UK has lost '40%' of its banks and building societies

- Published

Britain's most deprived areas are losing their banks fastest, says the report

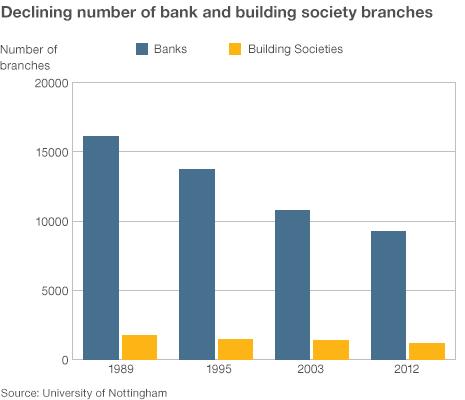

Communities across the UK have lost more than 40% of their bank and building society branches since 1989, according to a new report.

The study, by Nottingham University, found that nearly 7,500 branches closed between 1989 and 2012.

However, it said that the rate of closure had been slower since the year 2000.

The industry said fewer branches were now needed, as many customers had switched to phone or online banking.

The report also found that areas of high unemployment in the UK had lost bank branches at a faster rate than other areas.

Between 1995 and 2012, regions defined as "traditional manufacturing" and "built-up" areas lost 39% of their branch network.

By contrast, areas characterised as "middle England" lost far fewer branches.

Overall, manufacturing and inner city areas have lost branches more than three times as fast as suburbs and small towns, the study says.

Technology

The report's author, Shaun French, said he was particularly concerned about the effect of bank closures on poorer communities.

"Branches in less affluent areas have continued to disappear at an alarming rate," he said.

And he warned that fewer banks in areas of low incomes could drive people into the hands of payday or doorstep lenders.

He said he had particular concerns "for people on lower incomes, who may approach more predatory forms of institutions in the absence of a bank".

But, as the report recognises, the decline in branch numbers in recent years has been much slower than in the 1990s.

The industry body, the British Bankers Association (BBA), estimates a 7.4% decline in branch numbers between 2006 and 2012.

That amounts to 800 closures over six years.

The BBA said that decisions to close a branch were taken only after all other options, such as reducing staff hours, had been considered.

It said that technological advances had reduced the demand for branch visits.

"That change is only going to increase with innovations such as smartphone apps and internet banking, which ultimately means that fewer people now need to go into a branch on a regular basis," said a BBA spokesman.

Lull

But some people, including the Campaign for Community Banking, worry that a new round of closures could be just beginning.

This week, HSBC appeared to resume its closure programme after a strategic re-think.

It announced the names of five rural branches that are to close, with a further 20 closures expected by October.

Royal Bank of Scotland, which includes Nat West, has closed 82 branches this year, including 22 at Ulster Bank.

Santander has closed 45, while Barclays has shut 16.

The incoming boss of RBS, Ross McEwan, has said that the state-owned bank has 10% too many branches, prompting worries that more will close.

"It's the lull before the storm," said Derek French of the Campaign for Community Banking.

"We are concerned that we are going to see another take-off in branch closures," he told the BBC.