Welfare plans: Your benefits may be lower than expected

- Published

Maternity pay is among the benefits that would be affected by the proposals

MPs have voted on key changes to welfare entitlements that are set to affect millions of people in the UK.

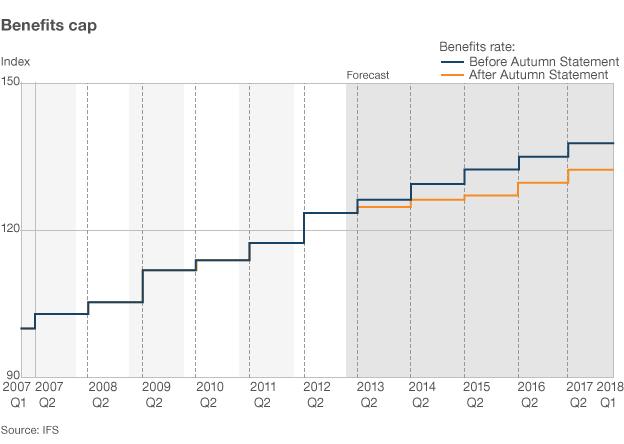

In his Autumn Statement, external, Chancellor George Osborne announced plans to place a three-year cap of 1% on increases in most working-age benefits and tax credits from April 2013.

That means benefits such as jobseeker's allowance and maternity pay will go up by less than the expected rise in the cost of living - in other words, a real terms cut.

So, what does this mean for you?

Who will be affected?

What does that mean for me exactly?

How does that compare with the cost of living?

How many families will be hit in total?

Is anyone protected from the planned changes?

What is the timetable for the welfare changes?

Is there any advice for those facing the cuts?

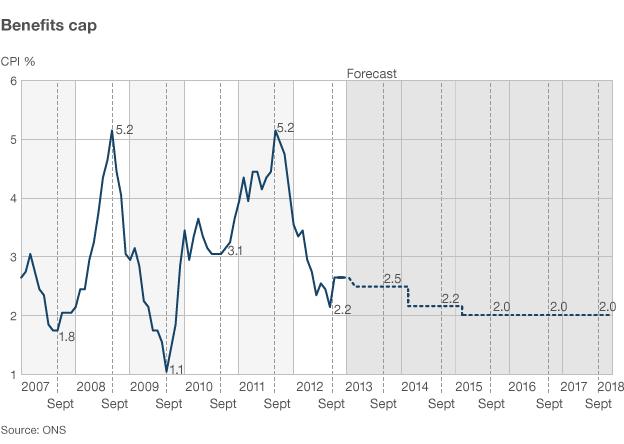

Benefits such as jobseeker's allowance have long been linked to inflation, meaning that when prices rise, so does the amount that claimants receive. The rate is based on inflation in September, with changes taking effect the next April. The Office for Budget Responsibility has forecast inflation to continue at about 2%.

September 2012's inflation rate was 2.2% so benefits were expected to rise by that amount in April 2013. However, in his Autumn Statement, the chancellor capped rises for many working-age benefits at 1% for 2013-14. The government is now seeking to pass legislation to continue this cap for a further two years.

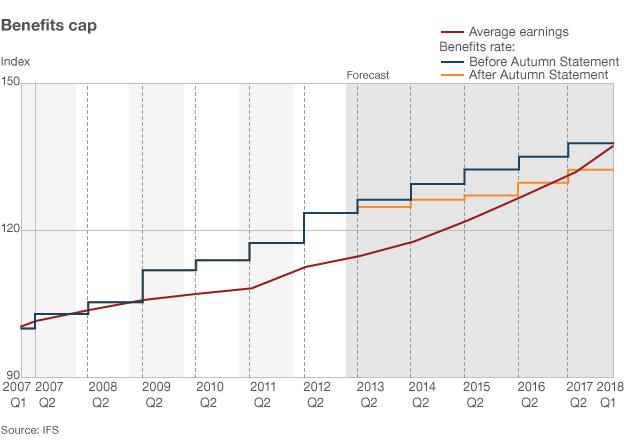

While average earnings are far higher than average benefit payments, they have not grown in line with inflation during the downturn. This analysis by the Institute for Fiscal Studies shows how pay rises have been held down while benefits have continued to keep pace with price increases in recent years.