UK economy avoids triple-dip recession

- Published

- comments

Chancellor George Osborne called the latest GDP figures "encouraging" and defended his austerity measures

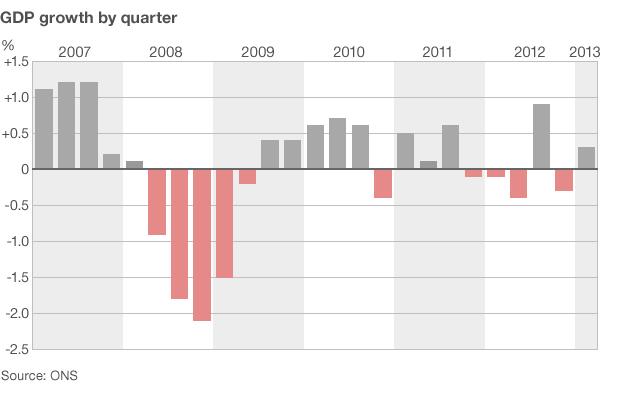

The UK economy has avoided falling back into a recession after recording faster-than-expected growth in the first three months of the year.

The Office for National Statistics said its first estimate for gross domestic product (GDP) showed the economy grew 0.3% during the first quarter of 2013.

Chancellor George Osborne said it was an "encouraging sign".

But the shadow chancellor, Ed Balls, said that the economy was "just back to where it was six months ago".

The growth in GDP means the economy avoided two consecutive quarters of contraction - the definition of a recession. There had been fears the UK would enter its third recession in five years, a so-called triple-dip recession.

Economists say the news should give a small psychological boost to consumers and businesses, but the broader picture of the economy remains the same.

The UK economy has been on a plateau since the financial crisis hit in 2008, with small spurts of growth and contraction.

'Making progress'

The better-than-expected rise in GDP for the first quarter was largely down to strong growth in the services sector and a recovery in North Sea oil and gas output.

The ONS figures also showed that GDP had risen by 0.6% when compared with the first quarter of 2012, the strongest year-on-year increase since the end of 2011.

Chancellor George Osborne said: "Today's figures are an encouraging sign the economy is healing. Despite a tough economic backdrop, we are making progress. The deficit is down by a third, businesses have created over a million and a quarter new jobs, and interest rates are at record lows.

"We all know there are no easy answers to problems built up over many years, and I can't promise the road ahead will always be smooth, but by continuing to confront our problems head on, Britain is recovering and we are building an economy fit for the future," he added.

Matt Basi, from CMC Markets UK, said: "Growth of 0.3% is hardly cause for celebration, but may ease some of the pressure that has been piling on the government's austerity plans."

The chancellor has faced calls from the International Monetary Fund to rethink the pace of the austerity programme.

But the government insists its austerity measures are vital to bringing down borrowing, and guarantee growth in the long-term.

Poor growth has already led to two international credit rating agencies stripping the UK of its top-notch triple-A rating.

Shadow chancellor Ed Balls said: "If we're to have a strong and sustained recovery, and catch up all the ground we have lost over the last few years, we need urgent action to kick-start our economy and strengthen it for the long-term - as Labour and the IMF have warned."

He added: "We need radical bank reform and a jobs and growth plan, including building thousands of affordable homes and a compulsory jobs guarantee for the long term unemployed. And instead of a tax cut for millionaires, we need a lower 10p starting rate of tax to ease the squeeze on millions of people on middle and low incomes."

Strong services

The pound rose nearly 1% to $1.5414 against the US dollar on the news, its highest point in two months.

The services sector, which accounts for three-quarters of the economy, grew by 0.6% in the quarter, with a strong performance from hotels and restaurants.

Transport and communications also made a solid contribution with growth of 1.4%.

But there were some areas of continuing weakness. Construction activity fell 2.5% in the first quarter and remains more than 18% lower than it was before the start of the financial crisis in 2008.

Phil Orford, the chief executive at the Forum of Private Business said: "While the service sector looks to have led the way, the construction industry figure is more worrying, and shows the need to get projects moving at a quicker pace."

Vicky Redwood, UK economist at Capital Economics said the recovery still faced "significant obstacles ahead, with households still experiencing falling real pay and policymakers still struggling to get bank lending to rise".

"Today's figure offers some hope that things might finally be starting to move in the right direction again," she added.

The economy has still not recovered from what has been the longest and deepest recession in modern history.

Overall the size of the economy as a whole remains 2.6% smaller than its pre-recession peak. Its pace of growth has also been much slower and weaker than in previous recessions in the UK.