Singapore Airshow aims 'big' despite global uncertainty

- Published

Thousands of trade representative from all across the globe are expected to attend the event

"Big Show Big Opportunities" - that is the theme of the Singapore Airshow being held in the city-state this week.

The numbers behind the event justify the tagline. Some 900 exhibitors from 50 different countries, including the likes of Boeing, Airbus and Bombardier, are taking part in the biennial showcase.

More than 40,000 executives from the aviation industry will be pacing the alleys, visiting booths and attending various conferences and summits being held on the sidelines.

Another 100,000-plus are expected to make a beeline for the show, once it is opened to the general public, to catch a glimpse of the latest technology on offer.

Small is big

While all the talk in town is about the presence of the "big" players of the aviation sector, it is the relatively small firms that are likely to generate most of the buzz.

The region's low-cost airlines are looking to expand in a bid to cater to growing demand for air travel.

Analysts say these firms need new planes to meet their needs and are likely to use the event to announce these purchases.

"There will be significant orders from the smaller airlines," Shashank Nigam, chief executive of consultancy firm SimpliFlying tells the BBC.

"They are creating new markets and getting people to fly for the first time. This is where the growth is coming from."

Mr Nigam adds that the majority of these orders are likely to be for narrow bodied aircraft as they are best suited for flights within the region.

Analysts say Boeing, Airbus and Bombardier will be leading the pack in trying to fill up their order books.

"We will see Airbus and Boeing really trumpeting their A320neo and 737Max, respectively," says Siva Govindasamy of Flightglobal.

"These planes offer greater fuel economy, lower operating cost and slightly longer haul flights, all of which are attractive incentives for an airline," he explains.

'Testing times'

However, along with the hype, there seems to be some uncertainty surrounding the event, not least because of the current global economic environment.

The eurozone leaders are yet to find a sustainable solution to the region's debt crisis and despite the recent encouraging data, the US economic recovery continues to remain fragile.

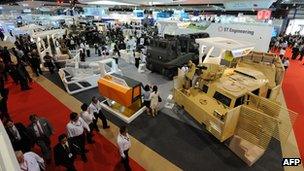

Exhibitors from the defence sector have been looking to tap into the Asian market

To make matters worse, China and India, two of Asia's fastest growing economies and aviation markets, are starting to show signs of slowing growth.

"We are entering testing times, not just for the airline industry, but also for the global economy," Shukor Yusof, an aviation analyst with Standard & Poor's tells the BBC.

The International Monetary Fund has cut its forecast for global growth for this year to 3.3%, down from its earlier projection of a 4% expansion.

A slowdown in the global economy is expected to have a negative impact on the airline industry.

Mr Yusof explains that these fears will make it difficult for airlines to convince lenders to commit to any long-term funding.

"People are starting to understand that orders placed now are going to be delivered over the next few years," he says.

"Given the uncertainties, it is going to be difficult for airlines to find adequate financing for their purchases."

Insecure region?

There are no such worries though for the government representatives visiting the show to take a look at the latest in defence technology.

The region's economic growth in recent years has seen government revenues rise, giving them extra resources to increase their defence spending.

Almost 50% of exhibitors at the airshow are from the defence industry. The event is also holding a "Land Defence Pavilion" for the first time as manufacturers look to tap into the Asian defence market, which analysts say is poised to grow.

While increased spending power is helping boost defence budgets, geo-political tensions are also playing their part.

In recent years, China, the biggest economy in the region, has not only increased its military spending but has also been using aggressive language while handling territorial disputes.

"We have seen an atmosphere of insecurity in the region in recent years and that encourages defence spending," says Tim Huxley, executive director of International Institute of Strategic Studies in Singapore.

"As the regional distribution of power is undergoing change, we are likely to see a continuation of this trend," he adds.

Analysts say countries are also keen to ensure that they keep pace with technology and have the latest defence equipment available for their forces.

"A lot of the nations are operating older fighter aircraft and are looking to upgrade," explains Flightglobal's Mr Govindasamy.

"The military side of the market in this part of the world will continue to grow."

'Big deal'

Another area of growth that aircraft manufacturers are keen to tap is the private jet market.

This is not surprising, given the fact that the number of billionaires in Asia-Pacific has surpassed those in Europe. China alone boasts of as many as 115 of them.

Firms such as Embraer are tapping into the star power to boost their sales in Asia

Earlier this month, Embraer, one of the leading manufactures of private jets, said it has received orders for 13 Legacy 650 jets from China's Minsheng Financial Leasing Company, one of China's leading executive jet leasing firms.

The plane manufacturer has appointed actor Jackie Chan as its brand ambassador in a bid to boost sales in the lucrative Chinese market.

It is even flying the Legacy 650 jet belonging to the actor into the airshow, in a bid to build its brand in the region.

"It will be a big deal. This is a growth market for private jets," says Mr Govindasamy.

"Big deal" for a "Big Show" with "Big Opportunities".

Big, then, seems to be the word of the moment in Singapore.