UK shale gas resources 'greater than thought'

- Published

- comments

Osborne: "Local communities should get, for example, at least £100,000 for every fracking well that is created"

UK shale gas resources may be far greater than previously thought, a report for the government says.

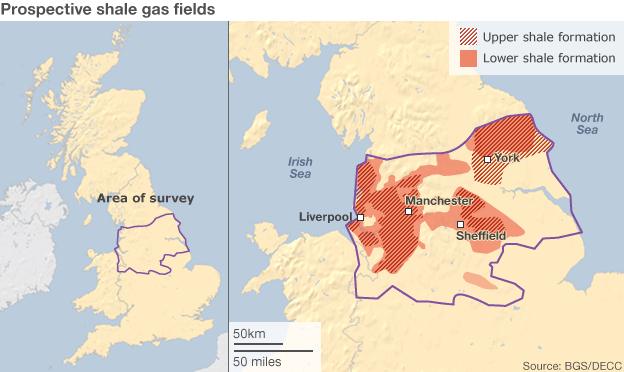

The British Geological Survey estimates there may be 1,300 trillion cubic feet of shale gas present in the north of England - double previous estimates.

Meanwhile the government has announced measures to enable shale gas drilling as part of its infrastructure plans.

Energy Minister Michael Fallon described shale gas as "an exciting new energy resource".

The BGS said its estimate for shale gas resources in the Bowland Basin region, which stretches from Cheshire to Yorkshire, represented potential resources, but "not the gas that might be possible to extract".

"Shale gas clearly has potential in Britain but it will require geological and engineering expertise, investment and protection of the environment," it said.

Drilling companies have previously estimated that they may be able to extract around 10% of this gas - equivalent to around 130 trillion cubic feet.

'Early days'

If the estimates are proved correct, that would still suggest recoverable reserves of shale gas far in excess of the three trillion cubic feet of gas currently consumed in the UK each year.

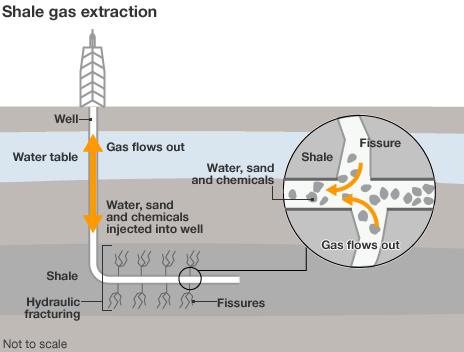

Shale gas is extracted through "fracking" - the controversial process of freeing trapped gas by pumping in a mixture of water, sand and chemicals.

The process has helped boost the domestic energy industry in the US in recent years, where oil production has risen and gas prices have plummeted.

In a statement, external, the Department of Energy and Climate Change said: "Though it is early days for shale in the UK, it has the potential to contribute to the UK's energy security, increase inward investment and growth."

The government has unveiled a package of reforms to encourage development in the industry.

They include new planning guidelines to make the process of approving new drilling sites more streamlined, and a consultation on tax incentives to encourage exploration.

Communities affected by shale gas drilling are also expected to receive £100,000 in "community benefits" and 1% of production revenues, should sites start producing gas.

"Shale gas represents an exciting new potential energy resource for the UK, and could play an important part in our energy mix," said Energy Minister Michael Fallon

"Development must be done in partnership with local people. We welcome the commitments from industry on community benefits.

"This will provide a welcome boost for communities who will host shale exploration and production as well as offering strong assurances that operators will engage with them and work to the highest health, safety and environmental standards."

He said communities hosting shale gas drilling could benefit from cheaper bills, regeneration schemes and new community facilities like playgrounds and sports halls.

The incentives are designed to overcome significant scepticism surrounding the process of fracking, which has generated environmental concerns.

Critics argue that it can cause earth tremors and pollute water supplies, and that shale gas wells could blight the countryside and affect house prices.

They also want investment in green energy sources, rather than fossil fuels.

Labour's shadow energy minister, Tom Greatrex, conceded that gas would remain "an important part of our energy mix in the future".

But he dismissed the announcement of incentives as "a desperate attempt to draw attention away from the government's cuts to infrastructure investment... and its abject failure to get the economy growing".

Power warning

Currently the UK's shale industry remains in its infancy, with relatively small energy companies such as IGas and Cuadrilla until recently the only firms with licences to explore share gas resources.

Centrica, the owner of British Gas, announced its intention to buy a stake in one licence in the Bowland Basin owned by Cuadrilla earlier this month.

The report for the government comes as energy regulator Ofgem warned that the risks of power blackouts has increased because excess capacity in the power industry has fallen in the UK.

The watchdog has twice warned in recent months that the amount of spare power is shrinking, partly due to some gas generators being taken out of service.

Centrica has already withdrawn two of its gas plants from operation. In April, SSE confirmed that it too would mothball gas plants and put off investments in new ones.

Adam Scorer, of the lobby group Consumer Futures, said: "Projections of ever-tighter capacity margins understandably raise fears of higher electricity prices.

"Government and regulator need to agree on the most realistic capacity scenarios, the least-cost ways of reducing demand and, where necessary, of incentivising new generation capacity."

Announcing further details of the government's spending review to parliament, Treasury Secretary Danny Alexander said the government had agreed "strike prices" in an effort to boost investment in renewable forms of energy.

The prices mean the government will guarantee to pay a certain price for energy generated through on-shore and off-shore wind, tidal, wave, bio-mass and solar power.

- Published21 December 2010

- Published26 April 2013

- Published7 June 2013

- Published21 March 2013

- Published13 December 2012