Car factory closures loom as Europe's market shrinks

- Published

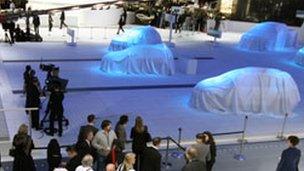

Plenty of exciting new cars will be unveiled at the show, but finding buyers for them is not easy

The discussions about who the winners and losers in the European car market will be are well under way, even before the covers have come off the latest models at the motor industry's annual jamboree in Geneva.

The motor industry here is feeling the full force of the economic storm that is lashing Europe at the moment - in sharp contrast to the bright spots elsewhere in the world where there is still plenty of scope for optimism for this inherently global industry.

"Our original forecast was that the European car market would contract 1.5% this year, but now we see it contracting about 5%," says Oh Tae-Hyun, Kia's chief operating officer and head of overseas operations.

Elsewhere in the world, the picture is very different.

Car sales in Japan are soaring on the back of new subsidies for green cars, the American market is motoring towards levels not seen since the pre-recession boom years, and momentum remains reasonably strong in emerging markets, including China and India, Russia and South America.

'Squeezed middle'

Weak demand in Europe is matched - or rather mismatched - with a severe excess manufacturing capacity by carmakers here.

Mainstream carmakers such as Opel/Vauxhall and Ford are feeling the squeeze more than most.

The cost of making cars must come down or prices must rise if carmakers are to make more money

They are both enduring losses to the tune of several hundred million euros per year, and their customer base is bombarded by rival models from both the low-end and the high-end of the market.

Opel/Vauxhall and Ford are thus finding themselves in the "squeezed middle", according to John Leach, head of UK automotive at consultants KPMG, with French carmakers PSA Peugeot Citroen and Renault as well as Fiat of Italy in similar situations.

"This trend looks set to increase the difficulties of the mid-market European brands," IHS Automotive analyst Tim Urquhart reasons.

Consumers everywhere "are becoming ever more brand and image conscious", according to Mr Urquhart.

Luxury car companies, notably Audi, BMW and Mercedes, "are looking to take advantage of this through expanding their model ranges downwards to enter lower price segments", he says.

Such changes are accelerated by high oil prices and stricter emissions regulations, which combine to push the market towards smaller and more frugal cars.

Profit margins tend to be tighter for small cars than for large ones, so to make money the carmakers need to either keep their costs down or secure high prices for their vehicles.

Fast-growing South Korean carmakers Kia and Hyundai are better than many European players at the former, according to Mr Leach.

"Their costs are lower - much lower - so their profitability globally is fantastic," he says.

The luxury car companies, meanwhile, are much better at sweating their brands, Mr Urquhart insists.

"The companies that have in general terms posted the strongest sales and financial performance since the financial downturn have been the premium carmakers," he says.

Closing factories?

With both the luxury car companies and the South Koreans selling all the cars they make, it is clear that the overcapacity is essentially a problem for the mainstream manufacturers, which essentially have too many factories.

Making matters worse, these factories are often old and inefficient compared with those operated by their more successful rivals, and industrial relations at these plants are often strained.

In Italy, Fiat chief Sergio Marchionne is embroiled in a war of words with the unions over pay and conditions.

Opel and others make too many cars in Europe, so many fear factories may close

His mantra during the past year or so has been to tell workers in Italy that unless they scale back their demands and accept cost-cutting measures, he will shift production to under-utilised factories in Canada and the US owned by Fiat's alliance partner Chrysler.

In France, PSA Peugeot Citroen has been urged by the government to resist the temptation to cut thousands of jobs, while German and British ministers are pleading with Opel/Vauxhall's parent company General Motors to preserve factories and jobs.

Plant closures are unlikely to be announced during the Geneva show, where the carmakers will try to keep the focus on their latest model launches.

But there is no denying that the future of some of Europe's oldest car factories hangs in the balance.

The Geneva motor show is open for the public from 8-18 March.