Fuel duty rise cancelled by chancellor

- Published

Osborne: "There will be no three pence fuel tax rise this January"

A 3.02p per litre rise in fuel duty scheduled for introduction in January has been cancelled.

Announcing the change in the Autumn Statement speech, Chancellor George Osborne said the move would be a "real help" for families and businesses.

The proposed rise would have cost motorists an average £2.53 for a full tank, so consumer groups and industry bodies have welcomed the freeze.

Both say higher fuel prices have curbed their driving and hurt the economy.

"It will provide much needed support for consumers," said Stephen Robertson, director general of the British Retail Consortium. "It will ease the pressure on household budgets, boost customers' ability to spend and help hard-pressed retailers contain their transport costs."

Gareth Kloet, insurance expert at Confused.com, described it as "relief for all motorists, including those who rely on the roads to keep their businesses up and running".

'Healthy tax take'

In the 2011-12 financial year, the Treasury received £26.8bn from fuel duty, a near trebling of the £9.63bn fuel duty received in 1990-91.

The fuel duty takings were lower, however, than they were during the previous year, when they peaked at £27.26bn.

This was because 527 million fewer litres of petrol and diesel were sold, as individuals and companies chose to drive less, according to Edmund King, president of the Automobile Association

"The tax take from fuel duty is pretty healthy and would be even better were it not for record fuel prices," he said.

"Arguably, the government would rake in more revenue if it tackled the causes of stubbornly-high fuel prices in the UK, allowing cash-tight businesses, lower-income families and the 28% who restrict their spend on road fuel to use their vehicles as they need rather than as they can afford."

Transport costs

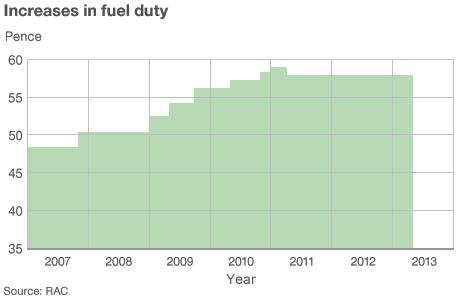

Fuel duty has risen from 45.82p per litre in March 2001 to the current 57.95p per litre.

Hence, 42.3% of the pump price - currently averaging 133.19p per litre for petrol - ends up in the government coffers as duty. This rises to 59% once value added tax (VAT) has been added.

As such, petrol and diesel are amongst the main drivers of overall transport costs, which average £75.10 per week per family when the cost of motor insurance is taken into account, according to the Office for National Statistics.

But fuel duty has not gone up since January 2011, when it was raised by 0.76p per litre.

It was then cut by 1p in March 2011 and ever since planned increases have been postponed repeatedly, before finally being cancelled altogether.

"Under this government we'll have had no increase in petrol taxes for nearly two and a half years - in fact they have been cut," said Mr Osborne.

"Fuel is 10p per litre cheaper than it would have been if we had stuck to the Labour tax plans and I want to keep it that way."