How Apple and Google's fortunes are linked

- Published

Investors are concerned about Apple's reliance on demand for devices such as phones, pads and computers

Seismic shifts are taking place in how investors view two of the biggest names in technology.

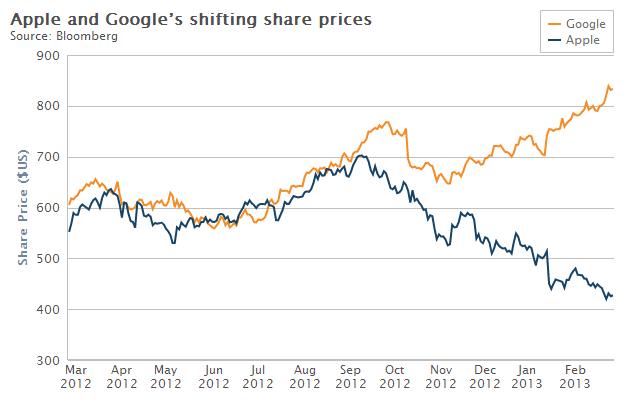

Apple, which until a few months ago was the star of Wall Street on the back of the massive sales success of its iPhones and iPads, has seen a significant dip in its stock-market fortunes.

Google, meanwhile, seems to be taking on the mantle of a company that can do little wrong in the eyes of investors.

Apple's shares fell to their lowest level in more than a year on 5 March, and have barely recovered since, reflecting a trend that has seen a whopping 40% of the company's market value wiped out in the past six months.

Google's shares have been moving the other way, climbing to an all-time high early in March and trading not far below that in recent days.

"Google's rise is a mirror to Apple's decline," says Colin Gillis, senior technology analyst at BGC Financial.

Device magic

Investors, Mr Gillis believes, are focused on future sources of revenue growth and, while the Google camp appears to be brimming with ideas for products that could turn into money-spinners in years to come, Apple has given little away about where its future profits will come from.

It never has.

"Historically, it's been a positive for Apple to be so secretive. Now it's a negative," he says.

Uncertainty has clearly undermined shareholder confidence, but its problems may go deeper than that.

"Apple's suffering reflects a broader issue", says James McQuivey, of Forrester Research, a consultancy.

"Devices are no longer the thing. What matters now is the overall service relationship with customers".

In his view, what gadget buyers increasingly care about is not so much the gadgets themselves - it is taken for granted that rival brands are all pretty good - as the quality of the software and services they deliver.

"Apple does that well too," says Mr McQuivey, citing the success of the iTunes music library and app sales for mobile devices.

The problem is software and services, however successful, are unlikely to generate the kind of outsize profit growth from rising sales of iPhones and iPads that drove Apple's shares to unprecedented highs last year.

"Investors pushed the shares high because they believed in Apple's magic with devices", he says.

That magic, it seems, is beginning to fade.

Reaching the limit

Google does not make devices, but it has partnered with several Asian manufacturers

But it would be mistake to overdo the gloom.

"Apple's market share is stable and it continues to make two-thirds of all the profits made from mobile handset sales," says Benedict Evans, a tech watcher at Enders Analysis.

But he too recognises the logic behind the share price decline.

"The fundamental issue is how many more people will buy a $650 (£435) phone in the next couple of years," he says, referring to Apple's position at the most expensive end of the market.

Apple's revenues more or less doubled in 2010, then doubled again in 2011, but in 2012 it rose by a mere 40% or so to $156bn.

Analysts say the slowing rate of increase in revenues and profits last year was taken as a sign by investors that Apple was reaching the limit of its ability to grow sales of high-priced smartphones and tablets, even if its hold on this market remains mostly intact.

Profit potential

So where does all this leave Google?

It is doing well in smartphones, where Google's Android software platform has become overwhelmingly the dominant force at the lower end of the market.

Android handsets, made by several different manufacturers, outsell Apple's iPhone by a margin of roughly three to one, although Apple still takes most of the profits.

Google does not directly make money from Android, which is free of charge, but owners of Android phones are effectively locked in to using Google services.

From its original base in search, Google has built up a comprehensive array of web-based services that cater for most aspects of people's digital lives, with products such as Gmail, Google+ social networking, and Google Play, its answer to iTunes.

But for Mr Gillis of BGC Financial, that is probably not the main reason why Google's shares have soared.

More important is the buzz coming from the company over potential new areas of business, he says.

"They're innovating, creating new revenue streams, they're quickly into video through [ownership of] YouTube and quickly into hardware," he says referring to the Nexus-branded smartphones and tablets Google has developed in partnership with Asian manufacturers.

There is also excitement about the longer term profit potential of the Google Glass project, Google's plan to market internet-connected headwear, worn in front of the eye like spectacles.

"Investors are looking at what they're doing that could be monetised in three to five years," says Mr Gillis.

Nuanced picture

But, as with the pessimism about Apple, optimism about Google's prospects merits caution.

"There's plenty Google can do to grow, but it isn't a high flier," says Mr McQuivey, of Forrester Research.

That may seem a churlish statement to make about a business that generated a record $10bn profit on $50bn of revenues last year.

But, he believes, there is nothing on Google's horizon to generate the sort of earnings growth that sent Apple's shares soaring into the stratosphere in early 2012.

Meanwhile, the company is not without problems.

It still depends heavily on profits from internet advertising, and those profits have been under threat from the trend for people to access the internet from mobile devices with small screens rather than from personal computers, which are preferred by advertisers.

Google is perceived to have managed this tricky transition rather well.

"Last year there were concerns that Google would not be able to maintain advertising revenues. Those fears have receded," says Mr Evans, of Enders Analysis.

But relief that things are better than might have been expected is rarely a recipe for spectacular stock market advance over the long term.

So the picture is more nuanced than it first appears.

Google is seen as doing quite well within defined limits by investors, while Apple's position can hardly be described as rotten.

- Published13 March 2013

- Published12 March 2013

- Published12 March 2013

- Published4 March 2013