Taxing the rich: Is it worth it?

- Published

How much extra tax was raised by the new 50% tax rate should be known soon

Next week's Budget may contain at least one interesting nugget of information.

Just how much extra tax has been raised by the 50% "additional" income tax rate, introduced by Labour in April 2010?

It was first announced a year earlier in the April 2009 Budget by Alistair Darling, the then chancellor.

It was always planned as a temporary measure to raise more tax in the depths of the recession.

But the Conservatives have hated it from the word go.

In last year's Budget the new Chancellor George Osborne said: "I am clear that the 50p tax rate would do lasting damage to our economy if it were to become permanent.

"But I think it's sensible to see how much revenue it actually raises.

"I've asked HMRC to find out the truth when the self-assessment forms start coming in," he said.

In the past year there has been a concerted campaign in favour of abolishing it, involving a variety of right-wing think tanks, wealthy business people and some economists.

How much?

Not surprisingly, income tax raises a lot of money: £153bn in 2010-11, according to the most recent HMRC estimates, external.

That was just over a third of all government tax revenue that year, with only national insurance (£97bn) and VAT (£84bn) coming close in the tax pecking order.

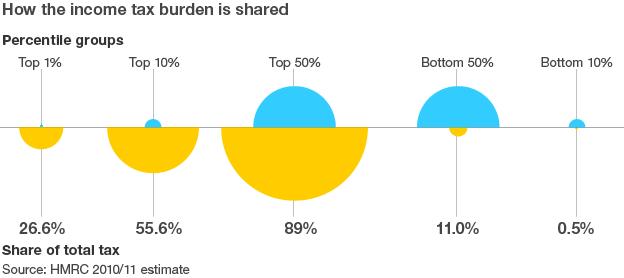

How much do the rich pay? Quite a lot in fact, and far more than most people realise.

Again, according to the wealth of HMRC figures, external on the topic, the top 1% of all income taxpayers contributed a whopping 27% of all income tax that year.

By contrast, the bottom 50% of income taxpayers paid just over 11% of income tax.

This highlights a fundamental truth, that in the UK, as you move up the income scale, so your personal income tax bill is likely to shoot up.

In 2010-11, the 26.3 million basic rate (20%) taxpayers paid £67.9bn in income tax, with average personal income tax bills of £2,590

The 3.2 million higher rate (40%) income taxpayers paid £50.7bn, or £16,300 each

And the far fewer 275,000 additional rate payers, charged 50% on their taxable incomes over £150,000, paid £41.4bn. A frankly staggering average of £151,000 each

No upper limit

A key fact here, at least for the super-rich, is that there is no upper limit to their taxable income.

Although there may not be many of them, they have incomes which are so fantastically large, running into millions of pounds a year, that their individual income tax bills are huge too.

Higher rate tax payers endured an average personal tax rate of 23% on their taxable incomes in 2010-11.

But the additional rate payers, paying at 50% on the top slices of their incomes, had a personal tax rate on all their taxable incomes of 40%.

No wonder some of them are complaining.

Off-putting?

Now all these figures, published a year ago, were estimates by HMRC.

We will not know the facts until the Revenue has carried out its calculations.

It should be in a position to have a first stab soon, now that it has most of the forms in from the 2010-11 self-assessment tax payers.

Back in 2010, the Institute of Directors criticised the new tax in these terms.

"We believe the 50p rate is likely to raise little or no tax overall in the short-term, and lead to lower overall tax revenues in the medium to long-term," it said.

Is that self-interested scaremongering, or just realistic?

The wealthiest 13,000 individuals, earning more than £1m a year, were estimated to have paid an average of nearly £1m in income tax each in 2010-11, so astronomical were the total incomes some of them earned.

It does not seem likely that they were all able to avoid completely the impact of paying an extra 10% tax rate.

John Whiting, tax policy director at the Chartered Institute of Taxation, urges caution in judging the policy before the facts are known.

But he is sceptical that the policy has raised enough to make it really worthwhile.

"It has almost a greater psychological impact than a financial one," he suggests.

"At one end of the scale it makes some people think about tax planning, so they pay more as capital gains and less as income tax.

"It's also sending out slightly adverse signals, sending a few people abroad and putting some off coming here," he says.