'Abusive tax avoidance' affects temporary workers

- Published

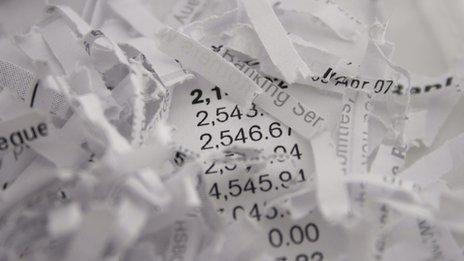

Rules on tax relief for expenses could mean big bills for temps from HMRC

Low-paid temps are being warned they could be chased for unpaid taxes because of complex arrangements on their expenses drawn up by employers.

Tax rules state that neither the agency worker, nor the company employing them, need pay national insurance on the money they receive to cover costs.

But HM Revenue and Customs (HMRC) is concerned that some agencies are paying staff for spurious expenses.

Campaigners say such schemes exploit workers by putting them at risk of being chased for unpaid taxes and have described the practice as "abusive tax avoidance".

Izabella - not her real name - works as a picker in a warehouse and pays no more than £40 a week on food and getting to work. However, her payslips show that she regularly gets paid more than double that amount in expenses.

She told 5 live Investigates that she did not appear to be any better off for being in the scheme - and that she was not paying any income tax, which worried her.

"When I checked the payslip, I wanted to know about where my cash was going," she said.

The answer is that the lion's share of any tax saving is often taken by the agency and any company to which it subcontracts to manage its payroll - sometimes known as an "umbrella" company.

The agency worker then effectively becomes the payroll company's employee.

HMRC told the BBC: "HMRC will always pursue the employer for any underpaid tax and national insurance when we find evidence of abuse.

"Where the employer cannot be found, we consider the case on its own merits, but would not generally hold an employee liable for the tax where evidence showed the employee had been misled by the employer."

Expenses dilemma

Under the complex tax rules, if the worker moves between different assignments but remains employed by the same company, they can claim tax relief on the expenses covering their travel from home to those different places of work.

But some agency workers have found they are being paid much more to cover the cost of food and travel than they actually spend.

These companies also save money by not having to pay employer's national insurance contributions on the part of the worker's income which is paid as expenses.

"I think it's bad but I have to live," Izabella told 5 live Investigates.

"I've got a family and a child and I must work. But I don't want to work there a second time because many people want to cheat me with cash."

The charity Tax Aid said it has even seen cases of employees being paid expenses where none are due at all.

"We certainly see cases where employees say, 'I didn't have any expenses. I walk to work'," says the charity's technical director, Frances Corrie.

"They may tell us that they have a bicycle or they really don't incur any expenses in getting there."

But Tax Aid said it has seen cases where HMRC has queried why such a worker would be claiming so much in expenses and, as a result, chased them for unpaid tax.

"It's possible for the worker to make an expense claim against that amount if they've got the receipts but, in the absence of that, the Revenue will just say, 'We want the tax from it'," says Ms Corrie.

'Spurious'

The charity says it has seen an example of a worker being chased for an unpaid tax bill of £600, which they then had to negotiate with HMRC.

The Low Income Tax Reform Group (LITRG) is also concerned that many agency workers being paid expenses in this way do not understand the potential implications.

"It is sometimes argued that the worker has a choice whether or not to accept employment under the terms of one of these schemes. That is spurious," says LITRG technical director Robin Williamson.

"First, the payslips are not easy to follow, particularly for someone who lacks numerical skills. And the terms and conditions we have seen tend to be convoluted and full of legalese."

"The workers, many of whom are paid at or near the minimum wage and tend to be relatively unskilled, have little hope of picking their way through the detail unaided," he told 5 live.

LITRG is also concerned that changes to the benefits system, due to come in to force in 2013, may mean workers face being fined if they are found to have been paid expenses on sums which should have been taxed as earnings.

"In the case of Universal Credit, it will be open to the Department for Work and Pensions (DWP) to charge a civil penalty if they think that the overpayment came about as a result of negligence by the claimant," warns Mr Williamson.

Some agency workers are being paid more for expenses than they have actually spent

"Not only does the worker face an unexpected tax bill, he or she would also have to reimburse the DWP for overpaid benefit and possibly pay a penalty."

The group says some of the schemes that it is aware of amount to "abusive tax avoidance".

The Recruitment and Employment Confederation, which is the professional body for the industry, told the BBC: "HMRC needs to investigate any complaints, apply the law and ensure a level playing field for all recruiters.

"The current lack of enforcement puts recruiters who abide by the rules at a disadvantage and could lead to workers missing out on benefits."

Last year, the government published a statement setting out its view that the payment of tax relief on expenses by an employer was not compliant with the rules.

But despite the warning, the schemes continue to be widely used.

You can listen to the full report on 5 live Investigates on Sunday, 21 October at 21:00 GMT on BBC 5 live.

Listen again via the 5 live website or by downloading the 5 live Investigates podcast.

- Published23 November 2011