Child benefit cuts may cost some families £50,000

- Published

Most child benefit claimants are too poor to be affected by the change

Some families may lose as much as £50,000 over the next 16 years due to cuts in child benefit, the accountancy firm PwC says.

The government will start to withdraw, or cut altogether, child benefit from families where an adult earns more than £50,000 a year.

The benefit clawback will start on 7 January 2013 and will affect about one million families.

PwC says their potential loss could be substantial.

"Many people affected by the child benefit cuts have probably not considered what the true cost will be to them over time," said Alex Henderson, a tax partner at PwC.

Losses rack up

Child benefit is currently paid at the rate of £20.30 a week for the first child, and then £13.40 a week for each child after that.

It lasts until each child reaches 16, or 18 if they are still in full-time education, and in some cases until they are 20.

PwC took two hypothetical families to see how much money they might lose, if all their benefits were withdrawn because one of the adults earned more than the forthcoming upper limit of £60,000 a year.

In one family, there were two children aged 1 and 3 at the start of 2013, currently receiving £1,752 a year in total.

In the other, there were three children aged 1, 3 and 5, currently receiving £2,449 a year in total.

PwC worked out that the two-child family stood to lose just under £39,000 in total, by the time the youngest child turned 18, while the three-child family would lose rather more at £50,700.

The calculations assumed that without the clawback, the families' benefits would have risen in line with the consumer prices index, at a rate of 2.5% in 2013 and then 2% thereafter until 2029.

'Grossly unfair'

Carol, a mother of three from Southampton, told the BBC News website that she was shocked at how the sums involved would add up over the years.

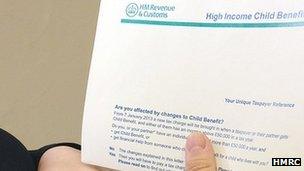

The letters are targeted at about one million of the current child benefit claimants

"We currently receive £2,260 a year, we are not on the breadline but it is the equivalent of paying for a family holiday," she said.

"The change is grossly unfair. We decided that one of us should stay at home to look after the family, but we are being penalised," she added.

She said her complaint to her MP had been channelled up to ministers but the reply had been that the cutback she faces was justified because it would help maintain the benefits for lower-paid claimants.

HMRC is starting to send out letters this week targeted at about one million child benefit recipients, who it thinks are also in households where someone earns more than £50,000 a year.

The letters warn them that they may lose some or all of their child benefit next year if they or their partner's earnings are above that limit.

The letters offer the recipients a choice - tell the Revenue about the family's income, using the self-assessment system if necessary, so the taxman can calculate the extra tax charge; or give up claiming the child benefit altogether.

The Revenue does make it clear that in families where someone earns between £50,000 and £60,000, it will always be to their advantage to keep on claiming the benefit.

- Published30 October 2012

- Published29 October 2012

- Published22 September 2014

- Published15 May 2012