High Street fashion brands look to China for profits

- Published

Fashion brands are vying for the attention of Chinese consumers

Student Michelle Yu, from Hangzhou in eastern China, spends around 2,000 yuan ($300;£200) of her parents' money each month on clothes.

Clutching a recent purchase while pop music blares out of a nearby store, she says her favourite brands are Louis Vuitton and Gucci.

But, as her budget rarely stretches this far, she likes to shop at Zara, H&M and the other Western chains that are springing up across China.

"They are fashionable and cheap," she tells BBC News while in Hong Kong for a shopping trip with her mother, father and sister over a recent holiday weekend.

Luxury labels have thrived in China and now their cheaper High Street counterparts are betting that young, fashion-conscious shoppers like Ms Yu, 20, will help them weather weak economies in their home markets in the US and Europe.

"They target a very different consumer segment compared to their luxury counterparts, but being Western brands they will always have a certain cachet with the Chinese consumer," says Ashma Kunde, a London-based global retail analyst at research group Euromonitor.

However, they will encounter stiffer competition from established local chains than their luxury forerunners, and with many brands expanding aggressively in China, they will also be vying with each other for customers.

Moreover, China's fickle consumers are unlikely to warm to all brands equally and may grow pickier as the Chinese economy is forecast to experience its slowest growth in 13 years in 2012.

"Whether they succeed will depend on their product. If their product can justify their pricing, if it's distinctive enough, it has the potential to do well," says Ms Kunde.

Bold plans

Many brands have ambitious plans for China and others are entering the market for the first time this year.

They are competing in an apparel market that was worth $243bn last year, not far behind the US market that was worth $331bn.

It has the potential to grow much bigger, with Euromonitor forecasting growth of 14% a year until 2016, and shopping mall space set to equal European levels within a decade.

Will High Street brands be able to replicate the success of their designer counterparts?

Sweden's H&M opened 32 outlets last year and now has 78 stores in China. Zara, owned by Spain's Inditex, had 92 stores in 30 cities at the end of 2011.

Gap aims to have 45 stores by the end of the year, while Japanese chain Uniqlo plans to open 100 new stores every year in China, according to Euromonitor data.

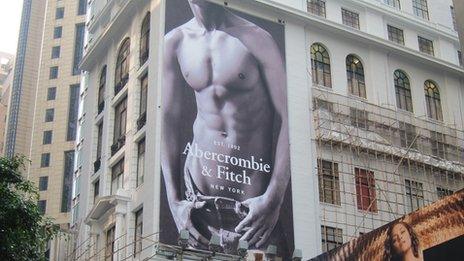

US fashion chains Forever 21 and J Crewe, a casual wear retailer favoured by Michelle Obama, will begin selling their clothing lines in China this year, and Abercrombie & Fitch will open a flagship store in August in Hong Kong.

While UK luxury labels like Mulberry and Burberry have enjoyed huge success in China, High Street names have been slower to embrace international expansion.

Marks and Spencer is the only British clothing chain with a significant presence in China, although fashion chain Top Shop had a pop-up store during Beijing design week last year, a move some say could herald a more permanent foothold.

Winners and losers

Shaun Rein, managing director of Shanghai-based China Market Research Group and the author of the "The End of Cheap China", says that fast fashion retailers like H&M and Zara that quickly churn out affordable copies of runway designs are most likely to succeed.

He says brands like Gap, Marks & Spencer, Abercrombie & Fitch and Banana Republic will find it difficult to gain any traction in China because they fall into a middle-class image trap, where the product is fairly expensive for the local market, but carries little prestige.

"The middle class in China - they trade up or trade down and anything in the middle will struggle," he says.

"That's why I am very bearish on M&S as their DNA is very middle class. You buy our clothes because you want to present yourself as middle class - that's not something that any Chinese person I've ever met wants.

"When we interview Chinese who are middle class, they really think they are on the way to riches because everyone knows someone that 15 years ago was a dirt-poor farmer but now is driving a BMW."

<bold>Local brands</bold>

Branding has also presented challenges for some players in China.

US retailer American Apparel found that its overtly sexy marketing was not to local tastes and ultimately had to close down some stores.

Gap promotes its 1969 jeans, but in China the year is associated with the violence of the Cultural Revolution not flower-power nostalgia, Mr Rein notes.

And even the foreign fashion brands that have the biggest market share in China are not yet household names that trip off local shoppers' tongues.

Zhang Jin, 33, visiting Hong Kong for the first time on a shopping trip, had not heard of H&M, Zara, Gap, Uniqlo or Marks and Spencer, even though she comes from Beijing where many of them have been in business longest.

She says she's happy to splurge on a designer handbag, but prefers to buy local brand clothes and shoes.

European names have so far fared better than their US counterparts, with Europe more closely associated with high fashion rather than the preppy, casual wear favoured by some American brands.

"One of Gap's problems was not just its price positioning, but its product was considered too bland for what people had to pay for it, and it wasn't considered trendy or up-to-date enough," Ms Kunde says.

Moreover, home-grown retailers like Metersbonwe, Belle International and Bestseller Group, which all own several brands, are still expanding market share in China despite the influx of Western names.

"I think there will be a place in the market for local brands that understand the consumer much better, especially because Chinese women sometimes have this very cute style of dressing, which is not necessarily reflected in the more fashion-forward styles in Europe," says Ms Kunde.

Mr Rein says that mid-range brands will perhaps find a more receptive audience in five to 10 years time, when a middle-class socio-economic status is more established in China and people realise that "not everyone can be a millionaire".

For now though, he remains sceptical, saying that the Gap stores he has visited in China are often empty: "Everybody is rushing into China but I think there will be more losers than winners."

Abercrombie & Fitch will open a flagship store in Hong Kong in August