Bank of England cuts UK growth forecast for 2013

- Published

Bank of England cuts UK growth forecast for 2013

The Bank of England has cut its growth forecast for next year to about 1% from nearer 2%, and said recovery will be "slow and protracted".

It now thinks that the economy will not get back to pre-crisis levels until 2015, two years later than it previously predicted.

The Bank also believes inflation will remain higher for longer.

Governor Sir Mervyn King also welcomed the latest jobs figures which showed a continued fall in unemployment.

He was presenting the Bank's quarterly Inflation Report, external, which forecast that inflation would not now fall towards the government's 2% target until mid-2013, rather than in the first half of next year as previously thought.

The report said the UK could be stuck in a "low-growth" environment, with economic problems in the eurozone and the rest of world continuing to have an impact domestically.

As the BBC's economics editor Stephanie Flanders put it: "The Bank hasn't just lowered its growth forecasts for the next year or so - it has more or less given up hope of being pleasantly surprised."

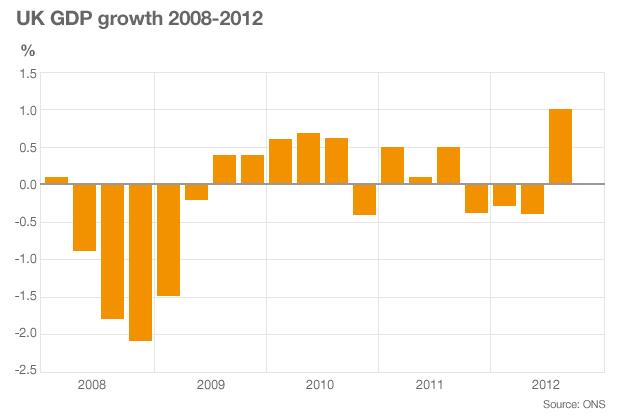

Sir Mervyn warned that growth from quarter to quarter would continue to fluctuate. In the April-June quarter growth was depressed by one-off factors such as the unseasonably bad weather and had given a misleadingly weak picture of the economy.

Similarly, growth in the July-September period was boosted by one-off factors including ticket revenue from the Olympics and Paralympics and gave "an overly optimistic impression of the underlying trend," he said, adding that the data was not necessarily "a reliable guide to the future".

He said: "Continuing the recent zig-zag pattern, output growth is likely to fall back sharply in Q4 [between October and December] as the boost from the Olympics in the summer is reversed. Indeed, output may shrink a little this quarter," he said.

The Bank has previously predicted that inflation might fall towards the government's 2% target in the first half of next year.

But it now expects inflation to stay higher for longer. "We face the rather unappealing combination of a subdued recovery, with inflation remaining above target for a while," Sir Mervyn said.

"The road to recovery will be long and winding, but there are good reasons to suggest we are travelling in the right direction," he said.

'Long process'

Treasury minister David Gauke said he recognised that these were tough times, but insisted that the economy was "moving in the right direction".

Asked on BBC Radio 4's The World At One if he agreed with Sir Mervyn's warning about a potential sharp fall in output, Mr Gauke said: "The independent Office for Budget Responsibility forecasts growth in the economy in the autumn statement in three weeks' time. I'm not going to pre-judge that.

"Clearly, there are international pressures on our economy that mean that this is going to be a long and challenging recovery from a very substantial crisis. That is what we are going through at the moment. I think the British people understand that this is going to be a long process," he said.

However, shadow chancellor Ed Balls said: "This sobering report shows why David Cameron and George Osborne's deeply complacent approach to the economy is so misplaced.

"Their failing policies have seen two years of almost no growth and the Bank of England is now forecasting lower growth and higher inflation than just a few months ago.

"Britain needs a plan to create the jobs and growth we need to get deficits down, including using funds from the 4G auction to build 100,000 affordable homes and create hundreds of thousands of jobs," Mr Balls said.

The Bank's report came on the day that the Office for National Statistics said that the UK unemployment rate fell to 7.8% in the July-September quarter, down from 8% in the previous three months.

The 49,000 fall in number of jobless, to 2.51 million, was almost entirely due to a fall in youth unemployment, the ONS said. It means that the jobless total is now 110,000 lower than for the July-September quarter last year.

However, the claimant count went up in September, leading some economists to suggest that the recent resilience of the jobs market was beginning to weaken. And the number of people unemployed for longer than a year also rose.

Sir Mervyn told the news conference: "I don't think one would say that the data released this morning were weak.

"This is still a pretty strong labour market and, of course, it is not easy to reconcile that with the picture of underlying growth being still so weak," he said.

Sir Mervyn also told a press conference that he had not "lost faith" in quantitative easing as a way to stimulate economic growth.

The Bank has kept the amount it injects into the economy by buying up government bonds at £375bn since July this year.

Some have questioned its effectiveness, but the Bank said it had not ruled out further asset purchases to try to stimulate growth.

He said that with the global economy still struggling, "there are limits to the ability of domestic policy to stimulate private sector demand as the economy adjusts to a new equilibrium".

"But the [Monetary Policy] Committee has not lost faith in asset purchases as a policy instrument, nor has it concluded that there will be no more purchases."