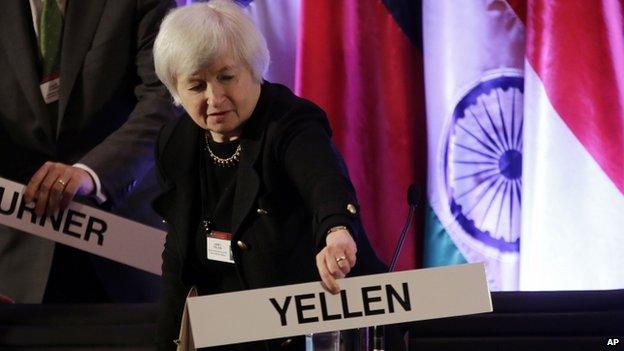

Janet Yellen: The first Fed chairwoman

- Published

- comments

Her appointment is groundbreaking, but the policies of the most powerful central bank in the world are unlikely to change radically.

It's because Janet Yellen has been the deputy to Federal Reserve chairman Ben Bernanke since 2010 and served in various capacities as a Fed governor and chair of President Clinton's Council of Economic Advisers (CEA) since 1994.

The CEA is the body that the most prominent academic economists in the country sit on to advise the US President.

In other words, she is highly qualified, long-serving, and well-regarded. With the withdrawal of Larry Summers, few other candidates would have rivalled her economic expertise, which is internationally respected, as well as have the experience to be able to work effectively within a large organisation such as the Federal Reserve.

Continuity

Crucially, in terms of policies, she was one of the proponents of the Fed's "forward guidance" policy that explicitly considers both sides of its dual mandate: to keep inflation in check and also to support employment.

This is the pledge to keep interest rates low until the unemployment rate falls to 6.5%, so long as inflation doesn't breach the 2% target by too much - so not rising above 2.5%.

Until the financial crisis, the Fed, like other central banks, essentially focused on keeping inflation in check. To do that required keeping an eye on economic growth and unemployment, of course.

But, the Fed's second target wasn't in focus until Bernanke and Yellen as his deputy crafted a new set of policies, which I wrote about before, that explicitly aimed to bring down unemployment.

This came as the US faced its third so-called jobless recovery, where the economy regained all of the lost ground since the recession but employment did not.

So although Yellen's appointment would make history, being the first woman to head the most powerful central bank in the world, her policies are unlikely to be a radical departure from Bernanke in the near term.

For those waiting to see what would happen regarding the Fed's tapering of its cheap cash injections, her appointment probably doesn't change the picture that dramatically if she takes over from Bernanke at the end of January.

As I said on the Today programme, it may depend on whether Bernanke wants tapering as his final act or perhaps leave it to his successor.

Face it, it may be a bit rough exiting the monetary stimulus that has been in place for five years.

Symbolic impact

Also, the symbolic impact of a female central bank governor should not be underestimated.

Her appointment would feature prominently in the debate over the lack of high ranking women in central banking and other prominent positions.

For instance, there are no female central bankers in the Bank of England or the European Central Bank at present.

Around the world, fewer than 10% of the 177 central bank governors are women. As the US Congress looks likely to confirm her appointment, Janet Yellen would join this small coterie:

Mercedes Marco del Pont of Argentina; Jeanette Semeleer of Aruba; Wendy Craigg of the Bahamas; Nadezhda Ermakova of Belarus; Linah Mohohlo of Botswana; Maria Mondragon de Villar of Honduras; Zina Asankojoeva of Kyrgyz Republic; Rets'elisitsoe Adelaide Matlanyane of Lesotho; Zeti Akhtar Aziz of Malaysia; Elvira Nabiullina of Russia; Atalina Emma Ainuu-Enari of Samoa; Maria do Carmo Silveira of Sao Tome e Principe; Jorgovanka Tabaković of Serbia; Caroline Abel of Seychelles; Gill Marcus of South Africa; Joyce Cocker Mafi of Tonga; Edmee Betancourt of Venezuela.

Finally, Yellen is married to someone who has received the highest prize awarded in economics, Nobel Laureate George Akerlof.

She and Akerlof have co-authored papers and both taught at the University of California at Berkeley and other places. Their son is also an academic teaching economics at the University of Warwick in the UK.

Her confirmation would mean that Akerlof may be the only Economics Laureate who is the lesser known half in their household.