Budget 2013: Chancellor's rebalancing act

- Published

- comments

Tiptree's boss says the rising cost of imported fruit has been an issue for them

When George Osborne became chancellor in 2010, he didn't only want to fix the hole in the public finances.

Along with pretty much every UK economic expert, he also wanted to "rebalance" the economy.

The idea was to get more of our growth from exports and investment, so we'd be less reliant on borrowing and consuming at home - and (hopefully) less vulnerable to crises in the future.

We know the hole-fixing side of the chancellor's plan hasn't been going according to plan.

Growth has been a big disappointment as well.

Sweet success

But what about that longer term quest, to turn ourselves into a more balanced economy? I went to a jam factory in Essex to take a closer look.

Wilkin & Sons have been making Tiptree jams at their factory in Essex since 1885, and you would have to say they were one of the business success stories of the past few years.

Their workforce has grown by more than 50% since 2005 and total sales have risen by 25% in the past two years alone.

But even though they've done well, it turns out that Tiptree's experience also highlights some of the issues that have been getting in the way of rebalancing the economy and thwarting growth at a national level.

Though the company has seen very healthy growth in exports since 2010, foreign sales have not actually grown as fast as sales at home.

Sales to China are up nearly 70% since 2010, and exports to Brazil are up more than 45%, but they still account for a tiny share of the total.

Because sales in more important markets like the US and Italy have been flat or falling, the proportion of Tiptree's business that comes from exports has actually gone down a little.

Exports of Tiptree products have grown more slowly than domestic sales

Tiptree is rightly proud of the overall result. They must be doing something right to boost sales at home by more than 25% at a time when UK consumers are so pressed for cash.

But if the chancellor or the governor of the Bank of England looked at the company's figures they might be a bit disappointed that the share of demand coming from exports hasn't gone up.

For all its success, Tiptree hasn't "rebalanced" at all. And neither has the UK economy.

The 'wrong' exports?

The value of UK exports has risen by around 25% since 2007. Exports to China have almost doubled in three years.

But total exports to the dynamic Bric economies (Brazil, Russia, India and China) still accounted for not much more than 6% of our total sales abroad in the first three months of 2012.

That means we do now sell more to those emerging markets than we do to Ireland. But we are still in a much weaker position than Germany or the US, which send more than a tenth of their exports to the Brics.

One measure of our ability to pay our way in the world economy is the current account deficit: that's the amount we have to borrow from the rest of the world to make up the gap between what we spend at home and what we earn abroad.

Alarmingly, that deficit has been going up: the Office for Budget Responsibility expects it to have risen to 4% of GDP in 2012, up from 1.3% in 2009.

It's true that the jump in 2012 was largely driven by a collapse in foreign earnings by Britain's financial sector. But the narrower trade deficit also went up last year. And the latest GDP figures showed that exports overall held back the recovery in 2012, rather than propping it up.

No easy fix

Is that all down to the crisis in the eurozone? Certainly, the crisis across the Channel hasn't helped.

But the Bank of England looked at this issue in depth, in its latest Inflation Report, external, and found that we had not even boosted our trade as much as other countries facing the same market conditions.

Tiptree's boss Ian Thurgood says the rising cost of imported fruit has been an issue for them

And, it's worth remembering that those other, more successful countries have not seen a roughly 25% fall in the value of their domestic currency since 2008.

The fall in the pound was supposed to kick-start the re-balancing process, by giving UK exporters the chance to cut their prices abroad and become more competitive - without having to squeeze domestic wages or profits.

But in the real world, it turns out that things are more complicated.

Tiptree's joint managing director, Ian Thurgood, told me they had benefited from the cheaper pound.

But, because they hadn't wanted to take risks with the currency they decided several years ago to set most of their European contracts in euros.

They are also hugely dependent on imported inputs, including Seville oranges for all their marmalade and the glass for all their jars.

It's not just Tiptree: companies up and down the land have found that the positive effect of a cheaper pound, when it comes to setting prices abroad, has been at least partly offset by the higher price of foreign inputs.

That is why economists such as the former MPC member Andrew Sentance argue that the Bank of England and the government should have been more concerned about the level of the pound and done more to offset domestic inflation.

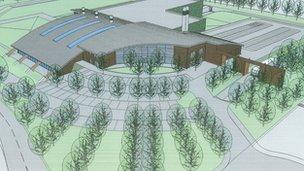

The company is hoping to build a new factory to increase its capacity vastly

In his view, far from making it easier for UK companies to compete internationally, the fall in the pound may actually have made it harder, at least in the long term.

I'm not sure that Graeme Leach, the chief economist of the Institute of Directors, would go that far.

But when he was kind enough to join me at the Tiptree factory he told me he thought the government should be focused more on the supply-side factors holding back growth - and when it came to competing in the global economy, companies should be looking at everything about their product, not just the price.

Slowly does it

Talk of the supply side brings me to the other side of re-balancing, which was supposed to be higher investment.

Tiptree has been investing; it's bought several small companies in the past few years to expand its product range.

It also has an ambitious plan to build a new factory, next to the existing site, which would help them massively increase their capacity.

But they've been very cautious about going ahead, and there have been so many twists and turns in the reform of the local planning regime, it's taken them three years to get to the point of submitting a formal application.

That also fits with the macro-level data for the UK. Nationally, investment did start to pick up last year but it is still well below where it was before the crisis, in 2007.

Many companies are still sitting on big surpluses which they are wary of investing.

Mr Osborne has launched a lot of schemes to make it easier for them to put that money back into the economy (including those ambitious planning reforms). And to make it easier for companies without a lot of spare cash to borrow from their bank.

But you don't need to read the newspaper headlines to know that none of these efforts to spur investment has had a big impact yet.

Those GDP figures I mentioned earlier showed that the small amount of growth the UK had in 2012 was all thanks to public and private consumption.

Most forecasts have consumers doing most of the heavy lifting in 2013 as well.

Growth burden

Can consumers continue to carry the recovery on their shoulders?

I put that question to Tiptree's brilliantly titled Pudding Room Supervisor, Tracey Warren.

She's one of many people at the factory who've lived much of their lives in and around the Wilkin & Sons factory.

She used to pick strawberries for them after school - and her husband, mother and sisters have all worked there over the years.

Unlike many, she's seen decent growth in her pay over the past few years. There was a brief wage freeze, but since then she says her pay packet has kept up with the rising cost of living.

Still, she laughed at the thought of spending even more, to support the recovery.

She also mentioned that she and her husband felt lucky to have bought their house a long time ago.

Friends in the community are struggling to get a mortgage and many young people in Tiptree are struggling to find work.

There aren't many places in Britain where a single employer has played such a big part in the area's history and needless to say, many companies are not doing as well as Tiptree, at home or abroad.

But when it comes to rebalancing, the Tiptree story does seem pretty representative.

The chancellor - and everyone else - wanted more balanced growth to come out of the embers of the financial crisis. But increasingly, we'd be happy to have any growth at all.