PPI: One woman's £65,000 compensation payment

- Published

The banking industry may have to pay as much as £9bn for past mis-selling of PPI

A businesswoman from Hertfordshire has been repaid nearly £65,000 by her credit card company, for mis-selling her payment protection insurance (PPI).

Roberta (not her real name) has been paid by the credit card company MBNA.

She had been paying premiums for PPI policies on one MBNA card since 1996 and another since 2001.

The policies were supposed to cover her in the event of her falling ill or losing her job and being unable to pay her credit card bills.

In fact, she could never have made a legitimate claim on the policies because she is self-employed.

"As a director of my own company I would never have been able to claim on the policy, and on the second card I was never given the option of asking for PPI, it just came through automatically," Roberta says.

Thanks to all the recent media publicity, she realised last year that the PPI had been mis-sold to her.

After complaining to MBNA directly, and then going to the Financial Ombudsman Service (FOS), the card company relented in June and told her a cheque would be on its way.

"I nearly fell off my chair," she says.

"I was absolutely staggered at the amount, I had no idea it was going to be anywhere near that."

Why so much?

Three factors have come together to generate a particularly large payout for Roberta.

Firstly, after she asked for her credit card records, MBNA revealed that they had them going right back to the beginning in 1996.

"I don't have old credit card records and would never have had any way of proving what I'd paid," Roberta says.

Secondly, at various times she had used her card to its limit.

As the premiums were a percentage of the monthly outstanding balances, this bumped up her premiums from £10 a month to, at times, £60 a month.

Compound interest

But that is not all.

She has been awarded interest at the very high compound rate she would have been charged in the past for borrowing on the card itself.

At times this had reached 29%.

"It is the very old charges that are giving me these interest calculations," Roberta explains.

"It is the very old statements, the very old PPI contributions, that made the bulk of this claim."

She was also awarded an additional 8% interest on her returned premiums.

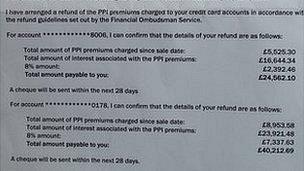

On the first card this came to returned premiums of £5,525, plus interest of £19,037, amounting to £24,562 in all.

On her second card, she had premiums of £8,954 returned to her, along with interest of £31,259, amounting to £40,213.

That makes a total payment from MBNA of £64,775.

"It is just astounding that the money can accumulate with the interest," she says.

Magic retrieval

The banking industry now appears to be facing a compensation bill of as much as £9bn for the past mis-selling of PPI.

The letter detailing Roberta's compensation

Several million customers are in line for payments, which currently average about £2,750 according to the experience of the Financial Ombudsman Service (FOS).

Marc Gander, of the Consumer Action Group, says banks often claim they do not keep records going back further than six years, when faced with PPI mis-selling claims.

He says Roberta's experience shows that people should not take "no" for an answer.

"Lots of financial institutions say they do not have records going back more than six years," he says.

"But my feeling is that in fact they never get rid of them.

"When pressed, they are often magically able to retrieve a few years more of past records ," he adds.

Big payouts

In March the financial website Moneysavingexpert reported that a man from Essex, Phil Stephens, had been awarded £82,300 for mis-sold PPI policies on two Barclaycards.

In May the BBC Moneybox programme told the story of a woman who had obtained £50,000 in PPI compensation from several credit card firms.

However the record payout so far appears to be that of a woman from Yorkshire.

According to her solicitors, Ashworth Law, she received £142,000 for two mis-sold PPI policies on credit cards first taken out in the early 1990s.

- Published22 May 2012

- Published11 May 2012

- Published3 May 2012

- Published1 May 2012

- Published26 April 2012

- Published23 April 2012