Budget 2013: Economic growth forecast for 2013 halved

- Published

The official forecast for growth in the UK economy this year has been halved.

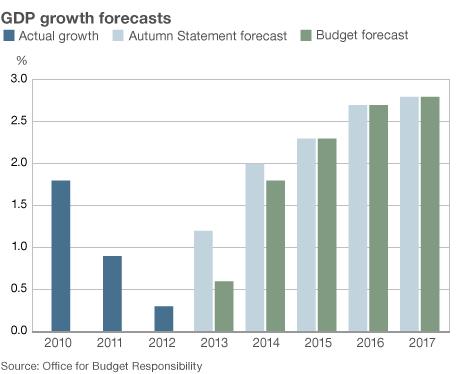

The Office for Budget Responsibility (OBR) cut the forecast for this year from the 1.2% it predicted in December to 0.6%.

The cuts were announced at the start of George Osborne's Budget speech, in which he blamed the cuts on lower-than-expected exports.

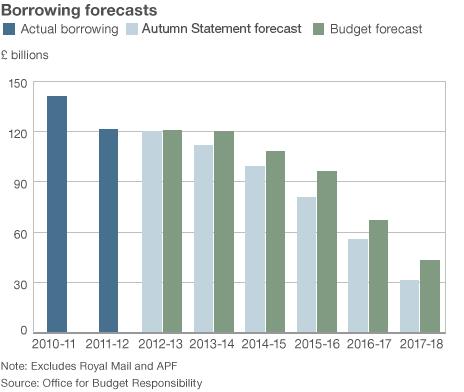

The OBR also revealed that the chancellor had failed to cut the amount the government borrowed this year.

It predicted that the government would be borrowing £121bn in the financial year ending at the beginning of April, which would be the same amount as it borrowed the previous year, excluding certain one-off factors.

The OBR has cut its growth forecasts repeatedly since it was established in 2010, when it was expecting 2.8% growth for 2013.

The chancellor said he was going to "level with people about the difficult economic conditions we still face".

'Taking longer'

The forecast for 2014 has also been cut, from 2.0% in December to 1.8%.

Predictions for 2015 to 2017 have been left unchanged.

The chancellor admitted that the recovery was "taking longer than anyone hoped".

He particularly blamed problems in the eurozone, highlighted by the bailout discussions for Cyprus.

OBR chairman Robert Chote confirms the downgrade of growth forecasts

He stressed that 40% of UK exports still go to the eurozone.

The OBR does not expect the economy to contract in the first three months of 2013, which would have put the UK into recession on the generally accepted definition of two quarters of negative growth.

It is expecting the eurozone to stay in recession this year.

"While less than we would like, our growth this year and next year is forecast by the IMF to be higher than France and Germany," the chancellor said.

The OBR said that employment "continues to surprise on the upside" and predicted 600,000 more jobs this year and 60,000 fewer people claiming benefits than a year ago.

The chancellor said in his speech: "The deficit continues to come down." But that depends on the figures used.

The figures for government borrowing, excluding the effects of both the transfer of the Royal Mail pension scheme to the government coffers and gains from the Bank of England's asset purchase facility, give a figure of £121bn for the current financial year, the same as it was in the previous year.

For the first time, the OBR also gave a figure excluding the effects of the special liquidity scheme, which has been reclassified by the Office for National Statistics and so, some would argue, should be excluded.

That figure shows borrowing rising from £121bn last year to £123bn.

On the other hand, the chancellor quoted figures in his speech that do not exclude any special factors, which see borrowing fall from £121bn last year to £87bn this year, before rising again to £108bn in 2013-14.

The OBR said that tax receipts had been lower than expected in 2012-13, but that had been offset by reductions in government spending, including pushing some spending into next year.

The Chief Secretary to the Treasury, Danny Alexander, told BBC News: "Of course, the borrowing numbers are not falling as much as we'd like."

BBC economics editor Stephanie Flanders suggested to him that it would be more helpful to think of government borrowing being basically unchanged last year, this year and next year at about £120bn.