Budget 2013: 'Cuts deferred' until after elections

- Published

The increase in National Insurance contributions will affect the NHS in particular

Further spending cuts by government departments have in effect been put off until 2015-16, a think tank has said.

"Year-on-year real cuts in departmental spending have effectively come to end for the period of this parliament," said Paul Johnson, director of the Institute for Fiscal Studies (IFS).

Tax cuts in the Budget entail a "modest loosening" in the next two years.

But austerity will tighten from 2015-16 as public sector worker National Insurance contributions rise sharply.

The increase in NI contributions - which will affect the NHS in particular - will occur due to the ending of the right to contract out of the second state pension.

Overall, Mr Johnson depicted the Budget as something of a non-event.

"Yesterday's Budget was sandwiched between an Autumn Statement three months ago and a Spending Review due in three months time," he said.

"This Budget looks like being the rather insubstantial filling between two pretty chunky slices of bread."

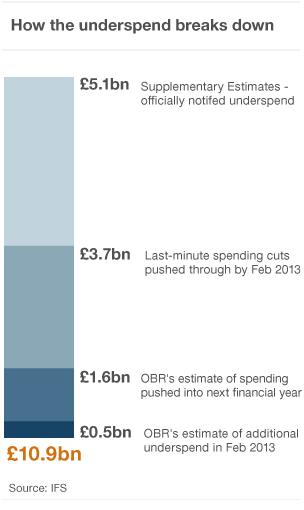

Departmental spending is expected to stay constant until the next election, thanks in large part to an unprecedented £10.9bn of under-spending achieved by government departments during the current year.

'Grim indeed'

Austerity during the coming two years has been moderated as a result of tax cuts, notably the increase in the personal allowance on income tax to £10,000, the further cut in corporation tax, the cancellation of the rise in fuel duty, and the £2,000 cut in employer National Insurance contributions.

However, the picture is likely to change from the 2015-16 fiscal year onwards, as the cost of a £3bn annual increase in infrastructure spending, more generous childcare assistance, and a watering-down of the cap on care for the elderly will need to be borne by other parts of government.

If some areas of spending, such as the NHS and international aid, continue to be ring-fenced, "the outlook for all other unprotected spending looks grim indeed", said the IFS head.

The Budget appears to set up a debate between the parties over whether to implement two draconian years following the elections, and how to split the burden between tax rises and further spending cuts.

"Whitehall departments might take some encouragement though from one rather heavy hint dropped in the Red Book," said Mr Johnson, referring to a line in the Treasury's full Budget handbook that stated: "It would, of course, be possible to do more of this further consolidation through tax instead."

The IFS also drew on data from the Office for Budget Responsibility to highlight how £5.3bn out of the total £10.9bn in departmental under-spending this year was seemingly achieved via last-minute spending cuts, of which £1.6bn came from simply deferring spending into next year.

'Rounding error'

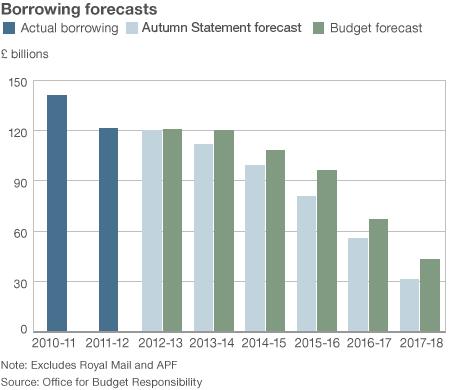

This departmental under-spending enabled the chancellor to fulfil his promise to cut the deficit - the government's borrowing - this financial year. But, Mr Johnson said, "only by a whisker".

According to OBR estimates, the deficit will fall to £120.9bn this financial year from £121bn in 2011-12 - a mere £100m, which Mr Johnson described as akin to a "rounding error".

"There is every indication that the numbers have been carefully managed with a close eye on the headline borrowing figures for this year," he said.

"It is unlikely that this has led either to an economically optimal allocation of spending across years, or to a good use of time by officials and ministers."

The IFS also highlighted how the poor performance of the economy had led the the OBR year after year to cut its forecasts for economic growth, and to raise its forecasts for the deficit, for total government indebtedness, and for the scale of spending cuts needed to bring its finances back under control.

In June 2010, the chancellor had expected that by 2014-15 the deficit would have fallen to £37bn. The latest revised OBR deficit now puts the figure at £108bn.