G20 summit to focus on eurozone debt crisis

- Published

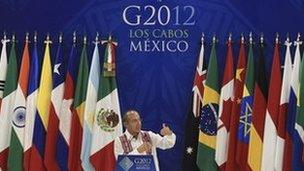

There is a clear line of division at this summit - the eurozone and the rest, our correspondent says

G20 summits, it seems, can make a real difference. One assessment of the second meeting put it like this: "An enormous success in stopping the drop in the global economy".

That was experts at the Brookings Institution, a Washington think tank, <link> <caption>writing about the London G20 summit of April 2009</caption> <url href="http://www.brookings.edu/research/opinions/2010/04/05-g20-summit-linn" platform="highweb"/> </link> .

Now that is not a universally shared view. In particular, there has been <link> <caption>criticism of the role of fiscal stimulus - tax cuts and public spending</caption> <url href="http://roomfordebate.blogs.nytimes.com/2009/11/01/did-the-stimulus-work/" platform="highweb"/> </link> .

But there certainly seemed to be a unity of purpose and a lot of joint action from the London summit, in the shape of stimulus measures and a hefty boost to the financial fire-fighting capacity of the International Monetary Fund (IMF).

That was during the post-Lehman financial seizure. Three years on, the crisis has entered a new virulent stage. Not as bad as then - not yet - but a serious danger to the global economy. So can we expect a similar performance from the G20 summit in the Mexican resort of Los Cabos?

Probably not.

There is a painfully clear line of division at this summit - the eurozone and the rest.

The eurozone financial crisis has been the festering wound threatening the health for the global economy for more than two years. The risk has intensified in the past few weeks. The immediate dangers have been the strain on Spanish government debt in the bond market and the political uncertainty in Greece. But there are plenty of other dangerous elements.

Ahead of the summit there have been many calls from other G20 leaders for their eurozone members to take decisive action to reduce the danger of the infection spreading.

As he left for the summit, the Indian Prime Minister Manmohan Singh called on European leaders to take "resolute action". The official Chinese news agency, Xinhua, said the eurozone countries should work together.

Co-ordinated action

No doubt this will be a major theme of Los Cabos, with pressure building on the eurozone leaders at the summit, especially the German Chancellor Angela Merkel. The key actions are really for the eurozone countries to take themselves - the moves towards greater integration that no end of commentators have called for, and which they appear to be edging towards themselves.

It is a major difference when compared with the London summit, where the need for decisive action was more widely spread.

That is not to say the rest can afford to sit back and jeer. There are things they could do, <link> <caption>as argued by Gordon Brown, the former prime minister who chaired the London G20 summit</caption> <url href="http://blogs.reuters.com/great-debate/2012/06/15/decisive-euro-action-is-needed-at-the-g20-summit/" platform="highweb"/> </link> . China and the oil producers, for example, could help Europe with loans, possibly via the IMF. And there may be a role for co-ordinated central bank action in stabilising banks and currency markets.

While Europe is clearly the big danger, there are also problems elsewhere in the G20, starting with the two largest national economies - the United States and China.

There is no denying that the recent performance of the US economy has been better than Europe's. The US economy grew 0.5% in the first quarter of this year, compared with no growth in the eurozone, itself better than the contraction of the previous three months. But the US is distinctly anaemic. Job creation has lost momentum and there are good reasons to worry about economic prospects.

Chinese shift

The US also has its own problems with fiscal policy and government finances. Spending cuts and tax increases are due to take effect next year, in a way that most economists think far too abrupt. Some call it a "fiscal cliff" that the US faces unless the administration and Congress can agree to postpone or moderate the measures.

The Congressional Budget Office has warned that if no action is taken, it could cause a recession. A downturn in the US would certainly be something for the rest of the G20 to worry about.

China's economy is slowing, partly due to the deterioration in its European export markets. The central bank has cut interest rates but there will be more decisions to take about how to respond.

One huge, but longer-term, challenge that matters for China and the rest of the world is the widely anticipated shift of the country's economy from its dependence on exports towards Chinese consumer spending.

The slowdown in India is another important point for the G20 to fret about.

They are all serious questions, but the big immediate issue for the global economy is one that doesn't really need G20 co-ordination. It needs Europe, in particular the eurozone, to take its own tough decisions. The rest of the G20 will say so at Los Cabos, but you would have thought the eurozone don't need to be told.

Still, it might be a useful reminder of the very high stakes when European leaders get down to business at their own summit less than two weeks later.