UBS fined £29.7m by FSA over Kweku Adoboli case

- Published

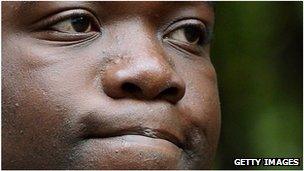

Kweku Adoboli is serving seven years in prison for the fraud at UBS

The Financial Services Authority (FSA) has fined UBS £29.7m ($47.6m) for failings that led to trader Kweku Adoboli losing £1.4bn.

The fine, the third largest imposed by the FSA, was for "system and control failings", external that allowed him to trade in London well beyond authorised limits.

The trader was last week convicted of two counts of fraud and sentenced to seven years in prison.

UBS said it was "pleased that the chapter has been concluded", external.

The FSA, which conducted the investigation into failings at the bank with its Swiss counterpart, Finma, said there were serious weaknesses at the Swiss bank.

It said in a statement: "UBS failed to take reasonable care to organise and control its affairs responsibly and effectively, with adequate risk management systems, and failed to conduct its business from the London Branch with due skill, care and diligence."

The FSA's director of enforcement and financial crime, Tracey McDermott, said faulty controls had allowed the losses to mount to what was the largest trading loss in the country.

"UBS's systems and controls were seriously defective," she said.

"As a result, Adoboli, a relatively junior trader, was allowed to take vast and risky market positions, and UBS failed to manage the risks around that properly."

'Gambler'

Adoboli, the 32-year-old Ghana-born son of a diplomat, joined UBS in 2003, becoming a trader in 2006.

He worked in UBS's global synthetic equities division (GSE), buying and selling exchange traded funds (ETFs), which track stocks, bonds and commodities.

He was arrested in September last year.

Southwark Crown Court was told that he was "a gamble or two away from destroying Switzerland's largest bank".

The judge said there was "a strong streak of the gambler" in him.

But, during evidence, Adoboli said everything he had done was aimed at benefiting the bank, where he viewed his colleagues as "family".

He said he had "lost control in the maelstrom of the financial crisis", but had been doing well until he changed from a conservative "bearish" position to an aggressive "bullish" stance under pressure from senior managers.

He told the jury that staff were encouraged to take risks until they got "a slap on the back of the wrist".

The fine was set at 15% of the revenue of the division where Adoboli worked and takes account of the revenue generated by the business area where the weak controls occurred.

'Serious deficiencies'

UBS said it had made a number of substantial changes since discovering the losses, including fixing the weakness in its financial reporting.

The bank added it was retraining staff on the importance of risk management and had changed the way it evaluated and compensated employees.

UBS is changing its own structure to make itself a simpler organisation.

The bank's chief executive, Oswald Gruebel, left the company in the aftermath of the scandal.

His successor, Sergio Ermotti, announced a major restructuring last month to run down the large, risky parts of the investment banking division.

UBS said it had fully co-operated with the regulators' investigations and that it accepted their findings and the penalties incurred.

UBS's fine was discounted from the original level of £42.4m for early settlement.

Switzerland's financial regulator Finma said in a statement, external that it would also check whether UBS had adequate capital backing for its operational risks.

Finma said it had identified "serious deficiencies in risk management controls" and that it would appoint a third party to make sure proper measures were introduced.

UBS has been banned by regulators from making new acquisitions and it also needs to get prior approval from Finma for any new business initiatives.

- Published23 November 2012

- Published20 November 2012

- Published20 November 2012

- Published20 November 2012

- Published20 November 2012

- Published20 November 2012