Global economy: Who can drive the recovery?

- Published

The global economy is faltering.

In the aftermath of the global financial crisis, countries like Germany, China and Brazil were the engines that kept the global economy expanding, but recent evidence suggests that they are losing steam.

The World Bank expects a soft recovery, with global growth of 2.5%. But within that there appears to be a clear divide between developing economies, which are forecast to grow by 5.3%, and advanced economies by just 1.4%.

Here is a round-up of the conditions and prospects for the key economies around the world. Who can be relied upon to drive the much-needed recovery?

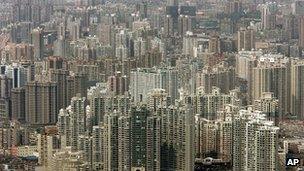

China

Second-quarter GDP growth has slowed to 7.6%

Annual Growth target has now fallen below 8% for the first time in almost a decade

China is now trying to shore up the economy after years of uncontrolled growth

China's second-quarter gross domestic product (GDP) figure has pointed to a continued slowdown in the Asian powerhouse.

Growth fell to 7.6% in April-June period, its worst pace since the depth of the financial crisis and below the 8% target that China aspires to.

Considered to be the biggest export market for many companies from the likes of Burberry, Carrefour to BMW, a slow-down would hurt their earnings.

Burberry, which banked on China's love of bling (it enjoyed a 30% revenue growth in the country) reported weaker-than-expected first quarter growth, external, disappointing investors.

Cooling growth in China and neighbouring India means the wider Asian region is likely to follow suit (aside from an exception or two like Thailand and the Philippines, which benefit from cheaper labour costs that have lured foreign companies).

Beijing in March downgraded its annual growth target to 7.5%, the first time that's dipped below 8% since 2004. The central bank recently slashed interest rates twice in less than a month in a bid to shore up growth.

China had until recently been grappling with an overheating economy driven by a property bubble and by the central government's post-crisis spending binge - much of which went into local infrastructure projects. The economy is now burdened with excess capacity and rising debt as unsold goods pile up in warehouses.

Caterpillar, the US construction giant, had a drubbing from investors, external in April when it said sales of construction equipment in China was expected to fall this year.

But analysts are hopeful that this marks the bottom for the world's second-largest economy, and that growth will pick up in the third quarter as Beijing loosens monetary policy and deregulates the financial system.

Eurozone

Unemployment rate: 11.1%

Over 3m people aged 15-24 are unemployed

Eurozone economy set to shrink 0.3% this year

German GDP expected to grow 0.7% this year

Young people have been the hardest hit from the recession

The euro-sharing region has been a tale of two halves, between the relatively wealthier northerners (Germany, Netherlands, Finland and arguably, France) and struggling southerners (Greece, Italy, Portugal and Spain) that are bogged down by a range of crises (debt, property, banking).

It is also a tale of much wrangling, as each camp differs on how to solve the eurozone crisis.

The euro has plunged to its lowest level in two years against the dollar as investors fret over weak data and recent rescue plans for the region, including bailing out Spain's banks directly and forming a fiscal and banking union.

And the ECB slashed rates for the first time below 1% recently, in efforts to encourage corporate and household borrowing.

In order to reassure investors, Spain announced a fresh round of austerity measures including tax hikes and spending cuts, which is squeezing an already squeezed out economy, but they remain unconvinced.

But even Germany, which has enjoyed record low levels of unemployment thanks to its manufacturing prowess, has been unable to insulate itself from the sovereign debt crisis plaguing the region.

Now, even the labour market is showing slower development. The jobless rate has risen for three consecutive months, reaching 6.8% in June. Meanwhile its double-digit exports to China have shrunk to a mere 6% (although automakers have bucked the trend, thanks to Chinese officials' love of BMWs and Mercedes-Benz cars).

Commerzbank, Germany's second biggest lender, recently announced , externalit was closing its real estate and ship finance units.

Carsten Brzeski, senior European economist at ING Group said of Germany: "The most solid ship can capsize in a rough thunderstorm."

United States

US facing a "fiscal cliff" as tax cuts end

Unemployment rate of 8.2%: fears of jobless recovery

GDP expected to grow 2% this year

The US is divided over how to pursue recovery

The US economy added just 80,000 jobs in June, a sign of persistent weakness in the labour market and a critical issue which could make or break President Barack Obama's re-election chances later this year.

The jobless rate has been stuck at 8.2%, although black workers suffer more, with a 14.4% figure.

Like its European peers, the US is struggling under piles of debt, which makes up around 70% of GDP.

