UK rebalancing - all in the timing

- Published

- comments

UK manufacturing is "booming again", according to the latest PMI survey

It's much better late than never, but earlier would have been better. That's how most economists would respond to mounting evidence that the UK recovery is starting to be more balanced.

It's great news that manufacturing and exports seem to be playing a bigger part in the UK's economic growth. It's also good to see British firms expanding their business with the Bric countries.

The shame is that all this is happening, just as those big emerging markets are slowing down - and just as they are looking to export more as well.

Today's PMI survey for UK manufacturing was the highest in more than two years and well above expectations. The output measure is now growing faster than at any time since the mid-1990s.

It adds to a feeling that the second-quarter GDP figures were not a blip, and the manufacturing side of the economy is starting to pull its weight, not just in the home market but abroad as well.

You'll remember the GDP numbers showed manufacturing output growing by 0.4% in the three months to the end of June, and city economists reckon it could do even better in the quarter we're in now.

The more detailed breakdown for the second quarter also showed net trade was responsible for half of our growth overall, with exports rising more than imports.

All of these things are good. So was the news - last month - that our trade deficit with non-European countries had almost halved in June.

Economists at Citi reckon the UK's exports have risen by 182%, in cash terms, in the last 10 years - five times faster than the UK's exports to advanced economies.

Within that, exports to China have risen six-fold since 2002, and exports to India are nearly five times higher. Goods exports to emerging markets now account for nearly a third of our goods exports, up from 17% in 2002.

But, as the prime minister has pointed out, this progress is from a low base. Emerging markets still account for a much smaller share of exports in the UK than the European average. Let alone Germany.

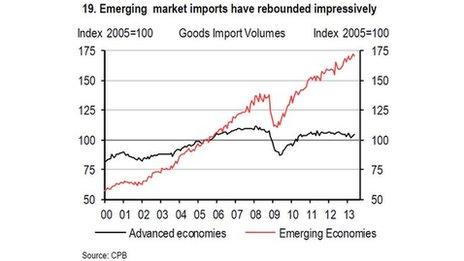

That weak position has been particularly troublesome recently, when emerging markets have accounted for so much of the growth in global imports (see chart from HSBC below).

For my piece on emerging markets for the TV bulletins last week I calculated that the G7 economies had grown by less than 2% since 2008. In those five years, the developing world has grown by 31% - and China has grown by well over 50%.

With the emerging market economies slowing down, you might think our relatively weak position in these markets was turning into a short-term advantage - that the UK would now be relatively less affected by any oncoming storms in the developing world.

But that may be wishful thinking. After all, we have lots of investment links with the likes of India and China. As Citi point out, we also export a lot to countries like Germany that are themselves vulnerable to falling Chinese demand. And when you are looking for exports to drive so much of your growth, every little hurts.

So yes (in case you missed me saying it the first five times), it is good news that the UK's manufacturing sector is making and selling more at home and abroad.

But that, too, is progress from a low base. Our manufacturing sector is still 11% smaller than it was at the end of 2007.

And with emerging market economies now faltering, our hopes of rebalancing further may be even more dependent on the eurozone's recovery than they were before.