House price inflation continues to rise, says ONS

- Published

North-east England is one area seeing record interest from home buyers

The rate of house price inflation in the UK is continuing to rise, according to official statistics.

Prices in the year to June rose by 3.1%, said the Office for National Statistics (ONS), up from 2.9% in May.

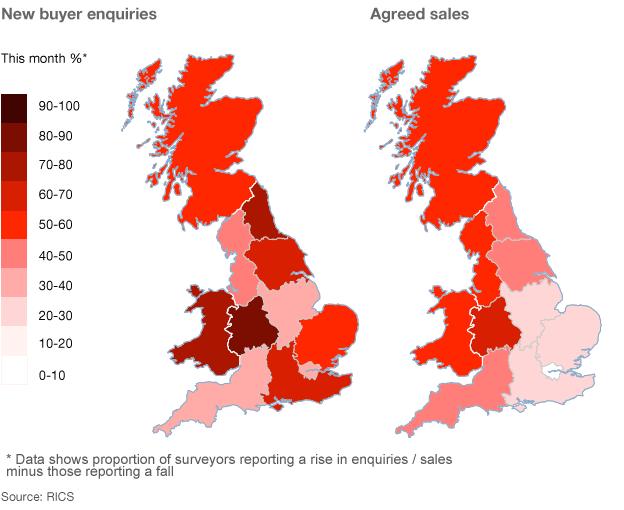

A separate industry survey suggests that home buyer activity is increasing fastest in parts of the UK where prices have been the most depressed.

The Royal Institution of Chartered Surveyors (Rics) says prices are rising at their fastest since November 2006.

The largest rise in activity came in the West Midlands and the North East.

New figures also suggest there has been an accelerated take-up of the government's Help to Buy Scheme.

Every region saw prices rise, Rics said, although London and the areas around it continued to see the biggest price increases.

But the ONS said there were price falls in Scotland and Northern Ireland.

Scottish house prices fell 0.9% in the year to June, while prices in Northern Ireland fell by 0.4%.

Prices rose 3.3% in England and 4.3% in Wales.

RICS director Peter Bolton King: Housing market on road to recovery

Revival spreads

Rics said that both the West Midlands and north-east England had seen their highest levels of interest amongst buyers for 14 years.

For the West Midlands, it was the highest level since the figures were first collected, in April 1999.

Wales and Scotland also saw a surge in demand, as measured by the number of people registering with estate agents.

In the West Midlands, enquiries turned into action and the region saw some of the biggest increases in sales.

Scotland and the North West saw the next largest sales growth.

"Growth in buyer numbers and prices have been happening in some parts of the country since the beginning of the year," said Peter Bolton King, from Rics.

"But this is the first time that everywhere has experienced some improvement."

Scotland, Wales and north-east England saw some of the largest house price falls during the recession.

When asked about values, more surveyors in the North East said prices were rising than surveyors who thought prices were falling.

That is the first time that a majority of surveyors in the region have taken that view since January 2012.

Surveyors in Scotland were more positive on prices than in any other area outside London and the South East.

But experts point out that rising house prices are only good news for people who own a house already and are considering buying something smaller.

"I tend to think rising house prices are terrible news," said Merryn Somerset Webb, the editor-in-chief of Money Week.

"It's an entirely unproductive part of the economy," she told the BBC.

Cheaper loans

Government help for the housing market is one reason for the pick-up in activity, said Rics.

The Help to Buy scheme, which began in April 2013, allows buyers of new-build homes to put down a 5% deposit and take out a government loan for up to 20% of the value of the property.

New government figures suggest there have been 10,000 registrations under Help to Buy since April.

This is an apparent acceleration since June, when 4,000 registrations were recorded.

From January next year, the scheme will be extended to help buyers of existing homes, and the government will guarantee a proportion of the loan to give the banks greater confidence to lend.

Rightmove's Miles Shipside: "When people see prices rise... they do try to get on the property ladder"

But Rics said that the Funding for Lending (FLS) scheme - where banks can borrow money cheaply from the Bank of England, providing they lend it on to businesses or individuals - has had a particular effect on improving mortgage availability.

It said FLS had improved so-called loan-to-value ratios, or the amount that banks and building societies are prepared to lend on any property.

On average, loans are now 83.6% of the value of a property, compared with 81.6% a year ago.

Mortgage rates have also fallen, making repayments cheaper.

Last week's announcement by the Bank, that interest rates are likely to remain at their record low for several years to come, is also likely to improve the number of cheaper mortgages on offer.