Independence day for central banks

- Published

- comments

And it all happened on the Fourth of July. Today the Bank of England and the European Central Bank tried to declare their independence from the US central bank.

Interest rates might be heading up in the US, they told the financial markets, but that does not have to mean that rates are going up in Europe too.

The date was fitting. So was the method, because they signalled their independence by moving to adopt the kind of forward guidance pioneered by, er, the Fed.

I wrote earlier about the change in policy embedded in the Bank of England's "no change" statement. Soon afterwards, we saw the ECB go in for a bit of forward guidance of its own, signalling that rates would not only remain low for an extended period but that the next rate-change was more likely to be down than up.

Both have clearly had a big impact on the financial markets. There was more content in the Bank of England's guidance, because it was responding to a specific set of forecasts and expectations.

By contrast, the ECB's forward commitment sounded pretty non-committal, with little hint of any date. But the ECB's move was, possibly, more historic.

This is an institution, after all, whose watchword has previously been "we never pre-commit".

However, it's hardly a surprise that the ECB felt it had to say something. It's not just Portugal or, even, that long-term interest rates have risen nearly everywhere in response to Ben Bernanke's comments in the US.

Dwarfing all of that, arguably, is the simple and glaring fact that the improvement in sentiment around the eurozone is still not getting through to the real economy in the periphery countries.

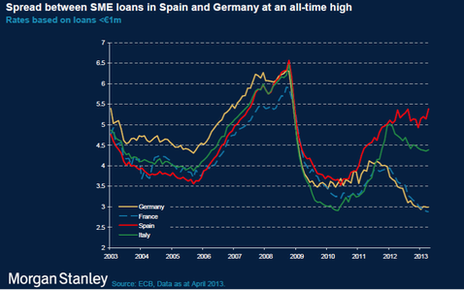

This chart, sent to me by Huw van Steenis at Morgan Stanley, puts the problem in stark relief:

It shows that the gap between what German companies pay to borrow, and what Spanish or Italian companies pay to borrow, is now larger than at any time since the eurozone crisis began.

That is partly because things have got better in Germany. But it also because, as Mario Draghi might say, the transmission mechanism for his low interest rate policy is still seriously defective.

Lending to companies and consumers in the southern economies is still falling, and has been since early 2012.

Optimistic souls had hoped that Mr Draghi might say something more about the options the ECB has been considering for several months now, to help get credit flowing to companies in the periphery, especially the crucial SMEs: for example, by encouraging the development of asset-backed securities linked to SME loans.

But I didn't hear the ECB president say anything new on that at all. He and his colleagues are still thinking about it.

Instead, the guardians of European monetary policy produced this historic, small step into the world of forward guidance.

Financial markets are cheering, understandably perhaps. But the ECB has said a lot of "historic" things in the past couple of years. Many people in the crisis economies have yet to feel the effects.