It is also staring at a so-called fiscal cliff, which refers to a combination of tax increases and spending cuts scheduled to start at the beginning of next year.

The inevitable result would be an austerity-driven recession - a prospect that prompted the Senate's top tax legislator Max Baucus to warn, external that the economy was on a "dangerous path" that could lead to a European-style fiscal crisis.

And, like much of the disagreements that have thwarted a coherent, concerted plan in Europe, both Republicans and Democrats have been unable to agree on a plan that would avoid that dismal outcome.

Despite gloomy headline figures, the US economy is forecast to grow 2% this year, the best of the advanced economies - and even more than Brazil.

The billionaire entrepreneur Warren Buffett said the US was still doing better, external than "virtually any other big economy" around the world.

The US has undertaken a series of unorthodox measures to shore up the economy, its latest being Operation Twist, a bond-buying programme designed to bring down mortgage and loan rates.

Investors want more, but they might be disappointed, if recent noises from the US central bank are anything to go by.

"There is not much to expect from economic data, there is not much to expect from earnings, so the only thing markets hope for is more quantitative easing, more stimulus from Europe - more stimulus from everywhere," said Philippe Gijsels, head of research at BNP Paribas Fortis Global Markets.

Brazil

Economists forecast GDP to grow by 2% this year

Loan delinquencies rose to 6% in May

Planemaker Embraer has symbolised Brazil's growing fortunes

Government spending and exports of commodities like soy beans and metals to fast-growing countries in Asia, have propelled Brazil's economy to sixth place in the world.

But red-hot growth when Latin America's largest economy clocked in a 7.5% growth rate in 2010 appears to have fizzled out.

The economy stalled in May following an unexpected drop in retail sales. That heightened fears for what was one of the few bright spots of the world economy, making it the worst performer among Brics nations.

Growth in Brazil is predicted to be less than 2% this year, the weakest annual performance since 2009.

In response, the government unveiled the first phase of a major economic stimulus package designed to boost growth in the flagging economy.

More than $60bn (£38bn) will be invested in the country's roads and railways over the next 25 years, with more than half in the next five years. This includes 8,000 kilometres of new roads and 8,000kms of railways and further investments in ports and airports are expected.

The government's recent measures, such as the recent devaluation of the currency, the real, and the progressive reduction in interest rates, have so far failed to stimulate growth.

Brazil's growth over the past few years has been based on the expansion of credit and on consumer spending, and is hoping for an economic boost from hosting the Olympic Games in 2016.

India

GDP grew 5.3% in the first quarter, slowest for nine years

Inflation highest of Bric nations

Industrial production up 2.4% in May

India's chronically high inflation is tough to handle

India's economy grew at an annual rate of 5.3% between January and March, its slowest pace in nine years.

Rising consumer prices have been one of the biggest concerns for India's policymakers over the past two years.

The central bank took various measures in a bid to control the rising prices, including raising interest rates 13 times since March 2010.

While the inflation rate has come down slightly in recent months, it still remains higher than many of the other emerging economies.

According to data released last week, external, India's wholesale price index, the key measure of consumer prices in the country, rose by 7.55% in May from a year earlier, among the highest of the Bric nations.

Analysts say the combination of slowing growth and high inflation has made it difficult for the central bank to formulate its policies. Cutting rates would stimulate growth, but could end up making inflation worse.

GDP is expected to grow by 6.5% this year, according to the Asian Development Bank. Its government has vowed to attract more foreign investment and speed up infrastructure and power projects.

Japan

Recovering from last year's major disasters

Exporter worried about eurozone woes and US slowdown

Growth expected to be 2.2% this year

Japan has struggled in the aftermath of last year's disaster

Once the world's number two economy, Japan is still recovering from last year's devastating tsunami and nuclear crisis.

Recent data have shown that Japan, one of the world's top exporters, was not exporting as much as it used to. In fact it has been massively importing - including energy, which has pushed the country's energy bills sky high after Tokyo stopped nuclear reactors.

The strong yen has also hurt exporters, making their products more expensive to foreign buyers.

However, sentiment is improving. The Tankan survey showed manufacturers were less pessimistic about business conditions.

The Bank of Japan forecast the economy would grow 2.2% in the current fiscal year and 1.7% the following year. The rosy growth projections were enough for the central bank to hold off on further easing to boost the economy.

"Japan's economic activity has started picking up moderately as domestic demand remains firm mainly supported by reconstruction-related demand" following last year's natural disasters, the Bank of Japan has said.

"[But] there remains a high degree of uncertainty about the global economy, including the prospects for the European debt problem... [and] the momentum toward a recovery for the US economy."