Model maker Hornby reports loss

- Published

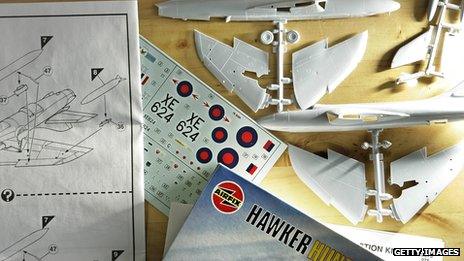

Hornby owns famous British brands including Airfix

Hornby, the model making firm that owns brands including Corgi and Airfix, has reported an annual loss, blaming the economy and supply problems.

The UK company reported a pre-tax loss of £3.4m for the 12 months to March, compared with a £4m profit a year ago.

But chairman Roger Canham said Hornby's "strong brands" made him optimistic that the firm could be turned around.

Hornby also announced plans to increase production in the UK, including a new line of Airfix models.

Airfix Quickbuild model kits were launched last year, and Hornby plans to produce them in Sussex as part of plans to have 10% of its manufacturing in the UK

Currently the majority of its manufacturing is done in India and China.

Olympics 'distraction'

Hornby's brands include Hornby model railways, Scalextric, Airfix, Humbrol and Corgi.

It sells models in the UK, mainland Europe and the US, although the UK represents nearly two-thirds of its revenue.

Hornby said sales in the UK were down 5% on a year earlier.

Sales of models related to the London 2012 Olympics were particularly disappointing, Hornby said. Before the games, it had hoped that its line of Olympics merchandise would provide a boost.

In the event, the company said the venture was "not only loss making but was a distraction from the core business for both our consumers and management".

But it also blamed broader economy and supply chain problems.

"This year was one of challenging economic conditions in all of our major markets that were exacerbated by continuing disruptions to the model railway supply chain," it said.

"We estimate that across the group, more than 10% of product ordered was not delivered during the year with our European subsidiaries faring worse than the UK business."

Hornby said it had written down the assets of its Italian business by £2.4m which had been "particularly affected by supply issues and the economic downturn".

The company also said it had incurred £0.7m in restructuring costs.

When one-off costs were stripped out, underlying profits were £0.15m, compared with £4.5m a year earlier.

"Consumer confidence in all our major markets continues to be weak," said Mr Canham, who took over as chairman in November.

"We have a broad portfolio of strong brands and we are optimistic that with a more reliable supply chain, we will see a return to growth."

He added that online retailing would become a bigger part of the business.

"The shape of the High Street is changing rapidly, our traditional wholesale customers are changing their retailing models, and we in turn are seeing the routes through which consumers purchase our products become increasingly digital and multichannel," he said.

- Published9 November 2012