Q&A: Pension automatic enrolment

- Published

Workers from Morrisons in Redcar are among the first to be enrolled, as the BBC's Simon Gompertz reports

Millions of workers in the UK will gradually see a slice of their pay packet being automatically diverted to a savings pot for their pension.

Employers are obliged to pay in as well, with the government adding a little extra through tax relief.

The system - called automatic enrolment, external - started at the beginning of October 2012 with staff who work for the biggest businesses, with others being signed up over the following six years.

Those who already save in a workplace pension scheme or are self-employed will not be signed up.

Experts and ministers say it is vital people make a start at an early stage in their working lives, to eventually have savings that will top up the state pension.

So who will automatically be enrolled into a workplace pension scheme?

A workplace pension is a saving scheme for retirement organised through an employer. The employer may have their own scheme, offer one from a specialist pension provider, or use a government-backed scheme.

Under the new system, those who work in the UK, are aged over 22 and under the state pension age, are not already in a scheme, and earn more than £8,105 a year will automatically be enrolled.

Part-time workers who earn less than that can ask to take part if they want to and, if they earn more than £5,564, their employer will be obliged to make a contribution too.

Those aged under 22, or over state pension age and still working, can also opt-in in the same way.

Do I have to take part?

No. You may decide that you need all of your monthly pay to make ends meet or you have a private pension policy you think is sufficient.

Staff will be given a letter about the scheme when it starts at their workplace. This will explain who the pension provider is. Workers can ask this provider for an opt-out form.

If they fill it in within a month, then their involvement will be cancelled.

If they take longer, then they will start to build up a very small pension pot. This will still exist when the opt-out is processed, but it will just sit there untouched until retirement.

It is worth remembering that by opting out, workers will miss out on the contribution their employer puts into the pension. In the majority of cases, they simply will not get these payments in any other way, such as in their regular pay.

Those who opt out will also be enrolled again every three years by an employer, or after three months at a new job, at which point they will need to complete the opt-out process again.

When will this system start?

It will be introduced gradually over six years.

Karren Brady is one of the faces of a new advertising campaign about automatic enrolment

The first wave has begun, with the largest businesses - with more than 120,000 staff - starting first. As time goes on, smaller firms will start enrolling staff.

The Department for Work and Pensions (DWP) estimates that 380,000 workers will be signed up in October, a total of 420,000 will be enrolled by the end of November, and 600,000 will be in place by the end of the year.

Firms with fewer than 50 workers will not start enrolling their staff until June 2015 at the earliest. But even the smallest employer - such as a plumber employing a full-time assistant - will eventually be obliged by law to enrol staff.

The Pensions Regulator, external is policing the system to ensure workers are enrolled at the correct time.

How much will I save?

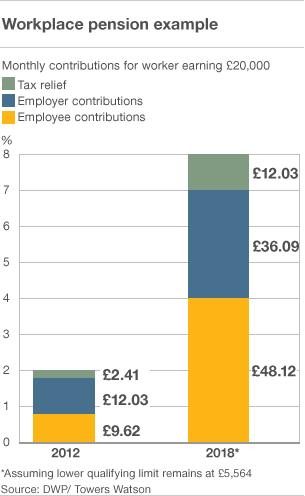

At first, an employee will only see a minimum of 0.8% of their earnings going to their workplace pension. Their employer will be obliged to add a contribution that is the equivalent of 1% of the worker's earnings. Tax relief adds another 0.2%.

However, these amounts will increase to a minimum of a 4% contribution from the employee, 3% from the employer, and 1% in tax relief from October 2018.

This means the equivalent of 8% of a worker's earnings (including overtime, but excluding any earnings over £42,275) will go into their pension pot.

That means that from October 2018, somebody earning £20,000 a year would see £96.24 going into their pension pot every month. For this, some £48.12 will be taken from their take-home pay.

They will not be able to get at the funds until the age of 55 at the earliest so, in the meantime, the money is invested. The pension firm, insurance company, or government-backed organisation that is running the scheme will give each worker a choice on how risky they want these investments to be.

There will also be options for people to choose Sharia-compliant, or ethical funds.

There will be a default option. This generally starts very safely, tries to make a bigger return during a worker's middle age, then plays safe again as he or she approaches retirement.

There will be a charge levied by the pension provider, which is taken automatically each year from the pot.

It is very difficult to predict what sort of pension somebody would have at the end of the process, owing to the impact of the success of investments, changes to people's earnings and the age at which they decide to retire.

However, as a ballpark figure, a 30-year-old who earns £20,000 now, sees a 1% above inflation pay rise each year, makes the minimum contributions permitted, whose investments have a small but regular return and who retires at 70 may receive a pension each year of £2,100 at today's prices.

"For many people this will not be enough [in retirement]," says Malcolm McLean, a consultant for Barnett Waddingham.

However, he says it will be good for people to get into the savings habit, as they may also choose to have parallel savings for retirement.

Has this automatic enrolment system been used in other countries?

A number of countries have implemented schemes aimed at encouraging saving for a pension - many of which have mandatory participation.

The KiwiSaver in New Zealand is the closest relation to the new UK scheme.

A large number of people remain in the system, owing in part to government incentives, clear communication when it was launched and beneficial tax rules, according to a report for the DWP.

Many of the schemes around the world have been introduced in the past 20 years, and - with the exception of the KiwiSaver - there has been little done to review how successful the schemes have been so far.