UK double-dip recession revised away

- Published

Joe Grice, ONS: "We've had pretty gradual, fairly bumpy growth"

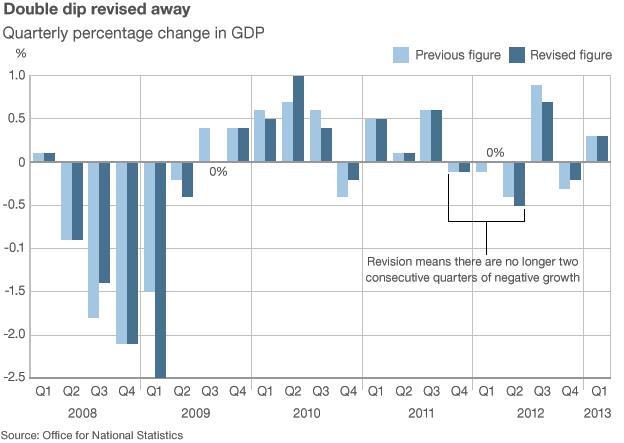

The UK economy did not experience a double-dip recession at the beginning of 2012, official figures have shown.

Updating its historical data, the Office for National Statistics (ONS) said growth was flat in the first quarter of 2012, revised from an earlier estimate of a 0.1% contraction.

This means the economy did not contract for two quarters in a row - the definition of a recession.

But the ONS said the recession in 2008 was deeper than previously estimated.

Gross domestic product (GDP) during that time is now estimated to have dropped by 7.2% from peak to trough, against a 6.3% fall previously recorded.

That means that GDP in the first quarter of 2013 was 3.9% lower than its peak in the first quarter of 2008 - previously it was estimated to be 2.6% below.

Escape velocity

Analysts said the fact that the UK had fallen deeper into recession than previously thought, meant it had further to go to recover lost ground.

"It certainly looks as if the UK is a step further away now from escape velocity," said Victoria Clarke from Investec.

Lee Hopley, chief economist at the EEF manufacturers' organisation, said: "Output across the economy and manufacturing has made up less ground since the end of the recession than previously thought and signs of any sustained rebalancing towards trade and investment remain elusive."

Meanwhile, the ONS was keen to point out that the fact that the UK avoided a double-dip recession by the smallest of margins was largely academic in the greater scheme of things.

"Relatively small quarterly changes up and down don't affect the overall story," said Joe Grice, chief economist at the ONS.

He added that it was better to concentrate on the "broader picture over a period of time".

Struggling households

The ONS figures also showed that household living standards suffered their biggest drop in a generation at the start of this year.

Real disposable income fell by 1.7% in the first quarter of 2013, the largest quarterly drop since 1987, as wages fell or stagnated and prices rose.

This led a fall in the savings ratio - households reduced what they save to the lowest slice of income for more than four years.

George Buckley from Deutsche Bank said the numbers questioned the recent optimism that many had had about UK household finances.

"My worry is that the saving ratio is just over 4% now when at one point it has been close to 8%," he said. "It makes me nervous about the UK economy and particularly the UK household sector."

Meanwhile, the ONS confirmed that GDP grew by 0.3% in the first quarter of 2013 - growth largely helped by a stronger performance from the construction sector.

- Published27 June 2013

- Published25 July 2013