UK economy 'to contract this year'

- Published

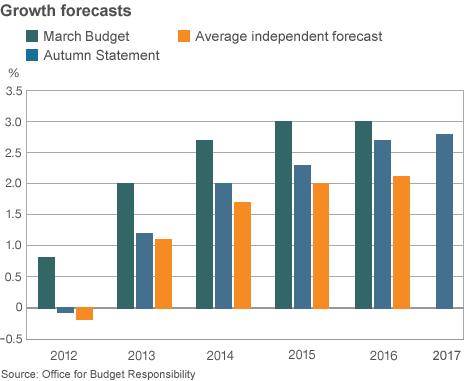

The UK economy will contract by 0.1% this year, according to the Office for Budget Responsibility (OBR), the independent body that makes economic forecasts for the government.

It is a big revision from the time of the Budget in March, when it said that the economy would grow 0.8% this year.

Also, debt will not fall as a proportion of the country's output until 2016-17, a year later than hoped.

Growth forecasts for the next five years were also cut.

The OBR is predicting, external that gross domestic product (GDP), which is the measure of all the goods and services produced in the economy, will contract in the last three months of 2012, having only emerged from recession in the previous quarter.

Mr Osborne quoted the OBR as saying: "The weaker than expected growth can be more than accounted for by over-optimism regarding net trade".

The OBR had previously forecast that the eurozone's economy would recover in the second half of this year. However, its continued contraction has hit the UK's exports to the eurozone.

Confusion on borrowing

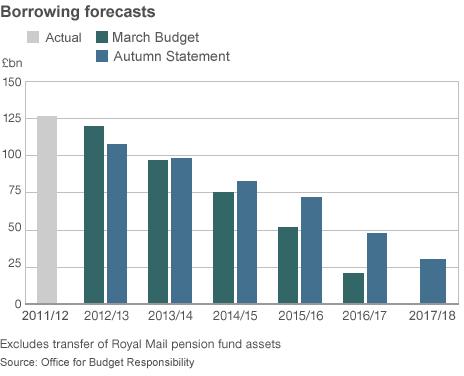

On borrowing figures, the chancellor said that debt would not begin to fall as a proportion of the country's output until 2016-17, which is a year later than the government's target.

Before the statement, many analysts had predicted that the budget deficit, which is the amount the government is having to borrow in the current year, would be higher than it was last year.

However, it is now forecast to fall from £121bn in 2011-12 to £108bn in 2012-13.

But there was some confusion about how that had been achieved, with shadow chancellor Ed Balls complaining about the full figures not being in the Mr Osborne's statement.

BBC economics editor Stephanie Flanders said that the deficit figure had fallen because the government had decided to use the proceeds from the sale of licences to run 4G mobile phone services to reduce this year's borrowing.

Without that, she said, the deficit would have risen "maybe by a couple of billion pounds".

There was also a reduction in the deficit of £11.5bn in the current year as a result of the Asset Purchase Facility.

The OBR's Robert Chote says the deficit is shrinking but more slowly than previously forecast

As a result of the Bank of England's quantitative easing programme, the central bank currently owns a lot of the government's debt.

If anybody else had lent money to the government it would have had to pay interest on those loans.

The government has now decided it should not be paying interest to the Bank of England, and the benefit of that has reduced the deficit and will continue to do so for the next four years.

Excluding the effects of the Bank of England money gives a figure of £121.4bn in 2011/12 and a forecast of £119.9bn for 2102/13, which demonstrates the importance of the inclusion of the assumed receipts from next year's 4G spectrum auction, without which the deficit would indeed have risen.

There was good news on unemployment, with the OBR cutting its forecast for the peak jobless rate from 8.7% to 8.3%.

It also cut its forecast for the unemployment rate this year to 8.0% from 8.7%, and for 2013 the rate is forecast to be 8.2%, down from the previous prediction of 8.6%.