Autumn Statement: More spending cuts 'on the cards'

- Published

Paul Johnson, IFS Director: "We're looking at really big cuts beyond 2015-16"

Further welfare cuts and tax rises "must be on the cards" to make the government's numbers in the Autumn Statement add up, according to the Institute for Fiscal Studies (IFS).

Spending cuts announced on Wednesday are "close to inconceivable", it said.

This is because if departments such as the NHS and schools are protected, unprotected departments would end up having to make cuts of more than 30%.

IFS director Paul Johnson said further cuts could target pensioners' benefits.

"There are big choices on health and welfare, crucially surely including benefits for pensioners, still to be made," he said.

The basic state pension is set to rise by 2.5% from April, according to government rules, while other benefits are limited to 1% rises.

The IFS said that it was already clear that in next year's budget, with the NHS and welfare again to be protected from cuts, other departments - such as police, local government, defence, environment and transport - would face cuts of another 3.2%, on top of the 21% cuts they have already undergone since the 2010-11 tax year.

If the NHS and welfare continue to be protected, then by 2017-18 the cumulative cuts would reach 31.5%, a level that Mr Johnson considered "inconceivable".

In his Autumn Statement, George Osborne said that the details of individual departmental cuts would be fleshed out in a Spending Review next year.

Simon Gompertz explains the difference between 'debt' and 'deficit'

'Unprecedented' spending cuts

However, in its review of the Autumn Statement, external, the IFS cautioned that the benefit cuts announced by the chancellor on Wednesday may not actually save the government any money, given the other changes presented.

"Welfare cuts over the next couple of years largely pay for two tax cuts," said Mr Johnson, "the cancellation of the fuel duty increase and the further increase in the income tax personal allowance."

Such was the detail revealed in the Autumn Statement, that Mr Johnson said that "the idea that there is only one Budget a year has been laid pretty firmly to rest".

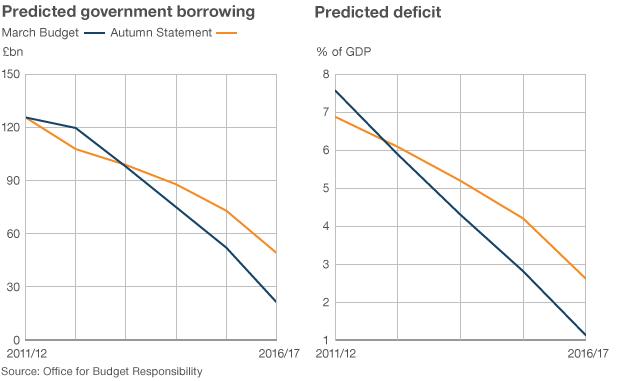

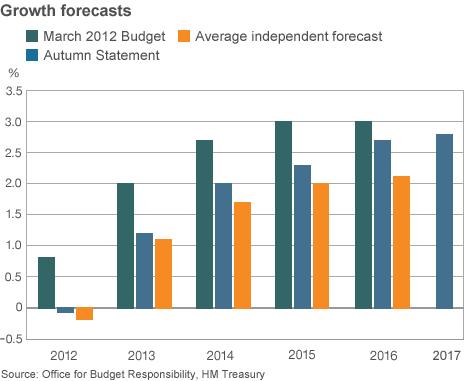

At the heart of Mr Osborne's budgetary difficulties was the fact that the Office for Budget Responsibility (OBR) was "forecasting that the economy will be 3.6% smaller in 2016-17 than it had thought back in March", the think tank head said.

It meant that the chancellor had, in effect, to abandon one of his two fiscal rules - namely that the country's debt should be falling as a percentage of GDP (annual economic output) in 2015-16.

It also meant that he would have to impose a further, eighth year of spending cuts in 2017-18. "That is even more unprecedented than the unprecedented seven years of cuts announced last year, itself superseding the unprecedented five years originally announced," said Mr Johnson.

The institute also pointed out that this year's predicted fall in the deficit - how much the government has to borrow this year due to its overspending - from last year's level has only been made possible by the OBR assuming that government departments would underspend their budgets by £7.5bn, in addition to banking the proceeds of the 4G mobile phone spectrum auction that has not yet taken place.

It suggested that if the OBR would not assume departmental overspends in the future, "then it possibly shouldn't be banking future possible underspends now".

The OBR is led by Robert Chote, who used to be director of the IFS.

Mr Johnson was quick to reject the suggestion that the ways the OBR had reached the conclusion that the deficit would fall this year meant it had lost its independence.

But he stressed that there was uncertainty surrounding the predicted figure of a £1bn fall in the deficit, which meant it was perfectly possible that the deficit could end up rising by the end of the financial year,

Richest 'hard hit'

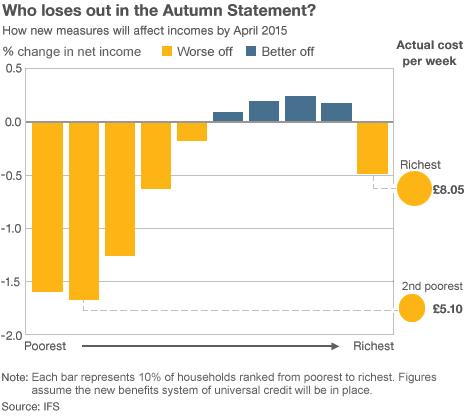

Mr Johnson concluded that: "Working age individuals receiving benefits and tax credits have been hit.

"The richest few percent have been hit very hard. Pensioners, and those in work on more modest incomes have borne less of the burden."

The increased tax burden on the rich came from two channels.

Firstly, the government reduced the amount that individuals can contribute tax free to their pension funds each year. The IFS criticised the policy change, claiming that frequent changes in pensions rules were making it increasingly difficult to plan for retirement.

Secondly - and less obviously according to the IFS - the chancellor reduced the income level, after adjusting for inflation, above which people must start paying the higher 40% rate of income tax.

This policy would mean that by 2015 there would be five million people paying the higher rate, one million more than now and double the number at the end of the 1990s.

Lower cost

Another IFS analyst, Stuart Adam, was asked whether the measures in the Autumn Statement were regressive, which would mean that poorer people ended up losing a higher proportion of their income than richer people.

"Not straightforwardly yes," he said, pointing out that the richest 10% of households were losing the most, but he added that ignoring the richest 10%, poorer households lost more than richer ones as a proportion of their income.

The IFS also pointed out that raising the amount of money that may be earned before any income tax is paid would cost less than the government had suggested.

The government's target is to get that threshold to £10,000 by the time of the next general election. Once it reaches that level it will begin to rise each year by inflation as measured by the Consumer Prices Index, instead of the Retail Prices Index by which it currently rises, which is usually higher.

Raising the threshold this year means it will begin to rise by CPI instead of RPI more quickly, which means the cost of the increase is £1.1bn for the next three years but only £600m a year after that.