A guide to the Church of England's huge investments

- Published

The Church of England has investments worth billions of pounds in the UK and abroad

The Church of England's investments are wide-ranging and complex.

They range from pieces of woodland used for timber to investment strategies run by some of the world's biggest hedge funds, and stakes in big oil companies.

The whole operation is overseen by an ethical investment advisory board designed to prevent the Church from funding any businesses seen as against Christian principles.

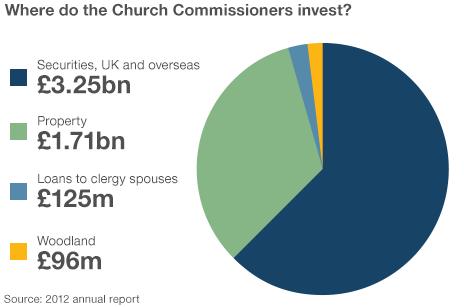

Around £5.2bn of investments are managed by the Church Commissioners, external - a body charged with managing the Church's assets in order to produce money to support its work.

Most of that - £3.25bn - is invested in securities - bonds and shares - both in the UK and abroad.

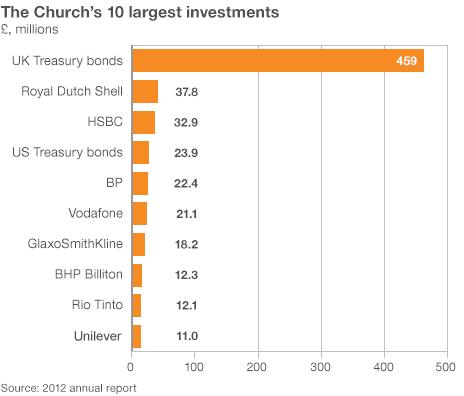

About £460m is invested in UK Treasury bonds and bills. The remaining £2.8bn is invested in stock markets, in major companies like Shell, HSBC and GlaxoSmithKline.

Some £1.71bn is invested in property - both directly and indirectly though third party investment companies. A further £96m is invested in woodland around the UK used to produce timber.

The church also has fixed assets worth £94m, including its huge network of properties and estates across the UK, and cash deposits and debts worth a further £379m.

A separate investment fund is run by the Church of England Pension Board, external, which is responsible for investing more than £1bn on behalf of the church's numerous pension schemes.

According to the latest figures available from 2011, £730m of that is invested in equities, both in the UK and abroad.

The rest is invested in government and corporate bonds, property, and investment schemes operated by hedge funds.

The board employs a whole host of investment companies to manage its investments, including BlackRock Advisors, Bridgewater Associates and Winton Capital Management - some of the largest hedge funds in the world.

Finally, a smaller Church of England investment pot is administered by CCLA, external, a company that provides investment management services for charities.

In order to keep these vast investments in check, the various bodies are advised by the church's Ethical Investment Advisory Group, external.

According to its official guidelines, it advises against investing in any company:

involved in indiscriminate weaponry

that derives more than 3% of revenues from the production or distribution of pornography

involved in conventional weapons if their strategic military supplies exceed 10% of turnover

whose business activity or focus (defined as more than 25% of group turnover) is tobacco, gambling, alcoholic drinks, high interest rate lending or human embryonic cloning.

It is that last figure that Archbishop Welby said was "probably too high" and would ask the Church's advisory group to review.

- Published26 July 2013

- Published26 July 2013

- Published26 July 2013