Economist magazine bets professor over China's future

- Published

How much longer can China's 30-year winning streak go on for?

Earlier this year, two economists made a friendly wager.

One of them, the blogger Prof Michael Pettis of the Beijing Business School, had earned kudos as one of the first to predict the sharp slowdown in China's economy seen over the last year.

The other was the Economist. The magazine, that is.

Their bet - for a bottle of booze - was over whether China's economy was about to run out of puff, external.

The country has managed 9.9% growth on average over the past 35 years, but Prof Pettis thinks that the growth rate will fall to a measly (by Chinese standards) 3% this decade.

The more gung-ho Economist by contrast was forecasting that China would stay on course to overtake the US as the world's biggest economy by 2018.

The Bear

Michael Pettis is a finance professor at the Guanghua Management School

"China has grown very rapidly in the last 30 years, but it has been following a model that is not unique," says Prof Pettis.

"In the 50s and 60s almost everyone 'knew' that the Soviet Union would overtake the US in the 70s - even Jack Kennedy - but it didn't happen. Instead, the Russian economy got mired in debt and years of stagnation."

Other examples include the Brazilian economic "miracle" of the 1960s and 1970s, says Prof Pettis, that ended in a 1982 financial crisis and a "lost decade" of growth, or Japan's rapid ascent up until its own 1990 crisis and subsequent two-decade stagnation.

What these countries have in common is an enormous level of government-led investment - in roads, trains, schools, hospitals, education and training.

"You can get tremendous growth by keeping investment levels high," he explains. "And in the early days, growth is healthy and sustainable.

"But later... you very easily reach a point where you can't identify economically viable projects any more, and you overshoot and start misallocating capital in a pretty significant way. That's when debt rises more quickly than the economy's capacity to service it."

China has been overinvesting perhaps since the 1990s, according to Prof Pettis, and certainly in the last five to 10 years.

"A lot of growth is fake," he says. "If you spend $1bn building an airport, it generates the same amount of [economic output] today whether or not anyone actually uses the airport.

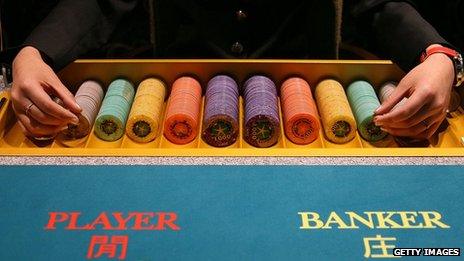

The winner must give the loser a bottle of the Chinese white liquor baijiu

"If no-one uses it, however, the economic value created by the airport is not enough to repay the debt, and so future growth must decline as wealth is transferred from some other part of the economy to pay down the debt."

He says that there are three main sources of growth for China. The first, investment, is already exhausted. The second, exports, are also no longer viable, as China's main export markets in Europe and the US are depressed, and China's trade surplus has become politically contentious in those countries.

The third option is for ordinary Chinese people to increase their spending on consumer products and services.

But here the numbers just don't stack up. Consumers account for just a third of spending in China - an unprecedentedly low share for any major economy - while investment accounts for a whopping half of the economy.

If investment just stagnates - and in developed capitalist economies it usually falls after such a long boom - then, with consumer spending starting from such a low base, China would have to pull off the biggest consumer spending boom in history just to maintain overall economic growth at the planned rate of 7%-8%.

But the kinds of policies that would be needed to pull this off - such as paying Chinese households more interest on their savings, paying Chinese workers higher wages at the cost of state-owned company profits, or providing Chinese migrant workers with decent social benefits - run up against powerful politically-connected interests.

Prof Pettis is doubtful that it can be done.

The (Cautious) Bull

Simon Cox is the Asia economics editor at the Economist magazine

"The bet's still on," says Simon Cox, Asia economics editor at the Economist. "Though it won't be resolved till the end of the decade."

The Economist's side of the bet - that China will overtake the US by 2018 - was the default scenario in an interactive forecaster that they stuck on their website, external to let readers play God with the Chinese economy.

"[2018] seems quite soon, but then you look at the individual assumptions, and they don't seem too whacky."

One crucial assumption is the exchange rate. Mr Cox's team expects the yuan to strengthen against the dollar, even while prices rise more quickly in China, meaning that measured in dollars China's economy could still grow very rapidly, even if in reality the country actually slows down.

"I agree with Pettis on a whole range of things. I think the investment rate is too high, and it is difficult to invest wisely when you are doing it so fast. A lot of investment, especially by state-owned companies, is inefficient."

Where he parts company with the Beijing-based professor is on the question of whether China is running out of decent investment opportunities.

China is still a very underdeveloped country, and he says the capital stock per worker - the quantity of buildings, machinery, infrastructure, vehicles and suchlike relative to the population size - is still very low by Western or Japanese standards.

He also says that while Prof Pettis is focused on where spending will come from, what really matters for long-term growth is China's ability to improve skills and adopt new technology.

"China is very good at absorbing knowhow from the rest of the world. It is much more open to foreign investment than Korea and Japan were. And it has a large domestic market, so foreign producers have an incentive to tutor local suppliers in their products."

Mr Cox confesses to being an old-school Keynesian. As such, he believes that even if - as Prof Pettis believes - China does run into the same problem as the West, that ordinary citizens are not increasing their spending fast enough, the government can cope.

"If the alternative is unemployment, it is better to employ people to do something, even if it is not very value-adding.

"Lots of people are still living in old housing units left over from the 1990s, so it would be worthwhile employing people to build replacements for those. Unfortunately, a lot of labour instead gets wasted on building tasteless villas for the super-wealthy.

"China's economy is unfair and inefficient, but it's not unstable."