When is tax dodging illegal?

- Published

Tax can be a complicated matter that leads to disputes and appeals

There are a lot of rash statements being made about whether or not the K2 tax avoidance scheme used by Jimmy Carr was "legal".

The implication being that if it was not, it was a bad thing to do - obviously. And if it was "legal", well that is OK then, even if Prime Minister David Cameron says it was "morally wrong".

Unfortunately, tax is a bit more complicated than that.

Tax evasion is the illegal thing. It happens when people deliberately do not pay the tax they should. It is criminal.

Tax avoidance is the arrangement of a taxpayer's affairs in such a way as to pay the least amount of tax legitimately.

A fine line? Some would say so.

Loophole

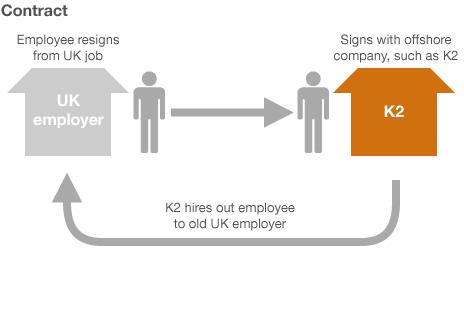

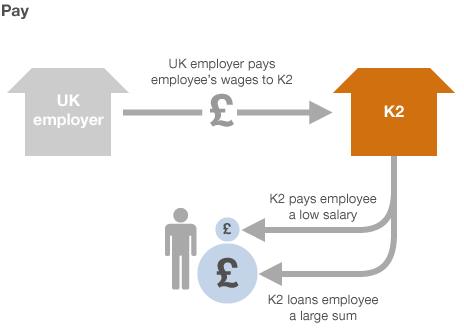

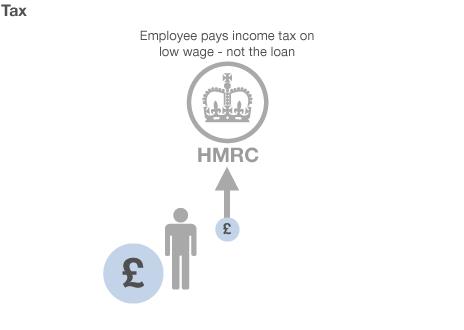

HM Revenue and Customs (HMRC) is referring to K2 in the category of tax avoidance, so let us concentrate on that.

Just because a scheme is classed as tax avoidance does not mean it is all right.

Usually, it has to be registered with HMRC, so they can check if it complies with tax rules.

If HMRC decides it is not acceptable, then the taxpayer would have to hand over all the unpaid tax along with interest and, possibly, penalties.

Basically, officials treat the underpayment of tax as a mistake.

It could be that the scheme takes advantage of some obscure loophole. In that case the tax people would get the Treasury to change the law, but the scheme's users would get away scot free until such an order was made.

So the Jimmy Carr ruse is not being talked about by the authorities as illegal, but that does not mean he - and the others who are or were signed up to it - will not have to pay back the tax.

HMRC's line is that K2 is being investigated.

Another phrase being bandied about is "tax abuse" which, confusingly, can be applied to both evasion and avoidance.

A tax avoidance scheme which HMRC finds to be a blatantly artificial construction to dodge tax could be an abuse.

There will soon be a <link> <caption>General Anti-Abuse Rule</caption> <url href="http://www.hm-treasury.gov.uk/tax_avoidance_gaar.htm" platform="highweb"/> </link> to deter this sort of dodging. Some accountants say it will "kill it stone dead", others that it will just lead to more complicated disputes.