Average earnings rise by 1.4% to £26,500, says ONS

- Published

The data in the annual survey of hours and earnings comes from a 1% sample of all employee tax records

The average annual earnings of full-time workers in the UK rose by 1.4% to £26,500 in the year to April 2012.

The figures have been published by the Office for National Statistics (ONS) in its annual survey of hours and earnings.

There was a cut in the real value of pay, however, as inflation was higher during the same period, at 3.5%.

And the ONS data also reveals that inflation has outstripped the rise in average pay for the past 12 years.

The survey results show that since April 2000, average annual pay for full-time workers has risen by 40%, from £18,848 to £26,500.

In that time, inflation, as measured by changes in the retail prices index, has gone up by 43%.

However, the trend has accelerated in the past five years since the onset of the international banking and financial crisis, the consequent recession in the UK and the imposition of austerity measures by the government.

In just five years since April 2007, prices have risen by 18%, while average annual earnings have gone up by just 10%.

That has left wages and salary increases lagging behind inflation by 8% in just five years.

Stagnant progress

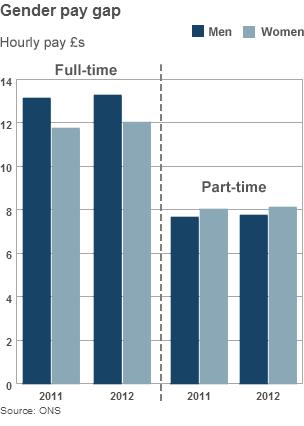

The pay gap between men and women shrank in the year to April 2012, from 10.5% of men's full-time hourly earnings to 9.6%.

The ONS said the shrinkage of this gap continued the trend of the past few years.

Full-time male workers earned on average £28,700 in the year, while women earned £23,100, a difference of £5,600.

Among part-time workers, though, most of whom are female, the position was reversed.

Looking at their weekly earnings, female part-timers earned on average 8% more last year than their male counterparts, with women earning an average of £158 a week and men £146.

Looking at their hourly pay rates, part-time women earned 5% more than their male counterparts, at £8.12 an hour compared to £7.72 an hour.

The TUC's general secretary, Brendan Barber, said: "The pay gap between full and part-time workers is actually getting worse."

"This is terrible news for the millions of people who need to work part-time to balance work and caring responsibilities, or who simply can't find full-time jobs," he added."

Daisy Sands, of the Fawcett Society, said progress in closing the gender gap had become slow and stagnant.

"In an age of austerity and declining living standards it's more important than ever that we tackle it," she said.

"We are concerned about plans on the table that will worsen an already difficult situation for women - moves to regionalise public sector pay and plans to enable workplace rights to be "sold off" via the employee ownership scheme could all impact negatively on the pay gap."

Public and private

The ONS survey found, external that the average weekly pay of staff in the public sector was still noticeably higher than for staff in private sector employment, despite the government pay freeze on most employees in the public sector.

Full-time staff there saw their weekly pay rise by 1.6% to £565, while those in the private sector saw their earnings go up by 1.5% to £479.

The ONS said the long standing difference in pay levels was due to the preponderance of low-paid jobs in the private sector and the concentration of better educated workers in the public sector.

"Consequently, differences in gross weekly earnings do not reveal differences in rates of pay for comparable jobs," it said.

"For example, many of the lowest-paid occupations, such as bar and restaurant staff, hairdressers, elementary sales occupations and cashiers, exist primarily in the private sector, while there are a larger proportion of graduate-level and professional occupations in the public sector," the ONS added.

Low pay

Average weekly earnings were highest in the London region at £653 and lowest in Wales at £453.

In districts around the UK, the highest average full-time earnings were in the City of London, at £917, while the lowest earnings were in Torridge in Devon, at just £348 a week for full-time employees.

The ONS survey found that in April this year, there were 287,000 people in jobs paying less than the national minimum wage, who amounted to 1.1% of all workers in the UK.

However, it warned that this did not mean they were all being paid illegally.

"This is because it is not possible to determine from the survey data whether an individual is eligible for the minimum wage," the ONS said.

"For example, it is not possible to identify people such as apprentices and those undergoing training who are exempt from the minimum wage rate or are entitled to lower rates.

"In addition, if employees receive free accommodation, employers are entitled to offset hourly rates," the ONS added.

- Published7 November 2012

- Published25 October 2012

- Published23 October 2012