When stores go bust: How to get your money or goods back

- Published

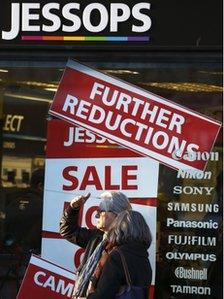

Numerous well known stores have collapsed since Woolworths went bust in 2008

What are your rights when a trader has ceased trading or has "gone bust"?

For consumers this is an upsetting but all too frequent event in these difficult economic times, and it helps to know your options.

Often a business will cease trading suddenly.

You may have paid a deposit for undelivered goods, have bought goods that are faulty, or be in possession of a gift card.

You will probably not know whether you will be able to get your money back.

What you can do depends on the reason for the trader stopping, and on the legal status of the business - whether it was a sole trader, a partnership, or a limited company.

Bust or just closed?

The first thing you should do is to find out whether the trader has actually gone bust or simply decided to close down.

If a business has simply decided to cease trading, you can still pursue any claim you have for faulty or misdescribed goods from them in the normal way, using the small claims court if necessary.

The legal contact details of the trader should appear on the receipt you received with your goods.

The next step is to find out if the entity you are dealing with is a person, or a limited company - this information will have a big impact on your rights to get your money or your goods back.

Establishing a limited company is a legal way of limiting the liability of those who run the company in a bankruptcy.

A company can be dissolved and those that ran it may not liable for any of the company debts.

You can find out if a company is limited because it will be registered at Companies House - telephone the contact centre on 0303 1234 500 or visit the website www.companieshouse.co.uk., external

The administrators

If the company has gone into administration, you need to find out who has been appointed as administrator - there will usually be a notice of this at the trading premises and at the registered office.

Jessops was just one of a recent flurry of insolvent store groups

Whether or not gift cards will continue to be accepted, or consumers will be able to exchange goods or obtain refunds, will be decided by the administrator.

It is worth following the news and keeping an eye on your local store as these decisions may change as the situation develops.

If the trader was a sole trader or partnership, you can continue to pursue any claim you may have against the trader, via the small claims court if necessary.

You can commence an action for the recovery of debt online through the official Money Claim Online, external website, or in person at your local county court.

You will have to pay a fee and it is important to bear in mind that even if you win, there is no guarantee the trader will pay.

It is wise to ensure the defendant has sufficient assets to pay their debt before going to court.

If a limited company becomes insolvent and cannot pay its debts, a liquidator will be appointed to collect and redistribute all the company's assets to the creditors.

If you are owed money, for example because your gift card was not settled or your goods were not delivered, you are a creditor.

It is important to register yourself as such with the administrators as soon as possible, to be within a chance of getting some of your money back, or obtaining the goods you may already have paid for.

You will need to show that you really were the buyer of those goods, by means of a confirmation receipt for example.

Fantastic plastic

So how else might you be able to get your money back?

If you have faulty goods that have a manufacturer's or third-party warranty, for example electrical items, you should be able to claim on this warranty to get a repair or replacement.

Check for any documentation that came with the item.

If you made any part of the purchase with a credit card and the price of a single item was above £100, you should able to claim from the credit card issuer under section 75 of the Consumer Credit Act 1974.

Contact your credit card company for more information.

If the goods were purchased on a Visa or Mastercard debit card, then you may be able to claim under the Chargeback procedure.

There is no minimum limit on the price you paid for the goods, but generally you need to register your claim within 120 days of the date you bought the goods or placed the deposit on the card.

Some card providers my have a different time limit on making claims.

You can also use Chargeback for a purchase on a credit card that cost less than £100. To make such a claim contact your card issuer.

More advice

Finally, to be sure you have all the advice you need relevant to your individual situation, call the Citizens Advice consumer helpline 0845 4 04 05 06, who will be able advise you and point you in the right direction.

They will also be able to refer matters to the relevant trading standards authority, if there is any allegation of illegal activity.

So, while there are a few things consumers can do in this situation, a lot will depend on the success of the administration process and on the severity of the business's financial situation.

Consumers who take immediate advice, and act fast, can have the best chance of recouping some of their losses - but it is wise to keep expectations low.

The opinions expressed are those of the author and are not held by the BBC unless specifically stated. The material is for general information only and does not constitute investment, tax, legal or other form of advice. You should not rely on this information to make (or refrain from making) any decisions. Links to external sites are for information only and do not constitute endorsement. Always obtain independent professional advice for your own particular situation.