The Vatican Bank is rocked by scandal again

- Published

Despite his cheery exterior, the Pope is angry at the goings on at the Vatican Bank

When I first settled in Rome in the early 1970s, it was common knowledge among resident foreign journalists that you could get a much better exchange rate for the Italian lira from your dollars or pounds by visiting the Vatican's own bank, situated inside a medieval tower next to the Apostolic Palace inside Vatican City.

So, showing my press pass, I climbed the stairs into this strange Holy of Holies, where the only other clients in the marble-lined banking hall were priests and nuns.

I wrote out a cheque, which the bank clerk cashed after checking my identity. He handed me about 10% more lira than if I had made the transaction in one of the commercial banks just down the street in Italian territory. I had just discovered my very own offshore fiscal paradise.

Thus began my short-lived but instructive introductory course into Vatican banking. A few months later, someone leaked what was happening and I could no longer gain access to the Vatican's financial inner sanctum.

Divine appreciation

Then I got to know the Most Reverend Paul Marcinkus, a giant of a priest, who hailed from Chicago, and who had been appointed by Pope Paul VI in 1971 to head the Vatican Bank, the "Institute for the Works of Religion", or IOR in Italian.

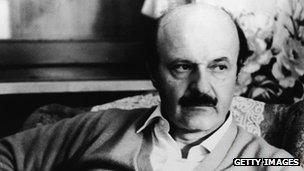

Financier Roberto Calvi was found hanging from a rope under Blackfriars Bridge

Pope Paul wanted to show his appreciation of the archbishop's efforts as chief organiser of the first ever visit by a pontiff to the Holy Land in 1964, where he had been the Pope's constant bodyguard and translator.

I learned with some surprise that the archbishop had no previous specialist knowledge of international banking. In fact, upon his appointment he had been sent off to Harvard University for a six-week crash course to learn the rudiments of international high finance.

During the 1980s, the archbishop got involved in some shady dealings, first with a Mafia-linked Sicilian banker called Michele Sindona, and then with an Italian financier called Roberto Calvi, president of the Banco Ambrosiano, which eventually collapsed with huge debts involving losses of at least $250m (£165m) to the IOR, one of the Banco's shareholders.

Mr Calvi eventually ended up dead, hanging from a rope under Blackfriars Bridge in London, victim of a faked suicide. The archbishop was wanted for questioning by Italian prosecutors, not in connection with what turned out to be a Mafia murder, but over the Vatican Bank's losses incurred through the setting up of phony offshore shell companies in the Bahamas.

But the burly archbishop successfully claimed diplomatic immunity, taking refuge inside the Vatican at one point.

He had a sardonic attitude to his work. "When my workers come to retire, they expect a pension," he once told a friend of mine. "It's no use my saying: I'll pay you in 400 Hail Marys!"

Broken promises

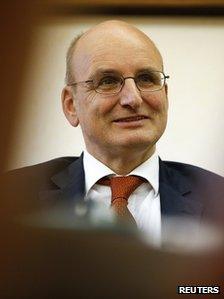

German banker Ernst von Freyberg currently heads up the Vatican Bank

Fast forward to the present. The Vatican Bank has once again been in the eye of a storm of scandal. It has been accused of money laundering and lack of due diligence in allowing non-religious, and even crony, businessmen to hold accounts in what amounts to an international offshore tax haven.

Pope Benedict XVI attempted in 2010 to bring the IOR back on course by creating a financial information authority to monitor its performance - but promises of greater financial transparency clearly failed to materialise.

A boardroom row erupted in 2012, and Ettore Gotti Tedeschi, an Italian economist then at the head of the bank, stormed out of a meeting chaired by Cardinal Tarcisio Bertone, the Vatican's secretary of state, and resigned.

Mr Gotti Tedeschi is the author of an economic textbook entitled Money and Paradise: The Global Economy and the Catholic World.

His post remained empty for nine months and then, on the very eve of Pope Benedict's retirement last February, the pontiff appointed a German banker, Ernst Von Freyberg, to head the IOR.

Money laundering

Now, another series of IOR bombshells have burst.

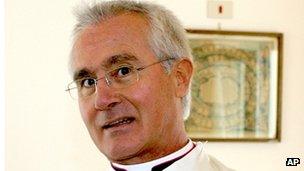

Paolo Cipriani, director of the bank, and his deputy Marco Tullio have resigned after the arrest by Italian tax police of a Vatican monsignore who used to work as a senior account manager in the Administration of the Patrimony of the Apostolic See (APSA), which manages Vatican real estate holdings. The monsignore, Nunzio Scarano, is being questioned in jail over allegations of money laundering, corruption and fraud.

Nunzio Scarano, who used to manage the Vatican's property holdings, is being questioned by police

Pope Francis is scandalised and angry at the goings on behind the scenes at the IOR. He has decided to begin his planned clean-up of the Roman Curia, the central government of the Church, with a complete shakeup at the IOR.

Vatican security officers have been instructed to freeze any attempt to meddle with IOR documents, while an internal commission of inquiry with wide powers prepares a secret report on the current financial shenanigans, for the eyes of Pope Francis only.

The Vatican Bank is a damaged brand at a moment when the Pope is urging his flock to turn their attention to the plight of the world's poor. There has been speculation that one of Pope Francis' options could be to dissolve the IOR altogether and hand over the Vatican's entire banking operations to a reliable commercial bank.

- Published28 June 2013

- Published26 June 2013

- Published16 May 2013