G20 vows to combat corporate tax avoidance

- Published

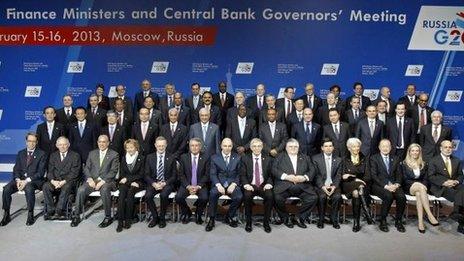

A communique from the G20 finance ministers spelt out opposition to any "currency war"

G20 finance ministers meeting in Moscow have pledged to crack down on tax avoidance by multinational companies.

The final communique said members were determined to develop measures to stop firms shifting profits from a home country to pay less tax elsewhere.

The UK, France and Germany were the main movers behind the drive.

The communique also said members would refrain from devaluing their currencies to gain economic advantage, amid fears of a new "currency war".

The fears had been sparked by Japan's recent policies, which have driven down the value of the yen, aiding its exporters.

'Strongly determined'

A recent survey carried out by the Organisation of Economic Co-operation and Development (OECD) found that multinational firms could exploit gaps between tax rules in the different countries in which they operate.

The finance ministers of the UK, France and Germany - George Osborne, Pierre Moscovici and Wolfgang Schaeuble - said international action was needed to crack down on companies which transfer profits from their home country to another in order to pay lower taxes.

Mr Osborne decried a global taxation system he said had been guided by principles set out by the League of Nations in the 1920s, with few changes since.

He said: "We want businesses to pay the taxes that we set in our countries. And that cannot be achieved by one country alone."

Mr Moscovici said France was "strongly determined to fight against tax fraud, tax avoidance, and tax evasion".

He added: "We must avoid situations in which some companies use international and domestic law to be taxed nowhere."

OECD secretary general Angel Gurria said laws had to be changed: "Avoiding double taxation has become a way of having double non-taxation."

The G20 communique read: "We are determined to develop measures to address base erosion and profit shifting, take the necessary collective action and look forward to the comprehensive action plan the OECD will present to us in July."

A number of companies, including Amazon, Google and Starbucks, have come under the spotlight for their taxation strategies in recent months.

Another giant international company, Facebook, has now been accused of ducking its tax obligations.

Facebook allegedly paid no corporate income tax in the US last year, and instead reclaimed $451m in taxes from the Internal Revenue Service, despite recording profits of over $1bn, US lobby group Citizens for Tax Justice has claimed, external.

Thanks to tax deductions the social network can claim on shares granted to its executives as part of its recent listing on the Nasdaq stock exchange, the company stands to benefit from a further $2bn of tax deductions in the future, the lobby group alleged.

However, in Facebook's defence, the same employee share scheme that has allowed it to cut its corporate income tax bill has also resulted in it handing over $2.86bn in employee income taxes instead, external.

Plan of action

The report by the OECD was released earlier this year, external, and found that:

inconsistencies between different countries' tax rules enable companies to move their profits to lower tax jurisdictions

the amount of taxable profits in a given country increasingly depends on hard-to-value intangibles such as intellectual property rights, services or brands

international royalties and licence fee payments, mostly paid between different subsidiaries within the same business group, grew 170-fold between 1970-2009

tax rules fail to take proper account of the growing volume of e-commerce, which presents particular problems as to which country has tax jurisdiction

The OECD action plan, to be laid before the G20 in July, will be formulated with the help of three committees.

The UK will chair a committee looking at transfer pricing - how international corporate empires calculate the payments passed between their subsidiaries in different countries, which can be used to shift profits from high-tax jurisdictions to lower-tax ones.

Germany will head a panel looking at the ways in which companies have reduced their tax base - their taxable income and assets - while France and the US will jointly consider the problem of identifying the correct tax jurisdiction for business activities, particularly e-commerce.

'Economic warfare'

Meanwhile, the G20 finance ministers avoided singling Japan out for criticism over the recent weakness of its currency.

But the communique pledged that G20 members would "refrain from competitive devaluation".

It read: "We reiterate that excess volatility of financial flows and disorderly movements in exchange rates have adverse implications for economic and financial stability.

"We will not target our exchange rates for competitive purposes. We will resist all forms of protectionism and keep our markets open."

Mr Osborne said: "Currencies should not be used as a tool of competitive devaluation. The world should not make the mistake that it has made in the past of using currencies as the tools of economic warfare."

International Monetary Fund chief Christine Lagarde said that global growth was still weak and unemployment "outrageously high" in many countries, and that policies should be directed towards creating jobs and growth.

- Published16 February 2013

- Published4 December 2012

- Published12 February 2013

- Published11 February 2013

- Published14 February 2013