Facebook unveils $5bn stock market flotation plans

- Published

- comments

The world's largest social networking site, Facebook, has announced plans for a stock market flotation.

Facebook said it would seek to raise $5bn (£3.16bn, 3.8bn euros), about half the amount many analysts expected.

But the initial public offering (IPO) is still expected to be the biggest sale of shares by an internet company.

Facebook, just eight years old and started by Harvard University students, now has 845 million users and made a profit of $1bn last year.

Facebook filed its intention to float with the Securities and Exchange Commission after the US stock markets closed.

<link> <caption>The documents revealed for the first time</caption> <url href="http://www.sec.gov/Archives/edgar/data/1326801/000119312512034517/d287954ds1.htm" platform="highweb"/> </link> information about the company that had previously been the subject of speculation.

This included news that Facebook's net income in 2011 rose 65% to $1bn, off revenues of $3.71bn.

It was disclosed that founder Mark Zuckerberg owns 28.4% of Facebook and has more than 50% of voting rights. It also revealed that the network now has 845 million monthly users of which 443 million are daily users.

A <link> <caption>letter from Mr Zuckerberg</caption> <url href="http://www.sec.gov/Archives/edgar/data/1326801/000119312512034517/d287954ds1.htm#toc287954_10" platform="highweb"/> </link> said: "Facebook was not originally created to be a company. It was built to accomplish a social mission - to make the world more open and connected.

"We think it's important that everyone who invests in Facebook understands what this mission means to us, how we make decisions and why we do the things we do."

The $5bn being raised would be the most for an internet initial public offering since Google and its early backers raised $1.67bn in 2004.

"The company is a lot more profitable than we thought," said Kathleen Smith, principal of IPO investment advisory firm Renaissance Capital.

She said Facebook's numbers were "very impressive," but she added that Facebook needed to talk more about where it saw its growth coming from.

"What new areas of business is it expecting to pursue beyond display ads?" she said.

The final amount Facebook will raise is likely to change as Facebook's bankers gauge the investor demand for the shares over the coming months.

The story of the company was made the subject of a 2010 Hollywood film, The Social Network, and the firm has made the verb "to friend" a part of everyday language.

Valuation justified

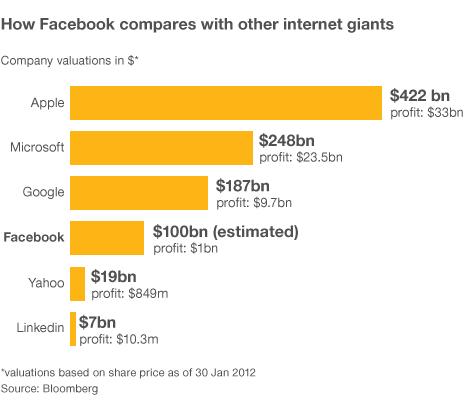

Reports have suggested the company could be worth $100bn, roughly the same as US giants Amazon and McDonald's.

Facebook currently makes most of its money from online advertising.

"As it is not a paying service, you are not the customer, you are the product," explains the BBC's technology correspondent Rory Cellan-Jones.

"What Facebook is selling to the world is users' time and their attention, their likes and dislikes, all that time and data they pour into the site, so that they can be very precisely targeted with adverts matching our interests," our correspondent says.

As a private company, Facebook has not had to publish detailed accounts so it has not had to make public whether, or how much, profit it makes. This has been the subject of much speculation, however.

Releasing much more detailed information on its finances will become part of the Facebook's duties as a publicly listed firm.

"The company does change when you go public," co-founder of online travel site Lastminute.com Martha Lane Fox told the BBC.

"Whatever Mark Zuckerberg says about continuing to run the company for users, for employees, not for shareholders... it does mean there is a level of scrutiny and accountability not known in a private company."

Planning the IPO

"The IPO of Facebook is the one that investors have all been waiting for, given that it is now an iconic global brand with huge scope to expand even further," said Phil Wong, stockbroker at Redmayne Bentley.

"The major investment banks have competed to be selected as lead advisors given the status of the firm, and investors are sure to be equally eager to acquire a holding in the business."

Facebook is the latest in a series of online firms to sell shares to the public in recent months.

Online voucher firm Groupon went public in November 2011 and online games maker Zynga in December 2011.

Zynga's stock market value immediately fell below its asking price on the first day of trading, whilst Groupon climbed initially before dropping to about half of its offer price.

Shares in the social networking site Linkedin fell below their May 2011 offer price after its shares became freely tradeable.

However stock market traders remain positive about Facebook's flotation.

"Facebook is worth the expected $80-$100bn valuation because we believe it is and will be the dominant social media platform globally," said Richard Nunn at Charles Stanley Securities.

"It has more than 100m more US users than Google did when it IPO'd, and Google is valued at $180bn, and most importantly for advertisers, the average dwell time of 6hrs 51m per month spent on Facebook trounces the competition by some way.'

- Published2 February 2012

- Published1 February 2012

- Published1 February 2012

- Published18 May 2012