants and lawyers. HMRC, on their own admittance, has very few people who have deep knowledge of tax affairs," she said.

Mrs Hodge said there was a lack of transparency and accountability and that HMRC hid "behind a veil of secrecy".

"It's imperative everyone is treated equally in front of the law," she added.

An HMRC spokesman said Mr Hartnett had answered questions strictly in line with the advice of the tax department's lawyers, which legally restricted how much he could reveal about individual tax cases.

Mrs Hodge disputed this defence, telling the BBC that there "isn't a legal inhibition that prevents them [HMRC] opening up and talking about, be it Goldman Sachs or Vodafone. It's a policy decision on their behalf," she said.

In early December Mr Hartnett announced he would be retiring in the summer of 2012.

Vodafone

The mobile phone company Vodafone again rejected the "urban myth" that it had been "let off" as much as £8bn in tax by striking a sweet-heart deal with HMRC.

The BBC's chief economic correspondent Hugh Pym says HMRC has to get the best deal for tax payers

It explained that in its case, after nine years of highly complex tax litigation, "the outcome was a full and final settlement with HMRC of £1.25bn, reflecting all liabilities".

"To be clear: Vodafone has no unpaid tax bill in the UK, and those who claim otherwise do so without any foundation whatsoever," the company added.

The tax campaign group UK Uncut is taking HMRC to the High Court on Thursday, seeking a judicial review to try to get it to reclaim millions of pounds in tax from Goldman Sachs.

Tim Street from UK Uncut Legal Action told the BBC the tax agency's ability to investigate tax avoidance in future could diminish.

"HMRC is going to have a decrease in the numbers of employees and money they receive," he said.

Mr Street said that clamping down on tax avoidance was an alternative to a strategy of public sector cuts.

- Published9 December 2011

- Published7 November 2011

- Published19 October 2011

- Published13 October 2011

- Published24 August 2011