Investment challenges facing Africa's mining industry

- Published

The real challenge for many African countries is not mining, but reaching their export markets

Fifty-three years ago this week, the then UK Prime Minister Harold Macmillan delivered his famous "wind of change" speech in Cape Town.

On 3 February 1960, he spoke of the political change that was blowing through the continent as African countries lined up to claim their independence from Europe's colonial powers.

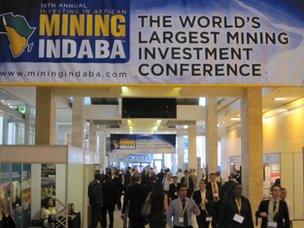

This week, aside from the strong south-westerly winds that blast through Cape Town at this time of the year, there was another wind of change blowing through the Investing in African Mining Indaba.

Many of the 7,500 delegates at the annual conference in Cape Town felt that the investment wind was no longer blowing south to South Africa's mining industry, but had changed and was now blowing north and west - seeking out opportunities in the rest of the continent.

The reason is simple. Many investors are still nervous about last year's strikes at many of South Africa's mines and the devastating effect they had on production.

Stability is key

Some analysts see better opportunities elsewhere and investors are looking at Ghana, Guinea, Mali and even Ethiopia.

"If you look at where the majors seem to be doing their business, many of them are withdrawing from South Africa," says Charles Bond of the law firm Gowlings.

"There are good deals to be had in South Africa but there's a lot of other opportunity around the other African jurisdictions.

"A lot of those countries are welcoming in investors with open arms. They're trying to make their mining codes more easy, more accessible - whereas South Africa, because of the political uncertainty here, it's been more difficult to promote their mining investment."

As belt-tightening happens in the investor countries, many countries in Africa are finding themselves competing for a shrinking pot of investment money.

African governments know that investors will balance risk and reward, and that stability is key. Keen to point this out, Gabon's exhibition stand at the Indaba had a large poster with "a safe and friendly country" emblazoned across it.

'Yesterday is history'

One way countries are stressing how investor-friendly they are is to quash any talk of nationalisation, which during the recent boom in commodities surfaced in certain places.

South Africa's Mining Indaba attracts delegates from more than 100 countries

Susan Shabangu, South Africa's Minister of Mining, spent some time last year reiterating her government's policy that there would be no nationalisation of the mines, despite the calls from the likes of the former ANC Youth League leader Julius Malema.

Other countries are adamant nationalisation is not even a consideration.

Yamfwa Mukanga, Zambia's Minister of Mines, Energy and Water Development, scoffed at the very notion when I asked him about it as a possibility.

Mike Allen Hammah, Ghana's outgoing Minister for Lands and Natural Resources, told me a renationalisation of his country's mines would be against the constitution.

"We won't go back," he said. "Yesterday is history, tomorrow is a mystery and today is the present. For us, having learnt from history, there's no way we are going to go back to nationalising mining companies."

Infrastructure investment

But other African countries do face a challenge that South Africa doesn't - infrastructure.

It is all very well having enormous mineral deposits, but if they cannot be exported, no-one benefits.

The biggest challenge for mining firms 'is infrastructure', says Tony Zoghby

Deloitte's South Africa mining leader, Tony Zoghby, says: "Africa, in terms of infrastructure, is relatively undeveloped.

"Although the resources are there, actually getting them out of the ground and getting them from where they're mined to the ports is the big challenge."

One estimate, by Standard Bank, says Africa will need $50bn (£31bn) of infrastructure investment over the next 10 years, if its resources are to be exploited effectively.

'Challenging time'

Knowing that the rule of law is being abided by all sides is important for investors too.

That's another reason why they were so spooked by last year's wildcat strikes in South Africa.

Peter Major, mining analyst at Cadiz Corporate Solutions, says: "If you have average deposits you'd better have way, way above enforcement of law - and you want regulations enforced on both sides.

"Mining companies have to comply but so do governments and the unions."

Mungo Soggot, at Risk Analysis, says that all the major mining firms have either "quite significantly reduced their exposure" to South Africa or are thinking about it.

"But it would be premature to say that the era of big mining is over in South Africa. It's an immensely challenging time," he says.

So the consensus might not be one of doom, but perhaps South Africa should be looking at its golden years in its rear-view mirror.

- Published4 February 2013

- Published28 December 2012

- Published20 September 2012

- Published18 September 2012