Mr Osborne and the semiotics of GDP

- Published

- comments

George Osborne: "You don't have to tell me the economic environment is very difficult"

He might be in Japan, but the chancellor is keeping one eye on the GDP figures back home.

I interviewed him in a slightly odd location earlier today - on an empty bullet train parked outside the main Tokyo rail depot. He admitted for the first time that the UK economy probably wasn't going anywhere either, at least in the fourth quarter of 2011.

He reminded me - not once, but twice - that the Office for Budget Responsibility had forecast that GDP would be negative in those three months. But, he was quick to add, it had not forecast a recession.

I thought it was very helpful of him. I might have forgotten.

Naturally, Westminster cynics will see it differently. They will say it's part of a careful softening-up exercise, so we're less perturbed, if and when there's a negative sign in front of that preliminary GDP figure estimate when it comes out next Wednesday.

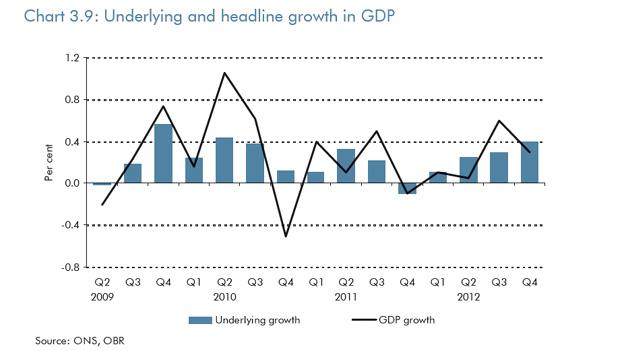

You can see the forecast in detail in Chart 3.9 of the OBR's Economic and Fiscal Outlook, external, released at the time of the Autumn Statement.

It's true that the OBR did not forecast another recession. Though it did say there was a one in three chance of the economy shrinking in 2012.

You might think the softening exercise unnecessary. After all, many private forecasters are also predicting a negative GDP figure.

If the ONS says that our national output shrank by, say, 0.1% in that period, you have to expect these City folk will not send out urgent missives declaring that our economy is heading into a downward spiral.

Instead, I am sure they will remind us that the average revision to these first estimates has been 0.23 percentage points in either direction over the last 5 years. Over a longer time period, the average revision is a good deal larger.

They say economists put decimal points into their forecasts to show they have a sense of humour. The ONS first estimate for GDP is better than a forecast and ought to be closer to reality. But it is still very much a first draft.

As I said last week, what we should take from a very small number - positive or negative - is that the economy is broadly flat. Whether it's +0.1% or -0.1%, on this view, shouldn't make much difference.

But the chancellor knows that in political terms that is all drivel. In Fleet Street and Westminster a negative sign will make all the difference in the world, at least for the first few days.

Rightly or wrongly (mainly wrongly), many will see -0.1% as clear evidence that we're heading for a double dip, whereas +0.1% will suggest the economy is holding its ground.

Perhaps the chancellor could expect a more logical, calm and considered response to the GDP figures if he were finance minister for Japan. But there's fat chance of him getting it next week.