Banks pay $8.5bn to settle home foreclosure review

- Published

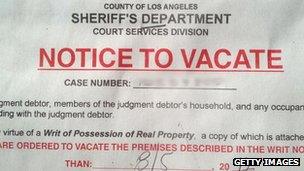

Many people lost their home in the financial crisis, and they may get compensation

Ten of the biggest banks have agreed to pay $8.5bn (£5.2bn) to settle a review of home foreclosures by US regulators.

Banks and mortgage lenders including Bank of America, Citigroup and JP Morgan Chase will pay $3.3bn directly to eligible homeowners, regulators said, external.

The lenders will also pay $5.2bn to modify and forgive loans.

The investigation began in 2011, and looked into whether borrowers had unlawfully had their homes repossessed.

The regulators were the Office of the Comptroller of the Currency (OCC), which is an independent bureau of the Department of the Treasury, and the US central bank, the Federal Reserve.

The US mortgage market boomed in the middle of the last decade. Banks made huge profits by buying home loans and repackaging them as complex products.

The housing bubble collapsed in 2008, making many of the homes worthless and causing the loans and their derivatives to become toxic. Many people lost their homes and all the major banks had to be bailed out.

The OCC said that more than 3.8 million borrowers, whose homes were subject to foreclosure proceedings in 2009 and 2010, would receive cash compensation "ranging from hundreds of dollars up to $125,000, depending on the type of possible servicer error".

'Roadkill'

But one homeowner advocacy group estimates that only about 400,000 homeowners would be eligible for compensation under the settlement.

"This is outrageous," Bruce Marks, head of the Neighborhood Assistance Corporation of America, a non-profit homeowner advocacy group, told the BBC. "The banks want to move on, the regulators want to move on. The homeowners, they are left on the side of the road as roadkill."

More than 1,000 consultants were combing through the loan documentation to see how much wrongdoing actually occurred, a process now stopped by this settlement. "We will now never know what the banks did in modifications of the loans.

"There is not enough money in there for the victimised homeowners," added Mr Marks, who used to work for the Fed in New York.

The banks involved in the settlement are Aurora, Bank of America, Citibank, JPMorgan Chase, MetLife Bank, PNC, Sovereign, SunTrust, US Bank, and Wells Fargo.

The regulators said that eligible homeowners whose homes were unlawfully foreclosed upon should expect to be contacted by the end of March with payment details.

"Borrowers will not be required to execute a waiver of any legal claims they may have against their servicer as a condition for receiving payment," the OCC said, leaving the door open for more legal action.

Earlier, Bank of America agreed to pay US government mortgage agency Fannie Mae $3.6bn to settle claims relating to residential home loans.

Fannie Mae argued the bank sold it toxic debts and should be responsible for the losses it suffered as result.

In February 2012, five banks - Bank of America, Citigroup, Wells Fargo, JP Morgan Chase and Ally Financial - agreed to provide $25bn to homeowners to settle claims over improper foreclosure practices in a deal struck with the US government and most US states.

- Published7 January 2013

- Published24 October 2012

- Published2 October 2012

- Published9 February 2012