Libor review: Wheatley says system must change

- Published

Martin Wheatley said trust in Libor "needs to be repaired"

The current Libor rate-setting system is no longer a "viable option", a government-commissioned review said.

It has proposed pegging the rate to actual market data, rather than subjective submissions from banks, and introducing formal regulation.

Stronger sanctions to tackle abuse of the system are also included in the initial discussion paper, external, which aims to restore credibility.

Barclays was found to have tried to rig Libor rates over several years.

The review was established after the UK bank was found to have tried to manipulate Libor rates by putting in inaccurate submissions, resulting in a record £290m fine in June from both US and UK regulators.

Several other banks in other countries are also under investigation.

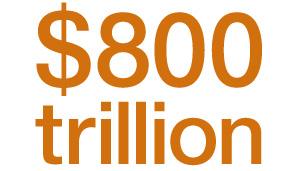

Headed by the managing director of the Financial Services Authority, Martin Wheatley, the review is examining how the Libor rate, the benchmark interest rate for trillions of financial contracts including some mortgages, is calculated and regulated.

Interested parties will have four weeks to respond to the proposals. Mr Wheatley aims to finalise his conclusions by the end of September.

The Treasury has said that the quick timetable will allow the government to add legislation through the Financial Services Bill, which is currently being discussed in the House of Lords.

The system is currently overseen by the British Bankers' Association (BBA), but is not formally regulated by the Financial Services Authority (FSA) nor Bank of England.

The BBA said it was "proactively cooperating with the regulatory authorities on Libor and ... providing its research and findings so far to the Wheatley review".

"The absolute priority of everyone involved in this process is to ensure the provision of a reliable benchmark which has the confidence and support of all users, contributors and global regulators," it added.

Libor is calculated using rates submitted by a group of leading banks who estimate how much it costs them to borrow in 10 currencies and 15 lengths of loans, ranging from overnight to 12 months.

'No radical change'

The Wheatley Review suggests:

setting Libor using actual market data, rather than subjective submissions from banks

making governance of the Libor-setting process independent, for example introducing a code of conduct to establish clear guidelines concerning submissions

strengthening sanctions to tackle Libor abuse

taking calculations away from the BBA and placing them in the hands of an outside authority, such as a commercial body or an industry group

considering alternative benchmarks for at least some of the types of transaction that currently rely on Libor

"[Libor] is something that is fundamental to the smooth running of markets, and to confidence in the financial system," said Mr Wheatley.

"Retaining Libor unchanged in its current state is not a viable option, given the scale of identified weaknesses and the loss of credibility that it has suffered," he added.

However, Mr Wheatley also said that there should be "enough change, but not changing it so far so that millions of contracts are put at risk".

"We will not come forward with radical shorthand proposals that say stop Libor, and replace it with X," he told a news conference, adding that the short and medium-term goal should be to fix Libor and then see "whether there are better rates going forward".

One of the difficulties stems from litigation risks as stopping Libor's usage would require re-negotiating and re-drafting millions of existing contracts that could lead to disputes between parties.

A change in such a global benchmark as Libor would also need careful planning and a coordinated international effort among regulatory authorities.

The review may also extend to other benchmarks including oil, gold, stock prices and other inter-bank rates in the future, said Mr Wheatley.

The paper is also exploring the option of giving the FSA and the Financial Conduct Authority - which Mr Wheatley will run from next year - new powers to criminally prosecute offenders.

Bank of England governor Mervyn King has said central bankers will discuss reforms to Libor when they meet in September.

'Decades of abuse'

The regulators' investigations into Barclays revealed that its traders had worked with staff at other banks.

It is therefore widely expected that other banks will face fines for manipulating Libor.

Douglas Keenan, a former trader at Morgan Stanley, said that Libor abuse went back decades, and called for an overhaul of how the rate is set.

"I believe it should be fixed on actual market prices. That has to be factored in there somewhere," he told the Today programme, adding that he witnessed discrepancies between what the market and the banks quoted when he began trading in 1991.

"There was clearly sometimes some difference, but it was not huge."

Regulators "had to know," he said. "This has been going on for decades. It's been blatant, it's been clear and if by some miracle they did not know, they should be fired for gross incompetence."