Mark Carney suggests targeting economic output

- Published

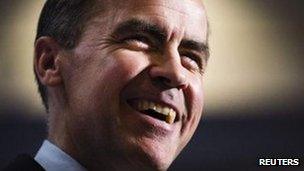

Mark Carney is currently governor of the Bank of Canada

Mark Carney, who will take over as governor of the Bank of England next year, has suggested targeting economic output instead of inflation.

At the moment, the Bank's job is to aim for an inflation target of 2%.

Targeting gross domestic product (GDP) that has not been adjusted for inflation would mean the economy would have to catch up with previous shortfalls, Mr Carney said in a speech, external.

He said it might be a good option when interest rates were near zero.

Mr Carney is currently governor of the Bank of Canada.

He said one problem with changing the target would be that "people must generally understand what the central bank is doing - an admittedly high bar".

It was his first speech since the unexpected announcement of his appointment to the Bank of England (BoE) top job.

Targeting the country's economic output rather than inflation would be a major change to monetary policy, although it is not within the power of the Bank to change its target.

Targeting inflation has been a key plank of economic orthodoxy around the world for decades.

A central bank could make it clear how high inflation or unemployment would have to go before interest rates would be increased, he suggested.

He said that people would have to be confident that rates would stay very low even if there was a small rise in inflation above the target level, because otherwise, low rates would be a less effective stimulus to the economy.

"On paper, this approach appears to be far more aggressive than the BoE's current objective," said Jane Foley, a senior currency strategist from Rabobank.

"However, in practice, the extreme economic climate of recent years has meant that BoE has not been conducting policy strictly in accordance with its 2% policy," she said, adding that it had paid "greater heed to the performance of the real economy" in recent times.

Inflation has been above target in 38 out of the last 44 months, and the Bank, through policies such as quantitative easing and the more recent Funding for Lending scheme, has been trying to ensure homeowners and businesses have greater access to cheaper loans to try to stimulate the recovery.

Despite these moves, official recognition of a shift away from the inflation target would be "a huge political and psychological step", Jane Foley said.

There is a similar debate at the Bank of England's US counterpart, the Federal Reserve.

Some members of the Fed's policy-setting committee want it to publish additional economic targets, such as an unemployment rate, which would guide interest rates.

The head of the Federal Reserve Bank of Chicago, for example, thinks that interest rates should remain at zero until unemployment drops to 6.5%.

This would be a shift from its current approach, in which it says how long it expects interest rates to remain at around zero for. Currently, that date is mid-2015.

- Published26 November 2012

- Published27 November 2012

- Published26 November 2012